USDJPY has gained nearly 600 pips in May

You can't beat an FOMC to get USDJPY excited. Throw in the Japanese messing around with their sales tax decision and there's two big reasons to see the pair go up.

So far, this is the biggest correction we've had during the fall from 125.85. All have failed to reach the 600 pip mark. That's probably not news you can use but it's a pattern nevertheless.

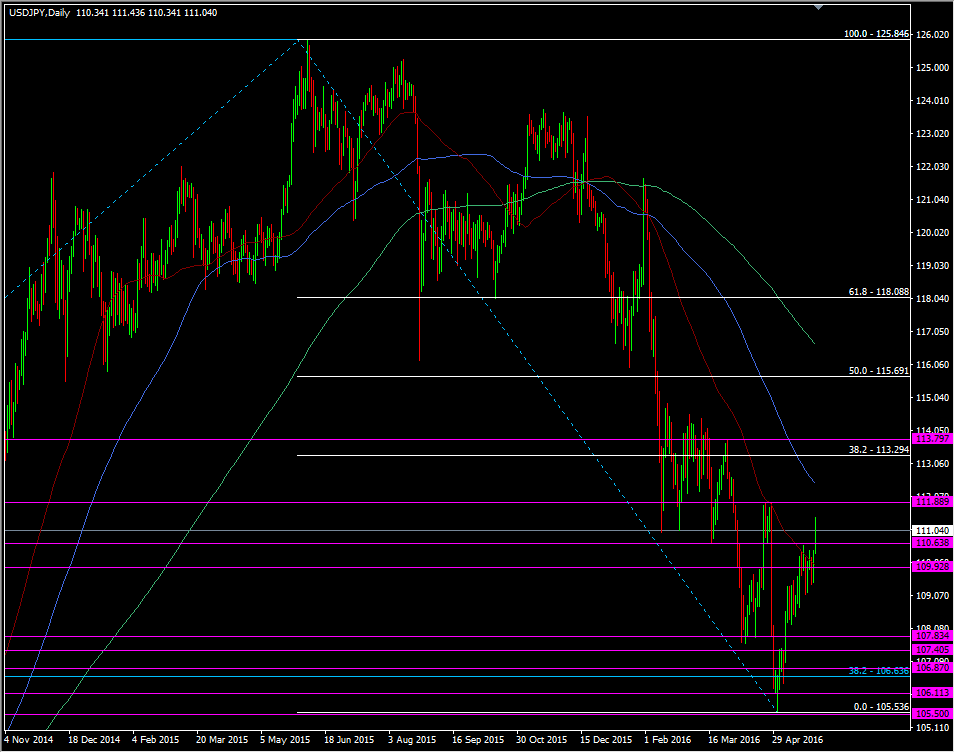

USDJPY daily chart

Should we maintain the rally and break the 600 pip mark, we still have work to do and the first target level comes at 111.85/90. This is where the break down through 112.00 was protected. Above that is the 100 dma at 112.45. Take out those two and we're on for a test of the 38.2 fib of the fall from 125.85, which in itself will the first main test of that move.

We've eased off from the 111.45 highs to test 111.00 and have held so far. If we go through the big figure 110.80/85 is next support followed by 110.70 and stronger at 110.45/50.

The market is probably a little on edge with the possibility of Japanese talking heads popping up but even they need to go to bed at some point and that risk will be reduced as it gets late in Japan. With the US shut today other influences will affect the dollar so keep half an eye on things like oil.