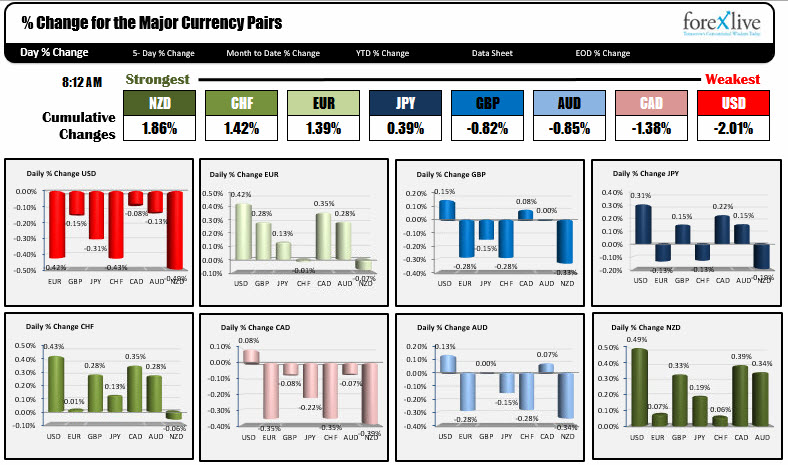

Friday January 13th, 2017: The NZD is the strongest. The USD is the weakest.

The snapshot of the strongest and weakest currencies is showing that the NZD is the strongest currency of the majors. The USD is the weakest - falling against all the major currency pairs - but all are pretty closely aligned.

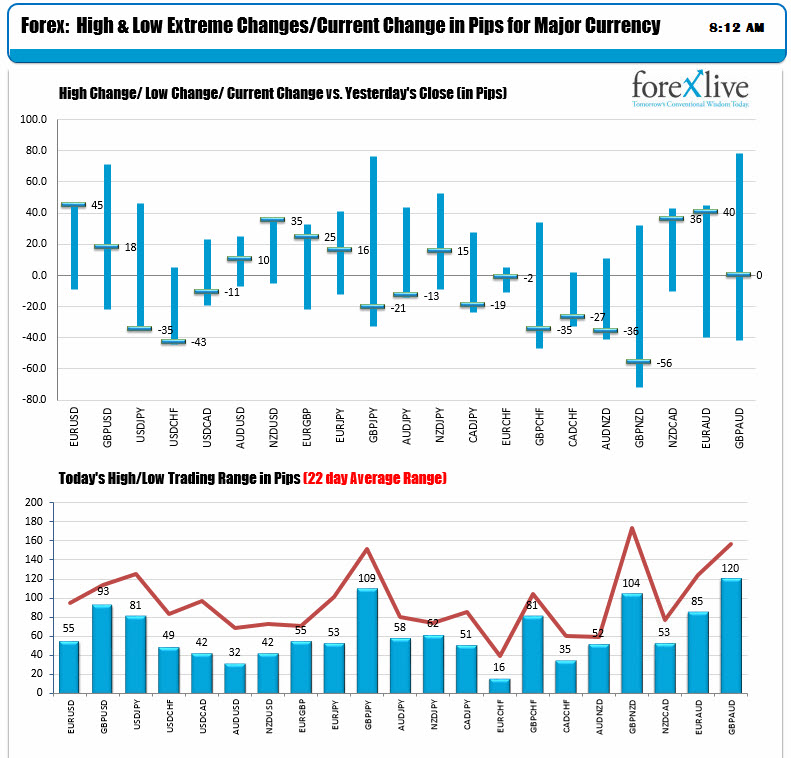

The volatility is lower today as the ranges, for all the pairs, are below the 22-day average (about a month of trading). The GBPUSD has moved the most but sits close to unchanged after a move higher (toward the 200 hour MA) and a tumble back down. The EURUSD, USDJPY and USDCHF are trading at their extremes.

In other markets:

- Spot gold is up $4.14 or +0.34% continuing it's move higher

- WTI Crude is down -$0.37 or -0.70%

- S&P futures are up 3.25 points. Nasdaq futures are up 9.5 points and the Dow futures are up 27 points

- US bond yields are lower. The 2 year is down about 1/2 bp. The 10 year is down 2.1 bp to 2.341%. The 30 year is down 1.9 bp to 2.94%. Earlier in the week the 30 year did move back above the 3.0% level but it has back below (of course)

- Europe stocks are higher: German Dax up +0.62%, France Cac up +0.89%, UK FTSe +0.39%, Italy FTSE MIB up 1.49%. Spain Ibex up +0.78%

Retail sales will be released at 8:30 AM ET/1330 GMT with the estimate of +0.7% vs +0.1% last month.

- Ex auto is expected to rise by +0.5% vs +0.2 latt.

- Ex auto and gas is expected at +0.4% vs +0.2% last

- Control Group is expected at +0.4% vs. +0.1% last

US PPP is also out at 8:30 AM ET.

- Final Demand MoM +0.3% vs +0.4% last, YoY +1.6% vs +1.3 last

- Ex Food and energy est. +0.1% vs +0.4% last. YpY 1.5% vs 1.6% last

- Ex Food and energy and trade est. +0.1% vs +0.2% last. YoY 1.8%vs 1.8% last.

US business inventories will be released at 10 AM with estimate of +0.6% vs -0.2%.

Univ of Michigan sentiment is estimate at 98.5 vs 98.2 last.

Feds Harker is expected to speak in Philadelphia at 9:30 AM Et