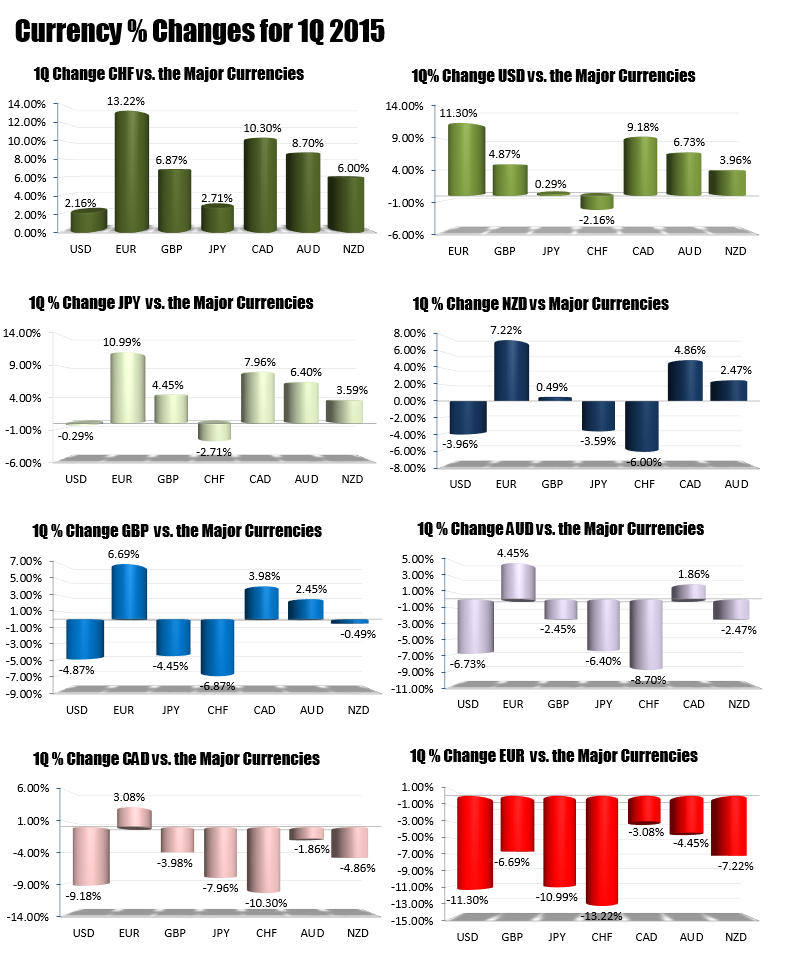

The CHF is the strongest. The EUR is the weakest

The 1Q 2015 is now behind us, and it is time to rank the relative performance of the major currencies for the quarter.

By accumulating the % changes of the USD, EUR, GBP, JPY, CAD, AUD and NZD vs each other, the strongest to the weakest currency for the 1Q looked like the following:

- CHF (Strongest)

- USD

- JPY

- NZD

- GBP

- AUD

- CAD

- EUR (Weakest)

The CHF benefited from the surprise de-pegging of the EURCHF by the Swiss National Bank on January 15th. That move sent that pair plunging (and the CHF soaring) to 0.8500 from 1.2000 in minutes. Since that day, the EURCHF has rebounded most of that loss (it closed near 1.0440). Nevertheless, the increase in the CHF vs. the EUR of 13.17%, coupled with the gains vs the other currencies, was enough to keep the CHF the strongest currency for the quarter (see chart below).

The weakest currency was the EUR. The largest negative catalyst for the EURs in the quarter was the announcement on January 22nd, that the ECB would begin QE to the tune of 60 billion euro per month (with a total of 1.1 trillion EUR ending in September 2016). This was larger than expectations. The QE - along with persistent uncertainty stemming from "Greece in or Greece out" - contributed to the common currency losing value against all the major currencies in the 1Q. In addition to the sharp fall against the CHF, the EUR also fell -11.30% against the USD and -10.99% against the JPY.

One interesting fact for the quarter is that the EURUSD opened the year at the high for the quarter(the high on January 2nd was 1.2108). When will that high be touched again? Ironically, in 2006, the low for the year was also on January 2nd. So their is a precedence of the extreme being set on day 1 (there is no way the EURUSD trades 1.2108 again, right?).

The USD was the 2nd strongest currency for the quarter, as it rose against all the major currencies with the exception of the CHF. Against the CHF, the pair recovered all but 2.16% of it's plunge, closing the quarter at 0.9719. The low price of the USDCHF had moved all the way down to 0.7400 (down some -25% from the end of December levels). As a result, the recovery to -2.16% was a pretty good result and comeback.

In the first quarter, the greenback benefited from continued strength in the US employment reports. The three reports announced in the New Year averaged a gain of 287.7K. The unemployment rate fell from 5.8% to 5.5%. Economic growth was sluggish with estimates for 1Q GDP slowing to the low 1%. A harsh winter in January and February was once again a negative influence in 2015. Despite the slower growth, the FOMC took the word "patient" out of their statement in March, and started to pave the way for "liftoff" in rates later in 2015. Softening the rate hike reality (or so it seems) was a bunch of caveats including risks from a higher currency, risks from global growth slowdown, risk from persistent lower inflation, etc.. The Fed also slashed their expectations for year end rates to 0.625% from their unrealistic December 2014 estimate of 1.125%. This implies two rate hikes in 2015. It may end up being one if growth does not thaw out in the spring. It may end up being three if there is a robust spring and wage inflation starts to kick in. Centering it at two is the most logical place to have it.

CAD was the second weakest currency. It continued to be influenced by lower oil prices (Crude fell from 54.96 at the end of 2014 to 47.60 at the end of quarter or -13.4%). The AUD was also generally lower on the month. Iron ore, a main export from Australia to China, closed the quarter at the lowest level since 2009. The calls for a rate cut at the RBA's April 7th meeting started to be heard toward the end of the month (80% chance of a 25 basis point cut vs 40% a few weeks ago). Higher house prices in major cities is a counter argument for not doing anything. We will know soon enough (next Tuesday to be exact).

Overall, the quarter was characterized by oversized ranges. The EURUSD range was 1600 pips. The GBPUSD was 928 pips. The CAD was 1200. The AUD was 725 pips. We will never know what the USDCHF true range was. The only pair that took the quarter off was the USDJPY which on a relative basis only traded in a 620 pip range. Do we settle down in Q2?