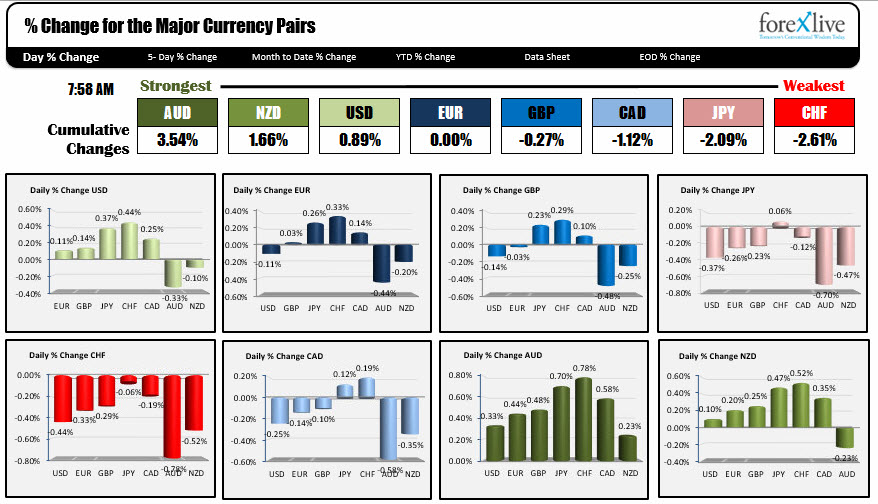

October 25, 2016. The AUD is the strongest. The CHF is the weakest.

As the North American traders enter for the day, the snapshot of the strongest and weakest show that the AUD is the strongest, while the CHF is the weakest. The USDCHF and the EURCHF just had a early NY session push to new extremes for the day. That has helped move the CHF to the weakest currency on the day. The AUD has been on a grind higher, after moving up and down yesterday (at least the AUDUSD did). Commodity prices are higher today with gold up $4.50, Oiil futures are up 0.24% (well modestly higher).

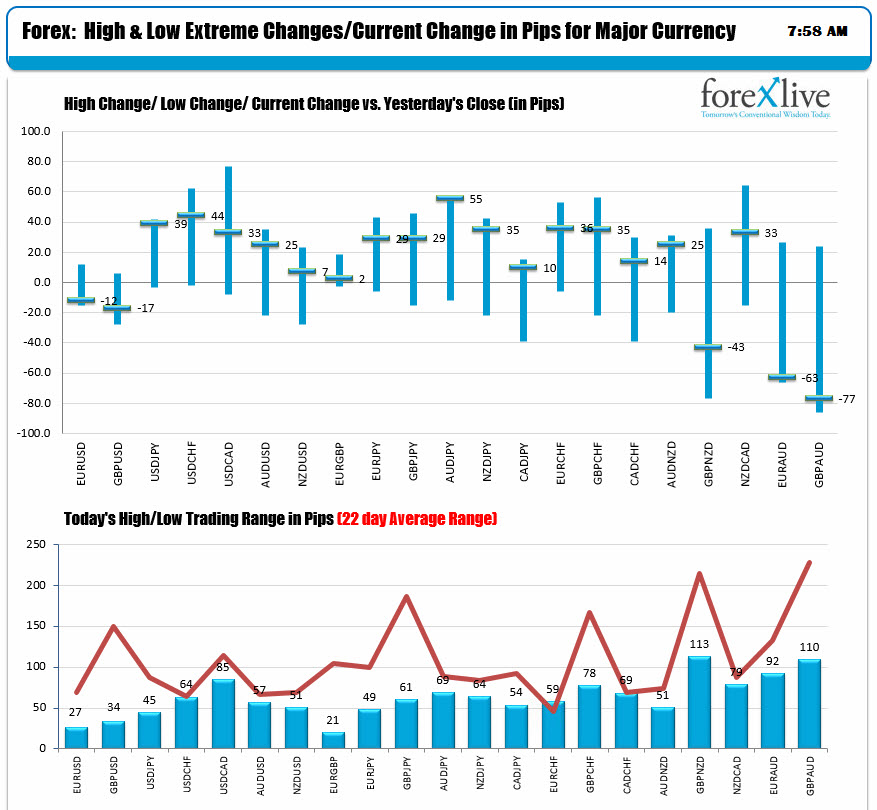

The ranges and changes are once again very contained in the snapshot. The USDCAD is the largest mover of the major pairs (largest trading range). Yesterday at the close, the pair was reacting to comments from BOC Gov. Poloz which caused a sharp fall at the close. Some after that, there was a snap back rise (at least partially) off another batch of more dovish CAD comments. As a result, the range is a bit influenced by the comments and illiquid markets at the close.

The EURUSD, GBPUSD and USDJPY ranges are well below the averages over the last 22 trading days (see red line in the lower chart below). Yesterday we were looking at a EURUSD range of about 40 pips at this time. It stayed in that narrow range the rest of the trading day. Surely we can best a 27 pip range in the EURUSD and a 34 pip range in the GBPUSD (look for an extension). As it looks right now, the GBPUSD intraday chart is like a heart monitor readout - up and down, up and down, up and down. We are trading near lows for each pair currently. so sellers are trying to make a bearish play in early NY trading

Dow futures +13 points

Nasdaq futures +8.25%

S&P futures +2.5 points.

Apple earnings after the close today.

European stocks:

Dax +0.32%

Cac +0.13%

UK FTSE +0.41%

10 year bond yields

US 1.7736% +1 BP

German 0.32%, unch

France 0.308% unch

UK 1.098% +1 BP