The 1:1 (Pink) and 50 Fibonacci level at 122.08 has held for the second time in as many days, the market fell 10 pips below the support level during yesterdays trading session but the bulls returned in force sending the market 90 odd pips higher over the last 24 hours. If a solid close is see above the 123.20 high we may see USDJPY close the gap that was left on Monday morning in the coming sessions.

USDJPY Daily

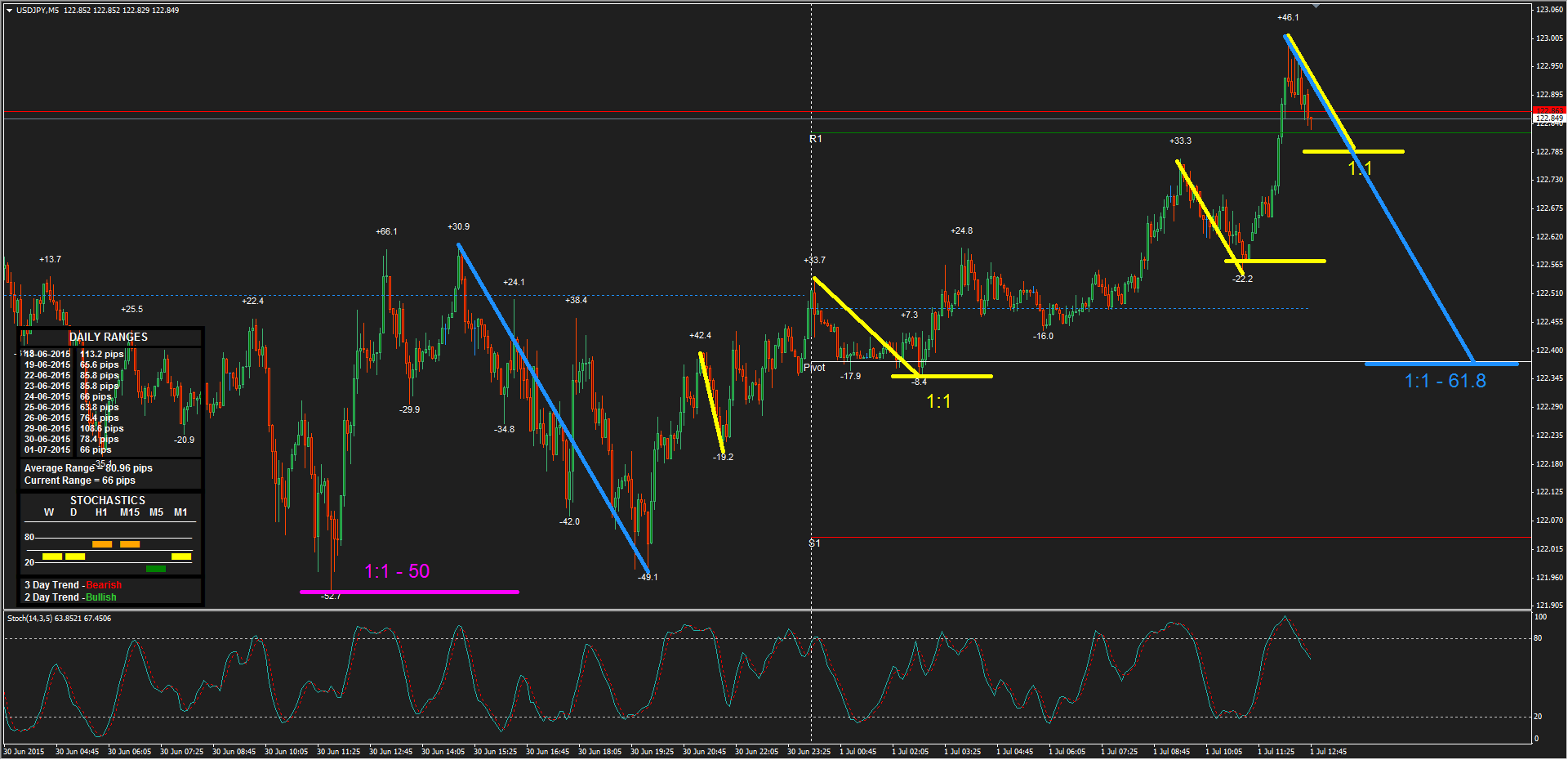

Moving down to the 5 minute chart we can see that the smart money has been buying aggressively on the 1:1 (Yellow) dips throughout todays trading sessions, with the most recent 1:1 (Yellow) at 122.57 attracting some solid buying interest from these intraday players.

The next level to keep a close eye on will be the 1:1 (Yellow) that comes in at 122.78, if this level can attract further buying interest from the bulls the market will likely take a run for Mondays trading session high at 123.20. However, if this support level fails a further correction is likely with the next major support in this degree not seen until the 1:1 (Blue) that coincides with the 61.8 Fibonacci level at 122.37.

USDJPY M5

* A 1:1 refers to a current correction being equal in length to a prior correction