Trade balance better than expected.

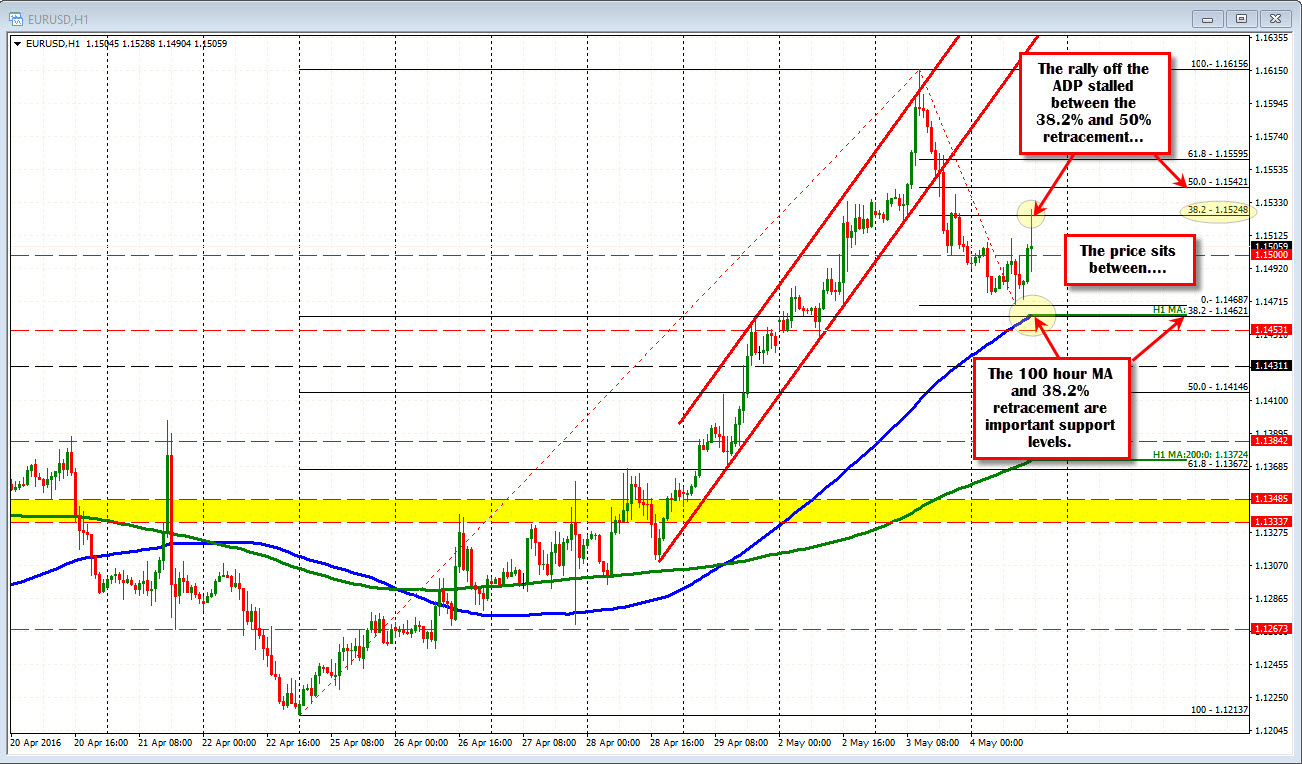

The ADP employment report was not so hot, with a rise of 156K vs the estimate of 195K. The weaker data has the EURUSD moving to new session highs (the price peaked 1.15288). The 38.2% of the move down from yesterday's high comes in at 1.15248. The midpoint of the same move lower comes in at 1.15421. Look for rallies toward the 50% to be sold today.

The US productivity just came out and it showed that although productivity fell, the main reason was wages increased by 4.1% in the 1Q. Is that good for inflation/Fed tightening? Perhaps. The US trade balance was also better than expectations with the deficit at -40.4B vs -41.2B estimate. That should be a positive for GDP 1Q (it is a March number so it's impact will be for the 1Q). The price of the EURUSD has reversed back lower - retracing all of the ADP gains.

Earlier today in Europe, the PMI services index for the EU came in 53.1 vs 53.3 estimate. Retail sales were weaker at -0.5% vs 0.1% estimate.

Overall, the pair is sitting unchanged on the day. The downside was tried and technically it got close to a pretty good support level at the 100 hour MA at 1.1462 (blue line in the chart above) and the 38.2% at the exact same level. The low reached 1.14687 (6 pips away). If the price does wander lower, that level will be the next key target. Look for buyers.

The upside has now also tried with the 38.2% level tested and failed. The ISM and PMI data come later along with Factory orders and oil inventories. Stocks are lower with the S&P futures down about -13.75 points and the Nasdaq down -31.

It seems like a coin flip from here. I would rather be patient and see what happens at the extremes, vs force something in the middle (like where we are currently at) for this pair....If you got in short from above you are ok, but expect buyers at the 100 hour MA area. If you go in near the lows earlier today, and did not get out, you are ok but hoping for buyers to come back in... (again against the 100 hour MA- blue line).

PS. Be aware of a key level off the daily chart in the EURUSD...The 1.1435-65 area had a number of swing highs in that area. In August and October of 2015, the price broke above, but quickly faded. The pair moved above that area on Monday and came down to test the upper line of the support area. Should the price move below this area going forward (it may not be today), the market may start to think that the break was a failure once again. If it holds, the buyers remain in control.