Stocks back in the red...A look at the technical levels in play into the new trading day.

The US House has cancelled the Thursday vote according to a senior house republican aide and we are seeing a weakening of stocks a bit with the S&P down -0.19% and the Nasdaq down -0.14%. The dollar is a little lower. Yields are back to unchanged.

The USDJPY is moving to test the low from yesterday at 110.74. The low earlier today extended to 111.62. It looks like it will be another negative day for the USDJPY. IT will be the 8th straight decline. The high today reached 111.57. The swing low in February reached 111.58. So that level becomes a key level on any move higher going forward.

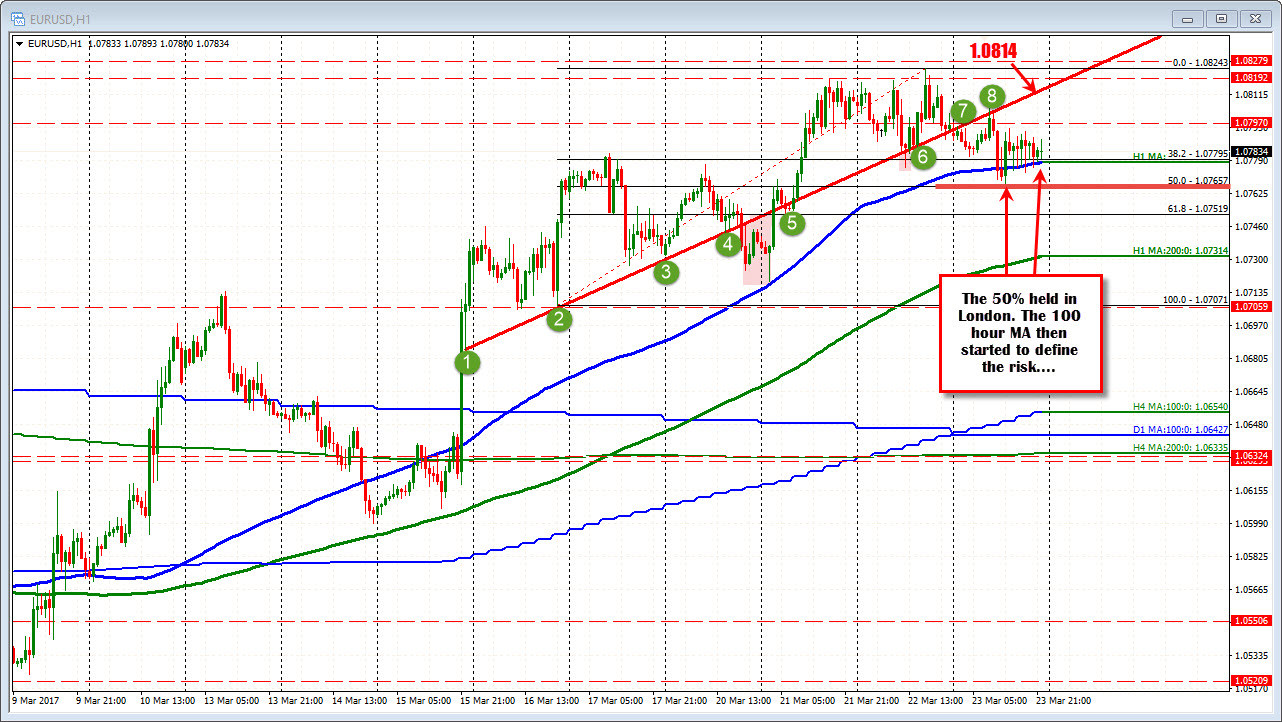

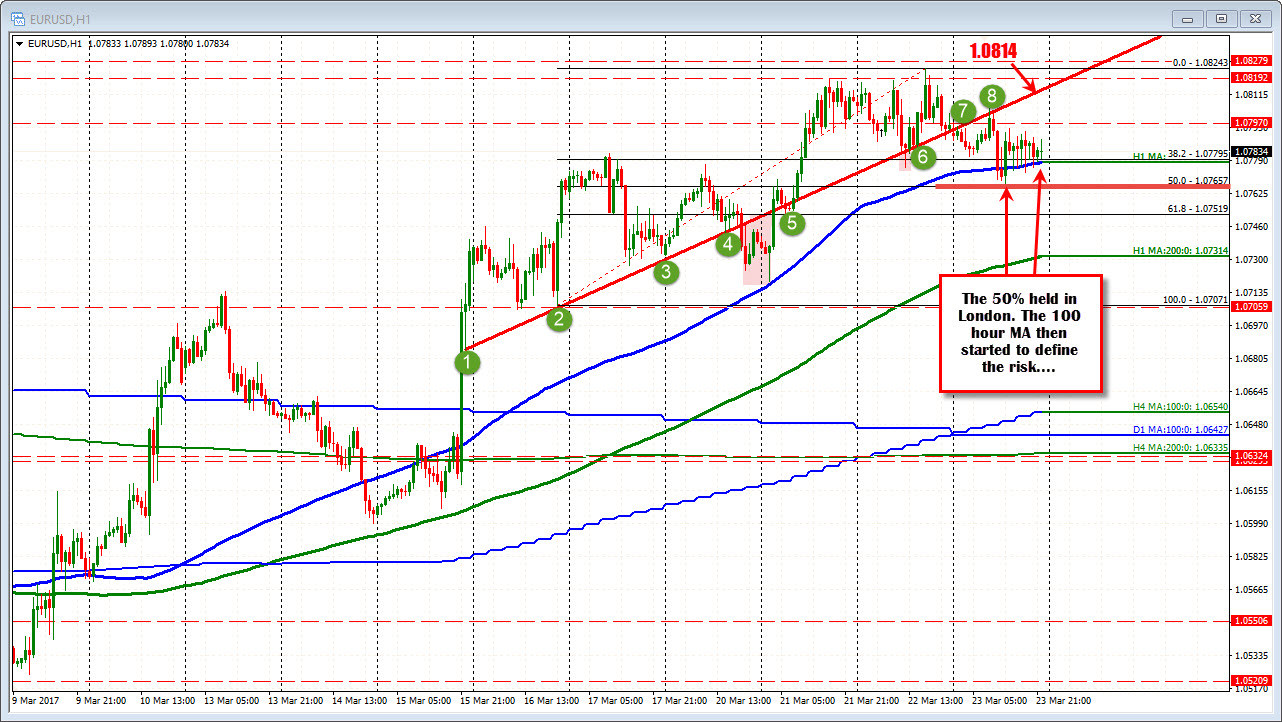

The EURUSD has been stalling against the 100 hour MA (blue line in the chart below) at 1.0778 during the NY trading session. In the London session there was a dip below the level but only as far as the 50% retracement level at 1.07657. On the topside, the 1.0814 is the underside of the broken trend line. Above that the 1.0819-28 is the next