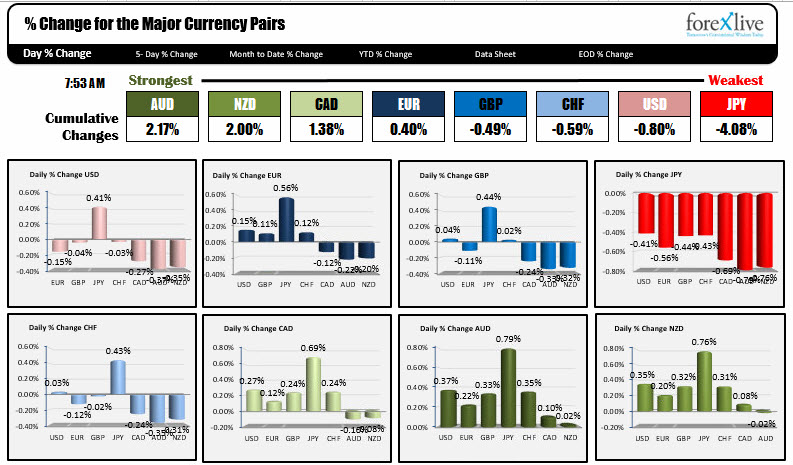

June 16, 2017. The AUD is the strongest. The JPY is the weakest.

As North American traders enter for the day, the AUD is the strongest while the JPY is the weakest. The JPY was the weakest currency at the end of the trading day yesterday. It is continuing its trend lower in trading today. The currency is weakest vs the commodity currencies which are all modestly stronger in trading today. The USD is mostly lower (modestly) with declines against all major currencies with the exception of the JPY.

