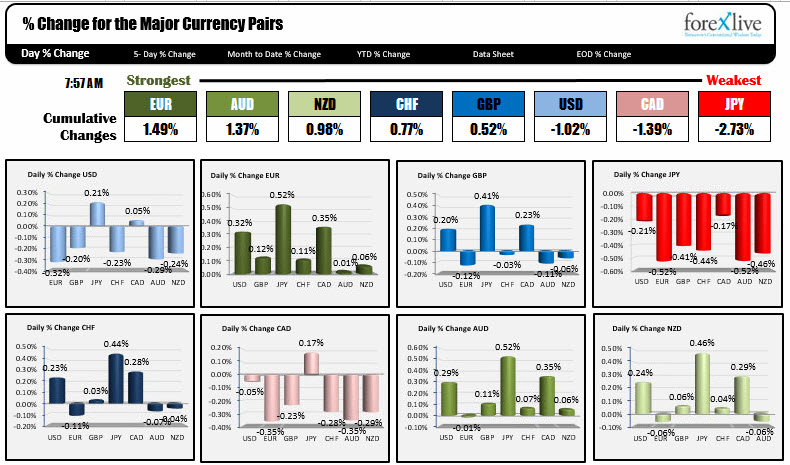

The EUR is the strongest. The JPY is the weakest.

As NA traders enter for the trading day, the EUR is the strongest of the majors while the JPY is the weakest. There was little data in Europe but the EUR did have a buyer into the early part of the European session. The EURUSD moved up to the 61.8% of the move down from the March 27th high. That retracement target came in at 1.0777. The high reached 1.07777. Yesterday, the price stalled at the 50% at 1.0737, and then at the 38.2% at 1.6977. So the Fibonacci levels are stalling rallies and falls too over the last few trading days.

The USD is overall more weak -declining against the EUR, GBP, CHF, AUD and NZD and rising vs. The JPY and CAD (near unchanged actually).

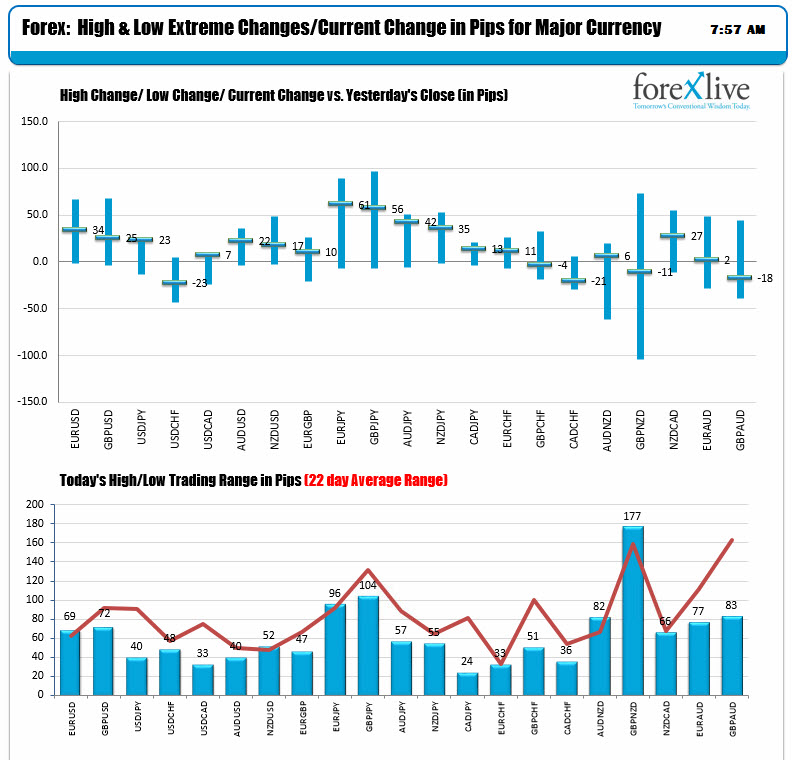

Looking at the high to low change chart (top chart below) , most of the pairs are trading near the middle of the high and low. The day's trading ranges in pips are mostly below the 22-day averages (although there are pocket of interest in some of the pairs).

A look at other markets shows:

- Spot gold at $1279.82, down -$0.46

- WTI crude which was down over 4% at points yesterday, is trading up $0.32 to $50.54

- The pre-open futures in the US are higher with the S&P futures up 6.25 points. The Nasdaq is up 20 points and the Dow futures are up 36 points

- US yields are up 1 to 2 BP with the 10 year at 2.2320 (low was 2.1965%). The low this week traded at 2.16%

- In Europe, stocks are mostly higher. Dax unchanged, UK FTSE unch. Cac +0.72%, Spain Ibex up 0.25%

On the calendar today:

- US jobless claims at 240K vs 234K last

- Philly Fed Business outlook index 25.5 vs 32.8 last

At 10 AM:

- Eurozone Consumer confidence for April -4.8 vs -5.0 last

- Leading index +0.2% vs +0.6% last

BOE Carney speaks in Washington at 11:30 AM ET/1530 GMT