Oil higher in light trading Monday but it's a big week for crude

The oil market is oversupplied. Millions of barrels are going into floating and land-based storage daily because drillers are producing more than people are burning.

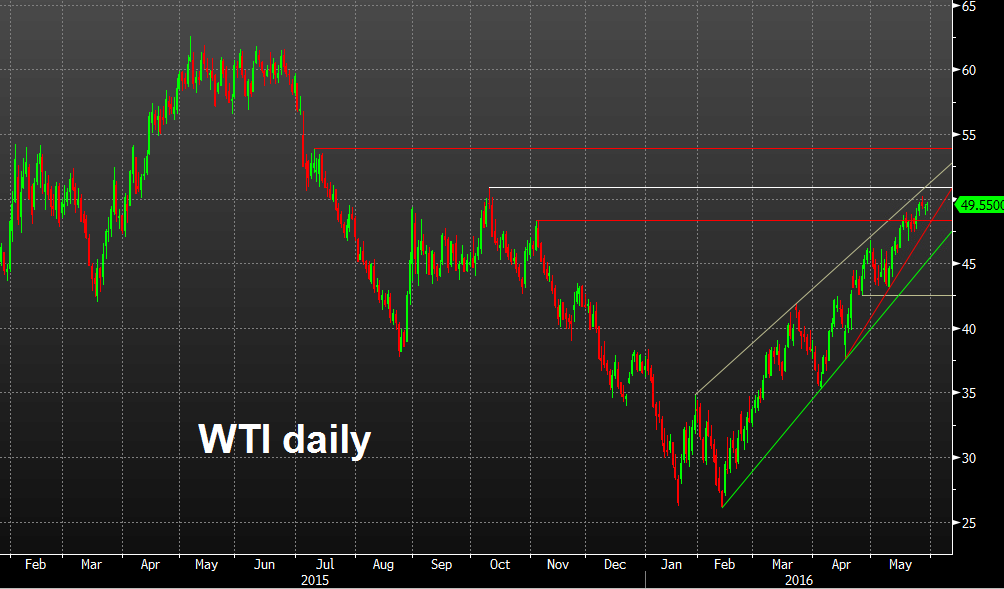

That dynamic crushed oil prices late in 2015 and into early 2016. But since mid-February, prices have bottomed and risen nearly 90%.

It was rebound that few anticipated. It was helped at various times by outages in the Middle East, Canada and Nigeria along with rumors of an output freeze. Some of that lost production will come back on line but at the same time, shale production in the US has declined by about 1 million barrels and is forecast to fall by another 1 million barrels by year end, to slightly below 8 mbpd.

The main medium-term risk is that prices above $40 help to restart shale drilling. More efficient drilling techniques and machines are constantly driving costs and improving efficiency. In the past month, active rigs in the low-cost Permian Basic have flattened out at 137.

For the moment, the momentum is to the upside. Last May/June, oil was in the $60 range and there is no reason to think the rally will subside.

The uptrend is well-establish and has steamrolled numerous headlines that would normally be bearish.

Technically, the October high of $50.92 was tested late last week and is the key short-term hurdle. There is some more minor resistance at $54 but I don't expect that to pose a stern challenge.

Seasonally, we've passed the peak of inventory building and driving season has begun. Historically, June is still a strong time but it's the final 'good' month of the year. Seasonals begin to tail from there with mixed pictures in July and August. Note, however, that last June is when oil turned for 2015 but it wasn't until the final week of the month.

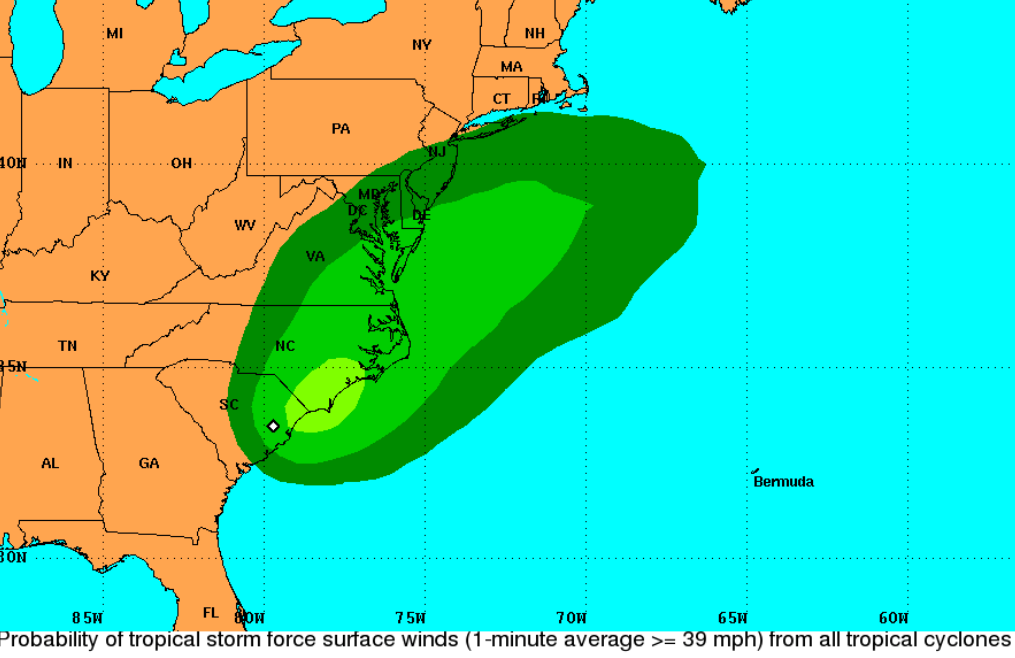

Another factor is storms. A peak is still about three months away but the first tropical storm hit the Carolinas today in a reminder that El Nino/La Nina could make for unpredictable storm season after several years of moderate hurricanes.

The OPEC meeting is Thursday and expectations are low. I struggle to see how they could influence prices beyond jawboning but leaders may highlight some of the dynamics and rifts in the market. An output freeze announcement is almost unthinkable.

WTI crude oil is up 24-cents to $49.57 Monday after falling as low as $49.02. Volume is light with the US and UK on holiday.