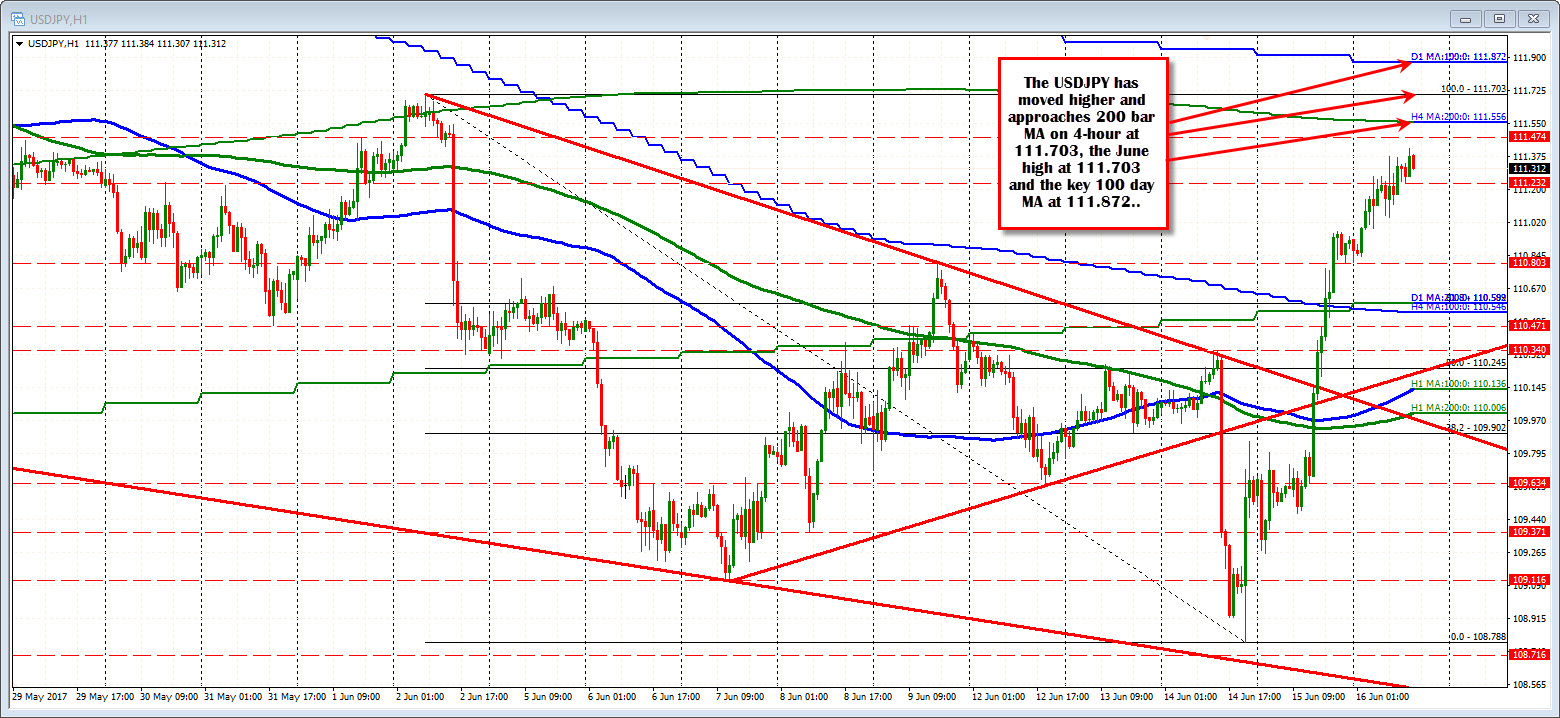

The USDJPY moved above its 200 day MA and 100 bar MA on the 4-hour chart at 110.55 area and has not looked back. The pair is aproaching the 200 bar MA on the 4-hour chart at 111.556, the swing high for June at 111.70 and then the 100 day MA at 111.872.

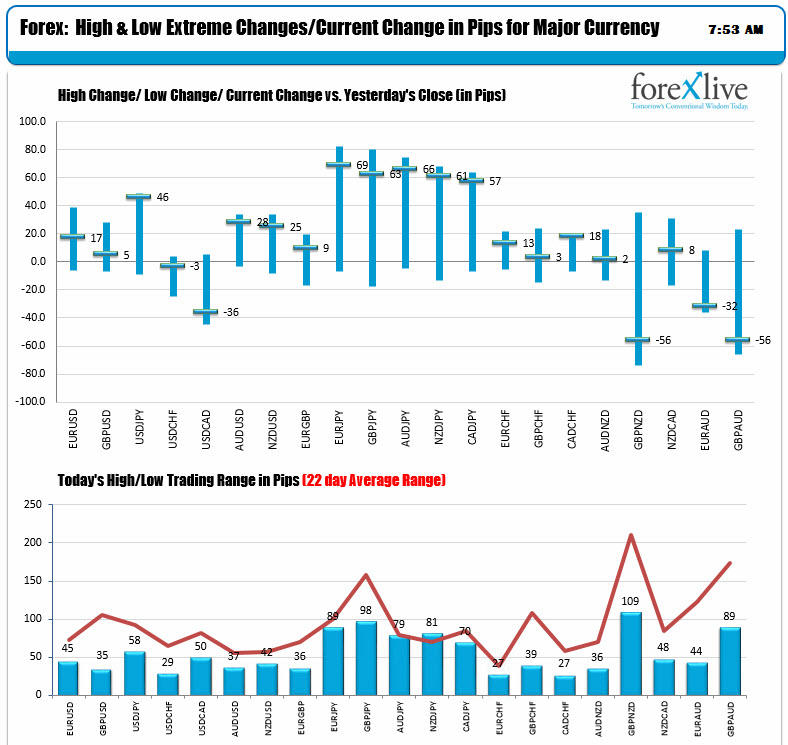

The changes and ranges show the JPY pairs all trading near high levels. The lows for the day in those pairs did not wander too far below the 0 line. So the pairs have been trending steadily higher today. Most of the pairs high to low ranges though are below there 22 day averages (about a month of trading days), signalling a lack of interest. It is Friday in the summer months. So that may not be too much of a surprise.

The calendar is light today with US building permits and housing starts due at 8:30 AM ET/1230 GMT. The Prelim University of Michigan consume sentiment will be relaeased at 10 AM ET/1400 GMT (est 97.0 vs 97.01 last). The labor market conditions index is expected to fall to 3.0 from 3.5 after the weaker than expected NFP this month.

In other markets:

- Spot gold is up $0.83 or 0.07%

- WTI crude is up $0.40 or 0.90% to $44.86

- US yields are marginally higher (less than 1 bp)

- US pre-market stock futures are higher. S&P up 1.5 points. Nasdaq futures up 1.75 points and the Dow up 12 points. All three fell yesterday. European stocks are trading higher (Dax up 0.26%, UK FTSE up 0.58%, CAC up 0.68%).