USDJPY clings to 121.00 after FOMC minutes and next batch of econ data

Initial jobless claims kick the US session off proper at the bottom of the hour. A slight jump in claims to 271k is forecast from last weeks 264k. The four week average is currently 271.75k

The April Chicago Fed national activity index hopes to unwind some of the negative 0.42 we saw in March at the same time as jobs

BOE's Martin Weale pops up for a natter around 13.15 gmt and then we head to the Markit manufacturing PMI flash for May. We're expecting a small gain to 54.5 from 54.1

At 14.00 gmt we're off to Philadelphia for the business outlook index which is hoping to gain half a point to 8 from 7.5 in April

Existing home sales join it and look to add 50k sales to the 5.19m seen in March

The hattrick of data is sealed by Eurozone consumer confidence. Always a laugh is that one. Could we finally see a smile on the face of you average European? Not likely says the market who expects confidence to fall from -4.6 to -4.8 Given the run it's been on of late there's a chance it could be better than that

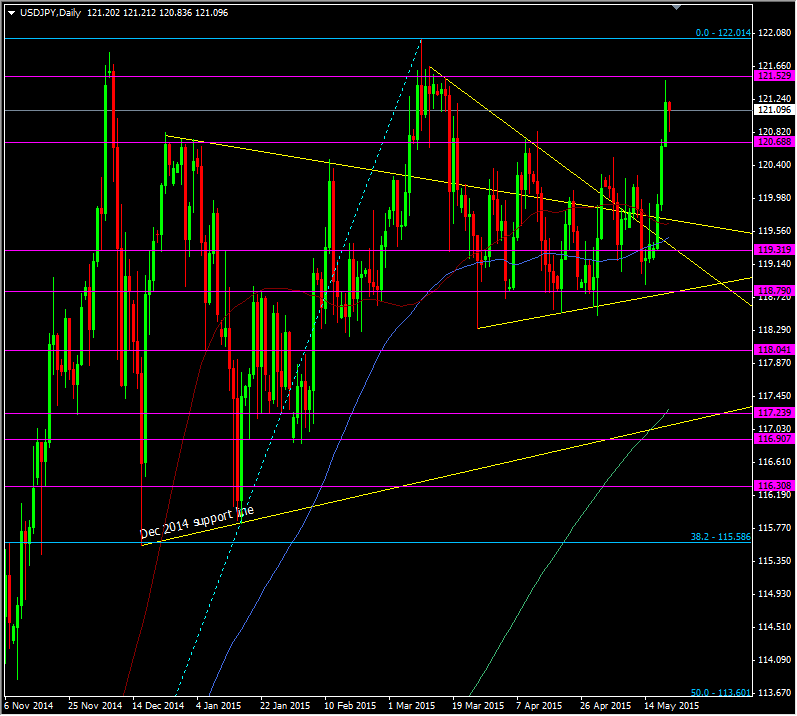

The dollar is treading water having held one of the bigger upside resistance levels at 121.50. 120.70 is the number to watch below

USDJPY Daily chart