So many worries whisked away

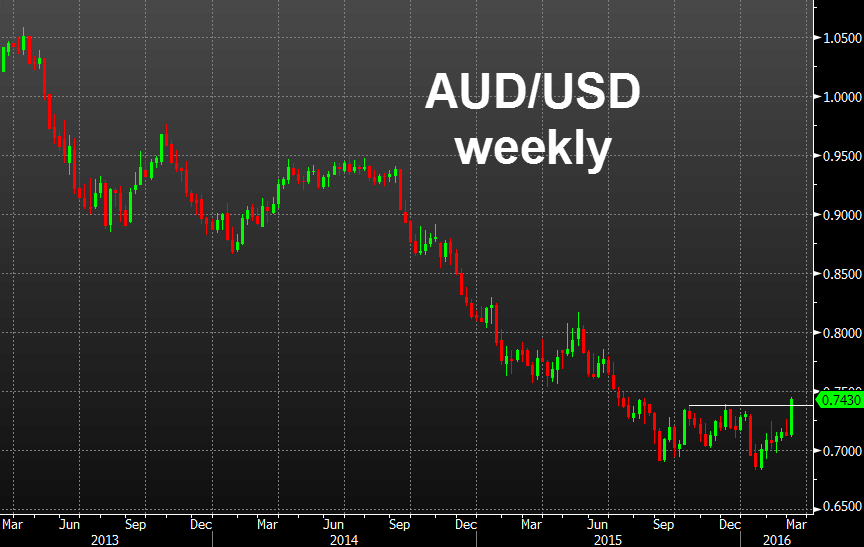

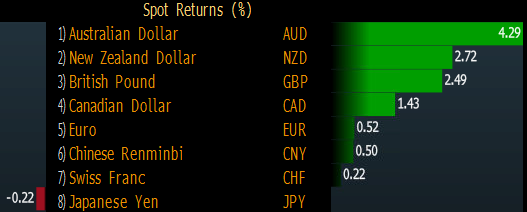

The Australian dollar was easily the best performer this week, climbing 4.3% against the US dollar to the best levels since August.

Here are the questions that were answered.

1) Will the RBA be dovish?

Not at all. The RBA said almost nothing at all and hardly attempted to jawbone the Australian dollar lower.

2) Is China imploding

Not even close. The RRR cut finally filtered through to Chinese stocks and it led to a promising rally.

3) How is growth?

GDP blew away expectations and that's when the AUD/USD rally kicked into high gear.

4) What's happening with copper prices?

The retracement in commodities is underway across the board and industrial metals are no exception. Copper is more than 12% from the January lows.

Technical analysis:

The Australian dollar chart is tough to ignore. It busted through the Oct/Dec highs and hasn't looked back. It gained all five days this week in a nearly 300 pip rally.

Scaling back, even if this is only a counter-trend retracement, it has plenty of room to run.