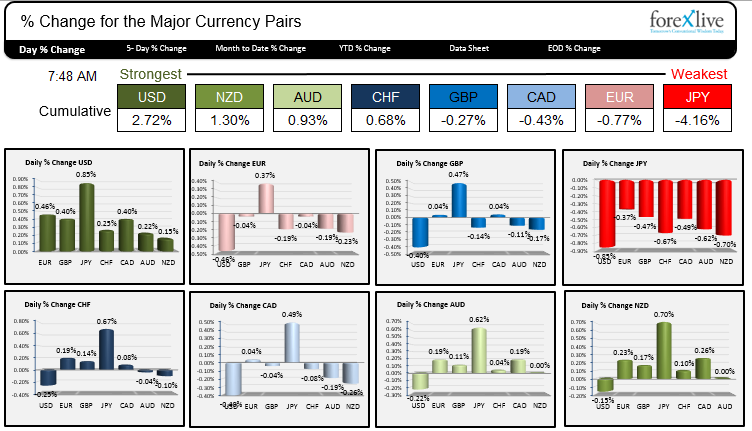

USD is the strongest. JPY is the weakest.

The USD is the strongest currency as traders return from the Memorial Day holiday in the US. The greenback is being supported by the comments from the top Fed officials. Janet Yellen on Friday continues to view a rate rise as appropriate in 2015, while Vice Chair Fischer warned that the Fed warned of having to play catch up. Admittedly, he also warned of being premature and said any rate increase was to be data dependent.

The USDJPY is the biggest % mover on the day. The USDJPY continued the move higher and extended above the 122.00 level where stops were triggered (and the high for the year at 122.01). The pair is trading at the price level since July 2007. The 123.66 and 124.14 are the highs from June and July. Look for intraday support in the 122.29-42. The 100 bar MA on the 5 minute chart is currently at the 122.32 level and moving higher (see chart below). Stay above (close risk for longs) and the buyers remain in control. Move below and the surge higher may have gone too far, too fast. There are not a lot of technical levels to snatch onto when the price trades at the highest levels since 2007. As a result, the technicals are more focused on the support levels below.

Lots of data today will also be in play.

At 8:30 AM ET durable goods for the month of April will be released US with a -0.5% expectations. Capital goods orders nondefense ex-air expected rise by 0.3 vs. 0.6% gain in March. The capital goods shipments nondefense ex-air are expected to rise by 0.2 after a +0.9% gain in March. And 9 AM ET, S&P Case Schiller home price composite index for April is expected to rise by 4.6% year on year vs. 5.03% in February. New home sales will be released at 10 AM with 508K vs. 481K. Richmond Fed manufacturing index is also released 10 AM with estimates for 0 vs -3 last month. Finally, the Dallas fed manufacturing activity index is expected to show -12.4 vs. -16.0. This index has been negative since January largely as a result of the oil complex