This looks to be more about positioning than substance

Two thoughts/theories:

1) The market doesn't see enough in the Fed statement to put a Sept or Dec hike seriously on the table

2) The market is long dollars but doesn't want to be. It's no secret that buying the US dollar has been a big trade over the past three weeks. The gains from strong consumer and jobs numbers have culminated towards this day and now traders might be looking to clear out with no clear dollar-positive catalysts on the horizon.

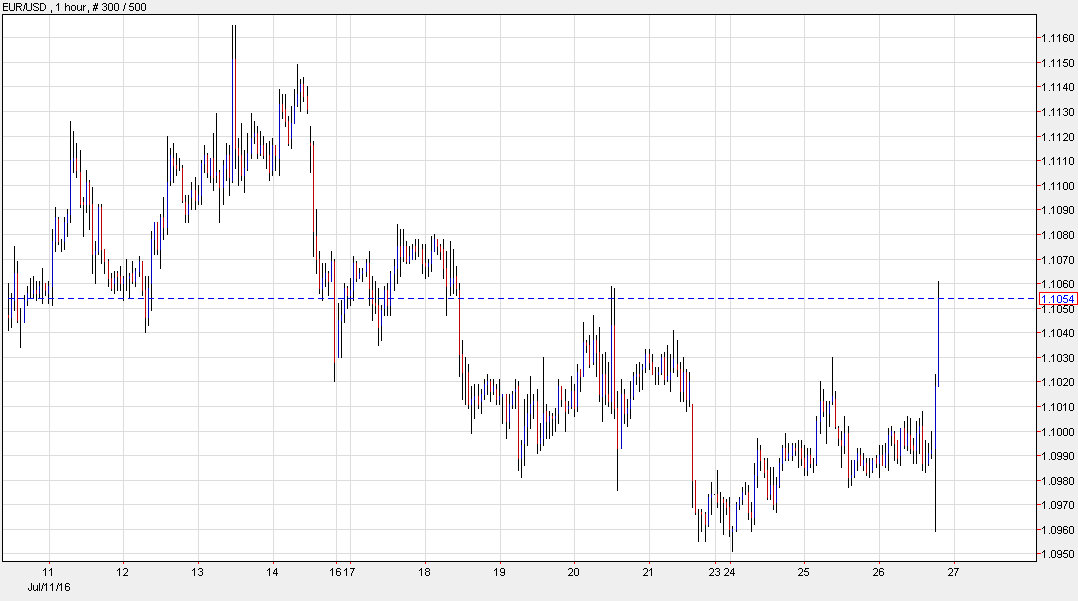

So far the technical damage in dollar trades is limited but there are some early reversal signals brewing.

The euro, in particular, could be forming a base at the June/July lows near 1.0900.