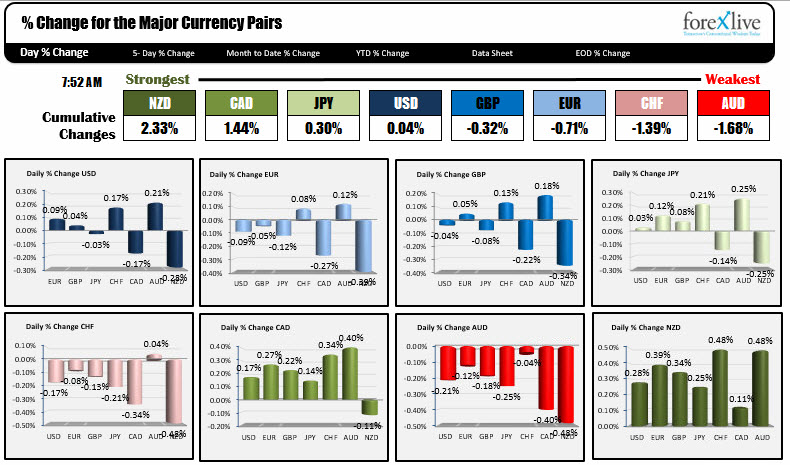

June 22, 2017. The NZD is the strongest. The AUD is the weakest.

As North American traders enter for the day, the NZD is the strongest, while the AUD is the weakest.

The RBNZ kept rates unchanged but did not talk about the NZDUSD strength. As Eamonn put it in his end of session wrap:

"The short media release that accompanied the decision (there was no Monetary Policy Statement nor media conference) was notable also for dialing back on the stern comments we normally get from the RBNZ on NZD strength; today there was no hectoring on the currency and a seeming acceptance that with strong terms of trade and economic performance it'd be nice if it fell but hey, whatareyagonnado?"

Anyway, it was enough to give the NZD a modest boost and advance it to the top of the major currencies at the morning snapshot. Note, however, that the pairs are pretty well compact in trading today.

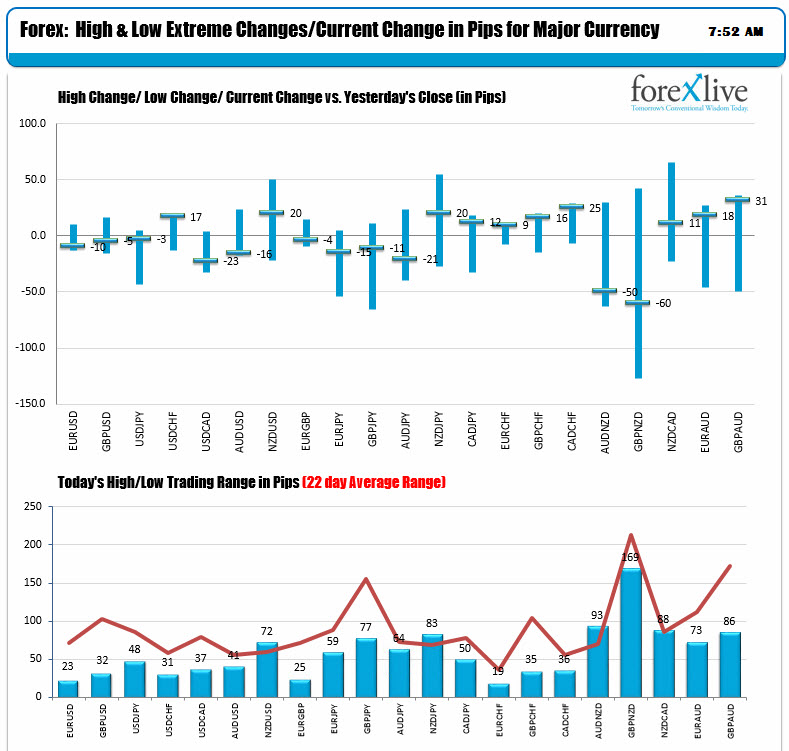

You can see the compactness of the pairs in the volatility charts below. The top chart shows that pairs like the EURUSD, GBPUSD, USDJPY are all very close to the closing levels from yesterday. The other pairs against the greenback are not that far away either. The lower chart is showing all the pairs against the USD are below their 22 day ranges with the one exception being the NZDUSD. Cross pairs with NZD in the name have better ranges, but they are also off extreme levels.

At 8:30 AM ET/1230 GMT,

- US initial jobless claims are expected at 240K vs 237K last

- Canada retail sales are important for the likes of Wilkins and Poloz who praised the strength of the economy. The expectations are for headline to be +0.3% (vs 0.7% last) and ex auto +0.7% (vs -0.2% last).

Later at 10 AM ET/1400 GMT,

- US consumer confidence is expected to come in at -3.0 vs -3.3

- US leading index is expected to rise +0.3% vs +0.3% last

In other markets:

- Spot gold is trading up $7 to 1253.50

- WTI crude oil is up $0.28 or $42.82

- US stocks are down a bit in pre-market futures trading. S&P futures are down -2.0 points. Dow futures are down -14.0 points. Nasdaq futures are down -7 points.

- US yields are down 0-1 bp across the curve