It all started with the inventory data..

The USDCAD has been on an up and down roller coaster ride.

The pair tumbled on a surprise draw down in oil inventories this week. That fall in the USDCAD was helped by a sharp rise in crude oil prices to $29.17 shortly after the inventory headlines.

However, the traders were not impressed by a one week drawdown, and crude oil prices fell back down quickly - taking the USDCAD back higher in the process. Crude oil, not only fell to new session lows, but also to new contract lows (at the $27.37 area). The price is back up to $27.60 currently.

Needless to say, the action has whipped the USDCAD price around. It has not been a smooth ride.

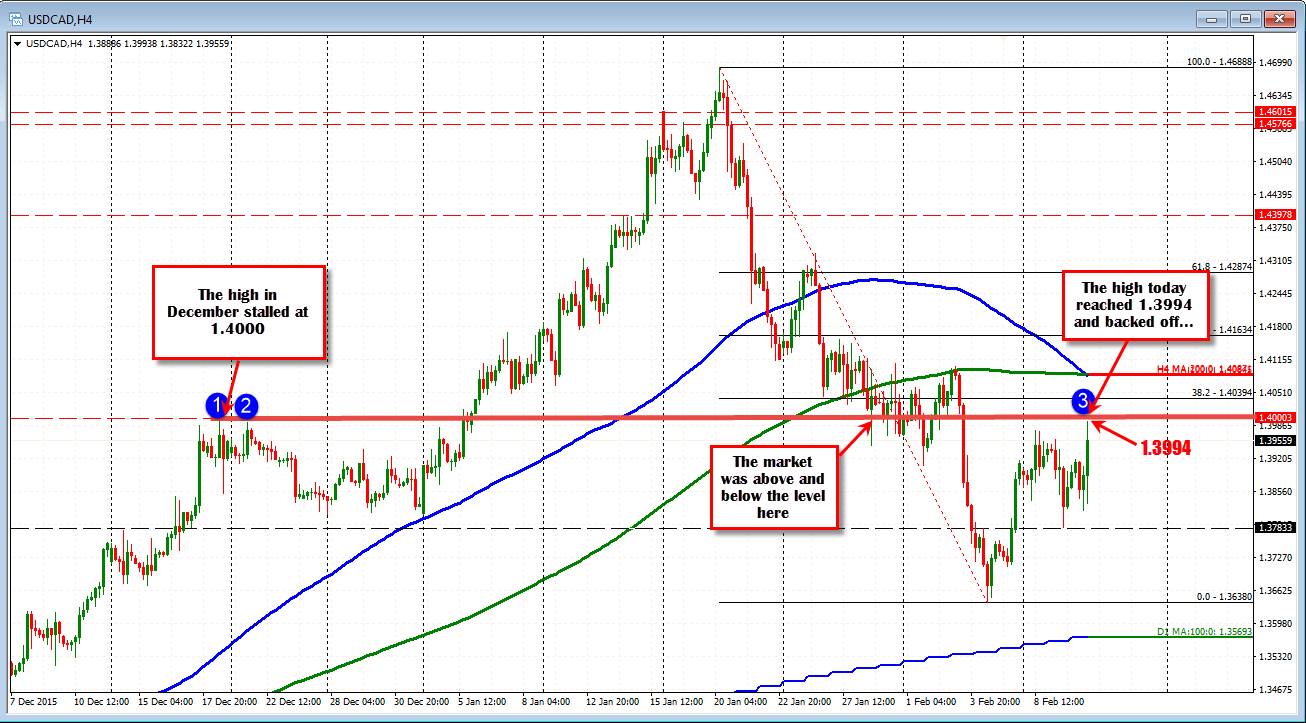

Technically, although the USDCAD price rose to new session highs on the new lows in crude, the pair stalled against the 1.4000 level. If you recall, the USDCAD peaked at the 1.4000 level in December. IN January, the price moved above the key level in early January, and waffled above and below it in late January/early Feb.

ON Feb 3, the price took off to the downside on it's way to 1.3638 low.

What now?

Well, the move back higher will need to get and stay above this 1.4000 level for the buyers to feel more comfortable. Remember, the USDCAD has not been able to move above that level despite lower oil prices. That divorce from the price of oil has traders confused. It could be a temporary effect from a weaker USD. It could be a sign that the USDCAD went too far, too fast and lower oil prices are all ready priced in.

We won't know but we can earmark the 1.4000 level as a key level to get and stay above if this bearishness is just a temporary phenomenon. On the downside now, watch the 1.3906 level. This is the 200 hour MA currently. The price moved above and below this level in trading today (see the green overlay on the 5-minute chart above), but on the last move higher today (to the highs), the pair corrected to the level, before taking off. If buyers are back on the horse, that MA should hold support.