key target to get to and through. The 1.0819 is the 50.0% of the move down from the November election high. The 1.0828 is the spike high from Feb 2. A move above those areas are more bullish.

The GBPUSD has risen 7 of the last 8 trading days. The pair yesterday found support at the 50% and the 100 day MA at the 1.2407 and 1.2415 levels respectively and closed near the highs. Today, the pair extended higher. Looking at the hourly chart, the pair has stalled near the 1.2530 level (kinda random level). A topside trend line comes in at 1.2560 currently. There is other resistance against the Feb 24th high at 1.2570. If there is a rally toward that area, there should be some slowing....

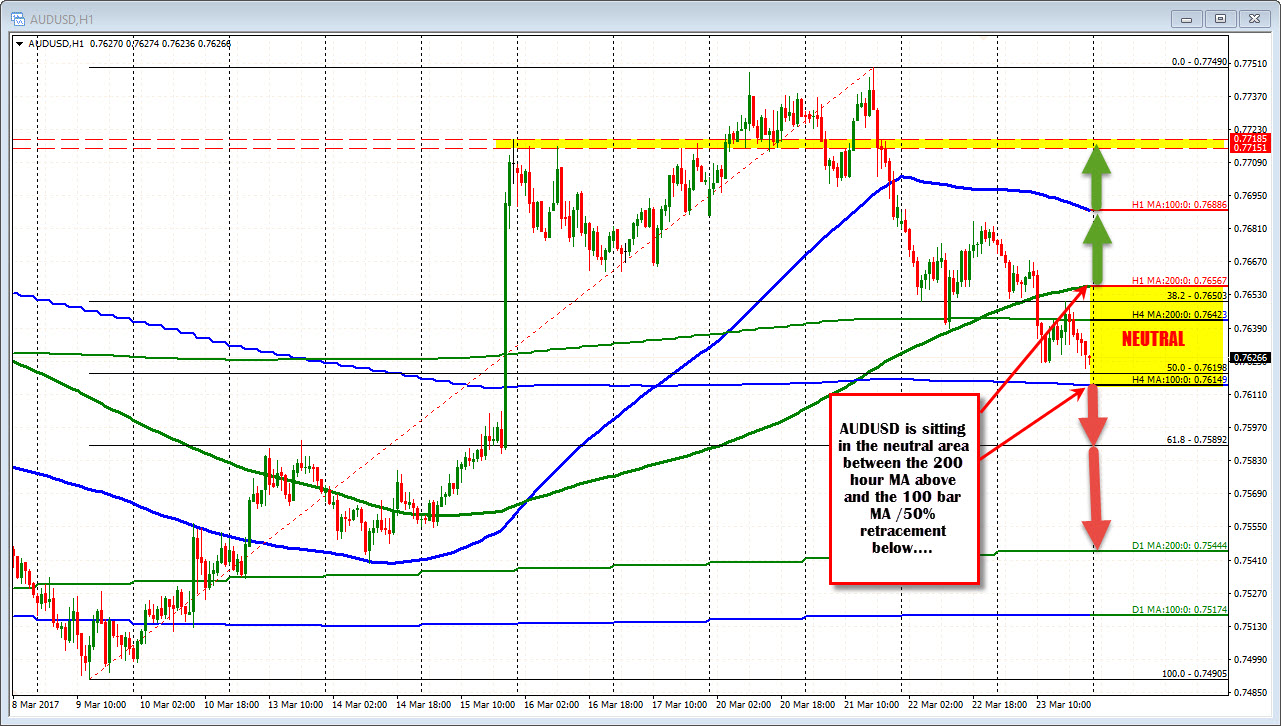

The AUDUSD is closing near the lows for the day and also near support defined by the 50% and the 100 bar MA on the 4-hour chart at the 0.76198 to 0.76149 level. A move below is more negative/bearish. The 0.7589 is the next target. If support holds a move back toward the 200 hour MA (green line) at 0.76567 would be eyed. A break above that area would be more bullish technically.