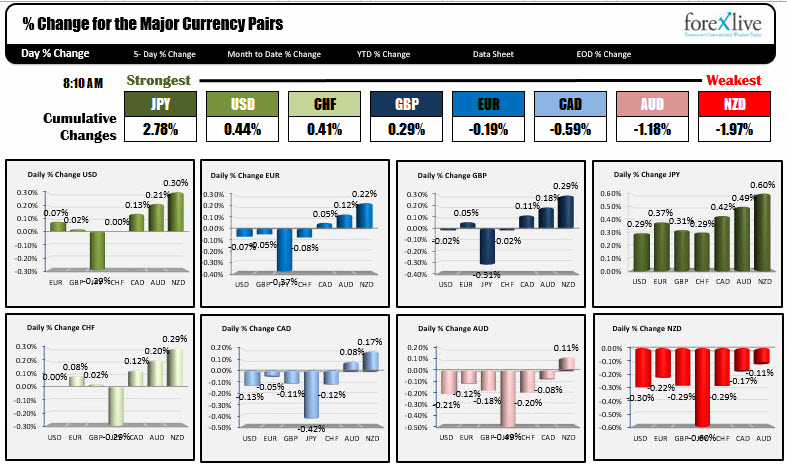

March 28, 2017. The JPY is the strongest. The NZD is the weakest.

As the NA traders enter for the day, the JPY is the strongest while the NZD is the weakest. The JPY pairs took a move to the downside in the London session after a NY session yesterday that saw the JPY pairs correct higher.

Looking at the USDJPY, the pairs modest move higher stalled well ahead of the 100 hour MA (blue line in the chart below) at 110.884 currently. The price of the USDJPY has been been above that MA since moving below on March 14. It is a risk defining levels for shorts now. US stock futures are lower in pre-open trading with the S&P down -3 points and the Nasdaq futures down -4.75 points. US yields are lower by about 1 bp in early NY trading.

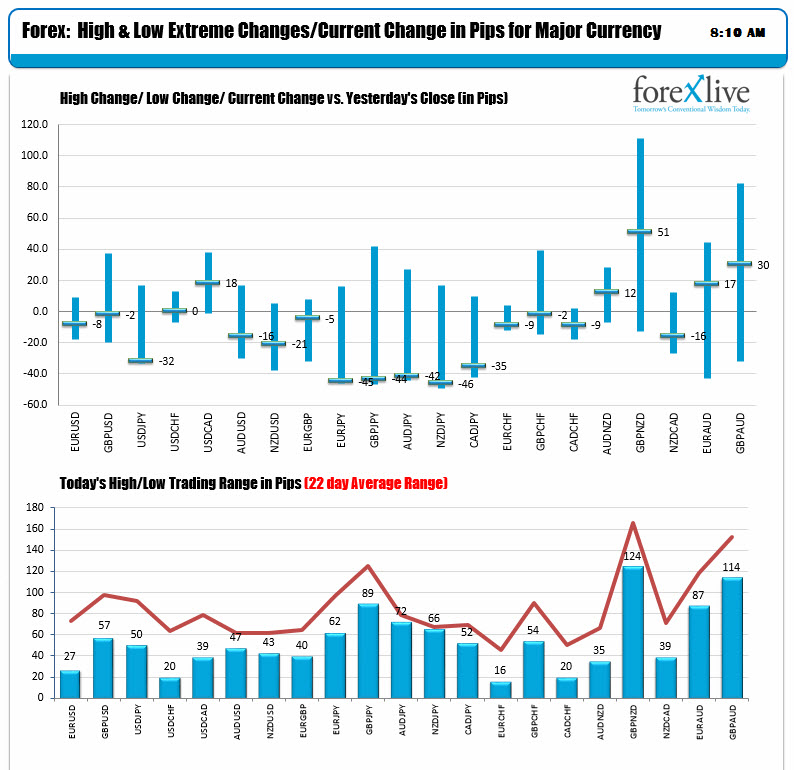

The changes and ranges snapshot show limited changes for the EURUSD (-8 pips from yesterday's close), GBPUSD (-2). The USDCHF is unchanged. The USDJPY is lower by -32 pips from the close. The commodity currencies are all lower vs the USD today. Ranges are mostly below the 22 day average trading range. So volatility is a bit light.

Snapshot of other markets:

- 2 year yield 1.26%. 10 year yield 2.362%

- Spot gold +$3.71 or +0.29%

- WTI crude oil +$0.49 ore +1.03%