Continues what was started last week after Ford news

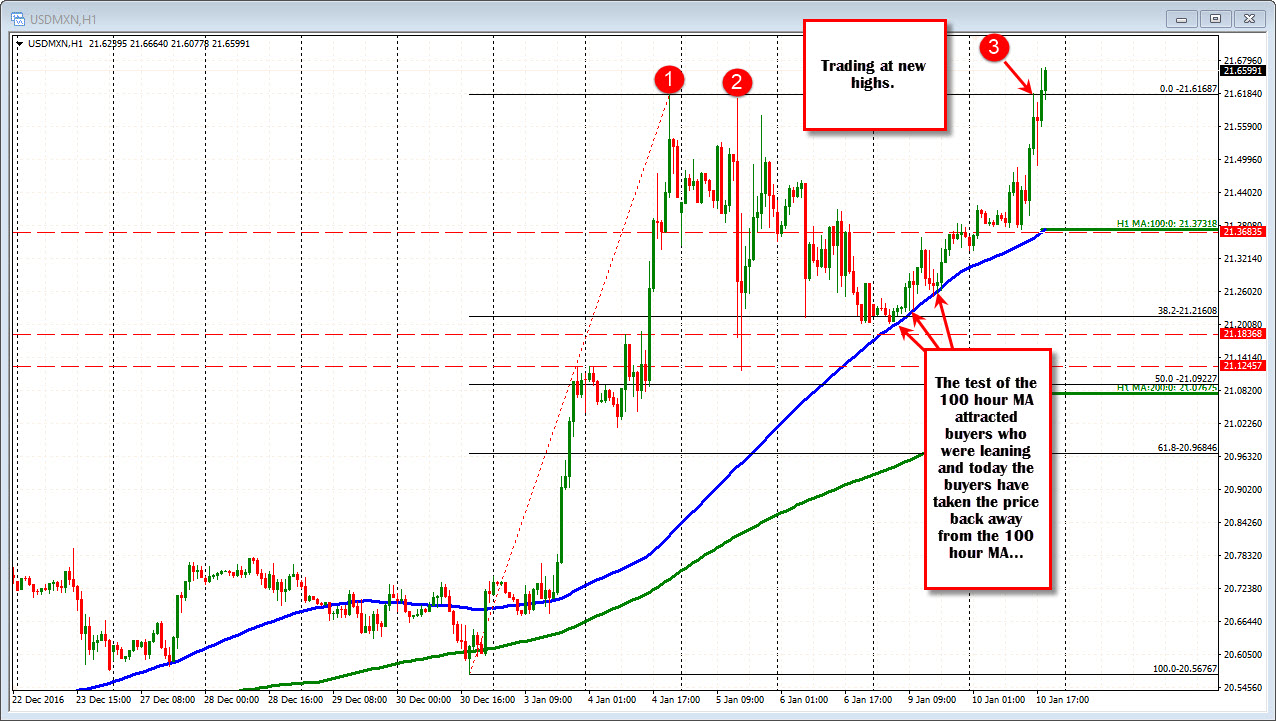

Last week, Ford announced that they would not build a plant in Mexico but instead invest in the US. That sent the USDMXN surging higher with the break leading to a new all-time high of 21.61687. The move took out the post election highs of 21.3726 in the process.

Since that peak, the price corrected lower, but when the 100 hour MA caught up to the price yesterday (see blue line in the chart below), the buyers leaned and lo and behold we see the extension higher today.

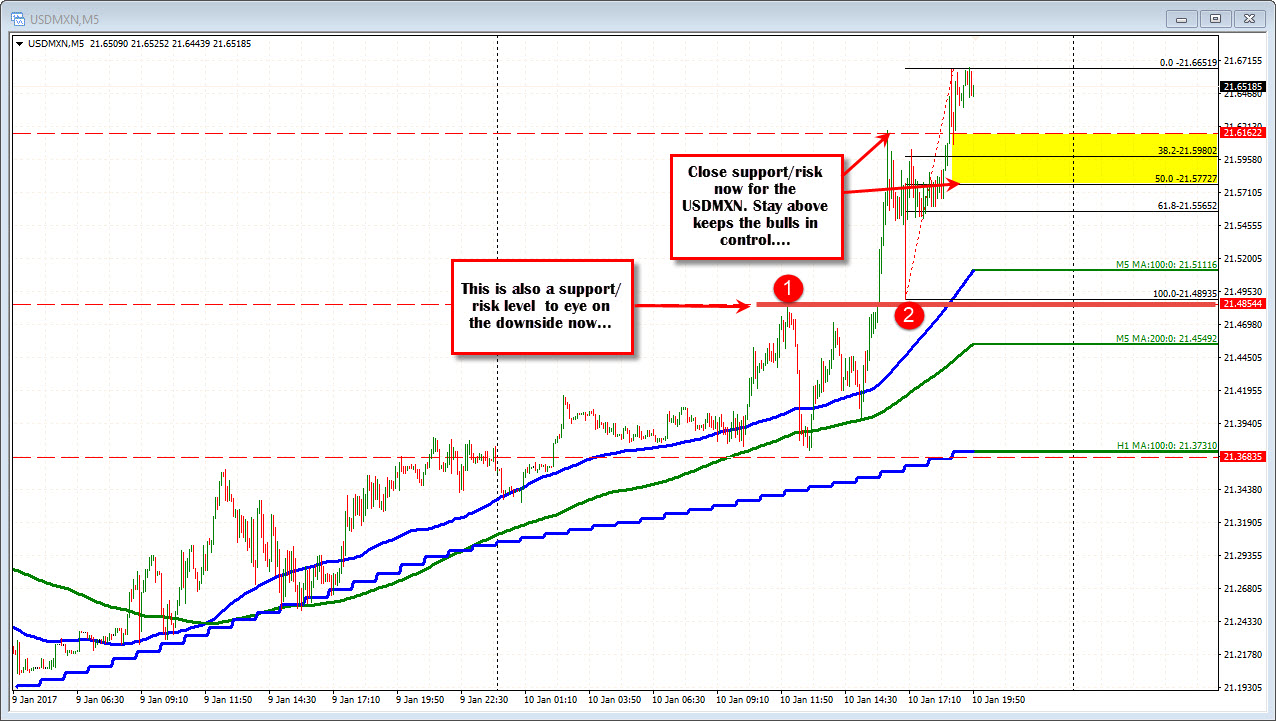

Drilling down to the 5 minute chart, watch 21.61622 area as close support. The 21.5772 is the 50% of the last trend leg higher. A move below that might not be the best price action given the break.

One thing to worry about is action by the central bank to stem the weakness. It could come on a surprise rate hike or intervention. However, with Trump taking office approaching, the markets will be nervous and the trend is not for a stronger MXN - that is for sure.