Back higher after better data

The earlier data in the US was weak with the ADP coming in lower than expectations. Productivity data was mixed. Trade was better. ISM/PMI and Factory orders are all better.

With more good than bad now, the USDJPY has pushed higher again in what has been an up and down day.

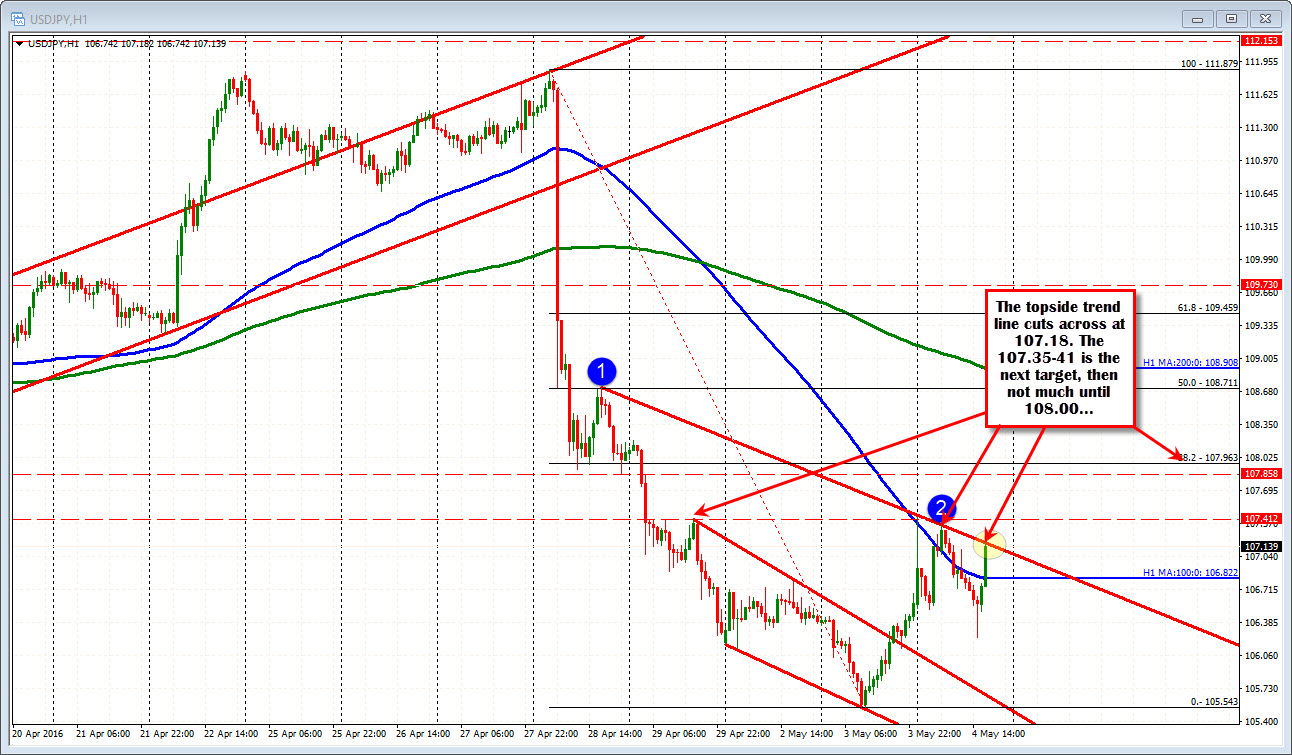

Technically, looking at the hourly chart, the pair is trading above the 100 hour MA at 106.82 and moving higher. Trend line target at the 107.18 is up next (testing now). The high for the day comes in at 107.35. There is a ceiling area at 107.41 from last Friday. Stepping through those levels keeps the momentum going.

It has been an up and down type of day, but I like the move away from the 100 hour MA.

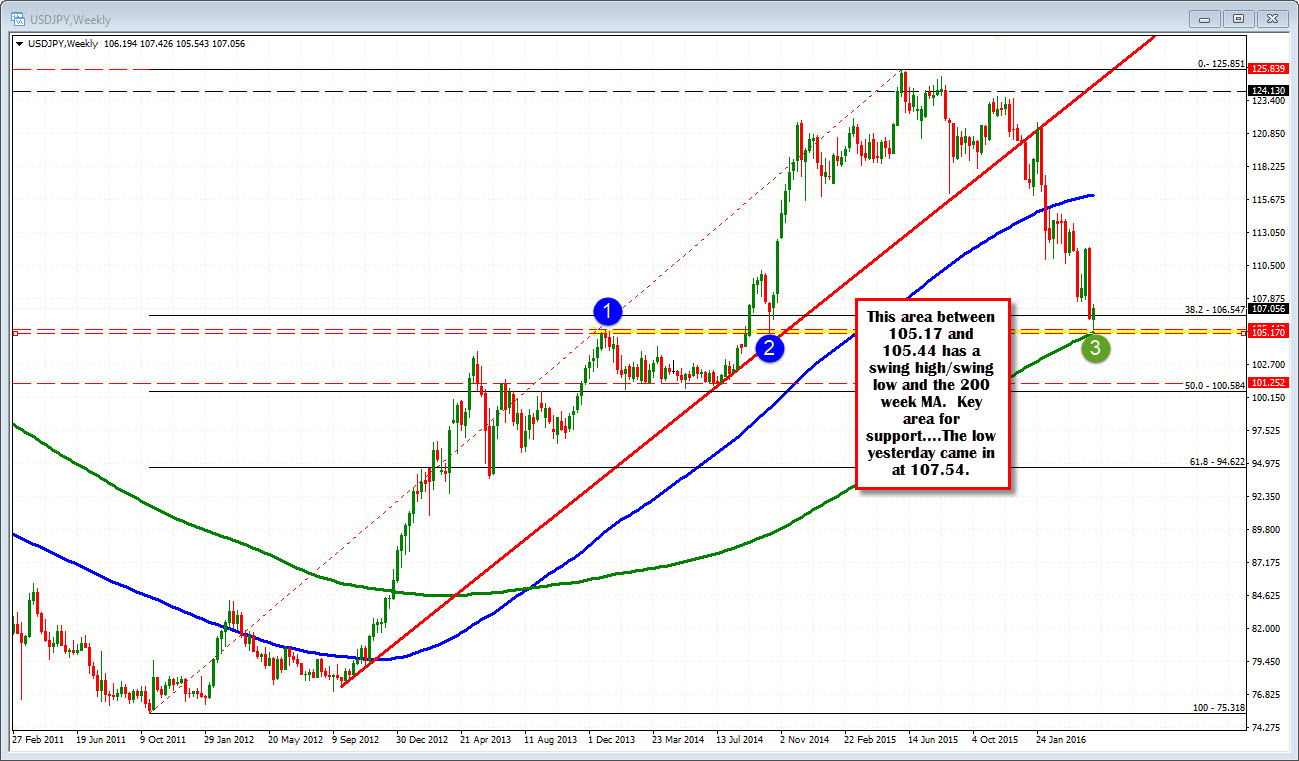

Now what about the longer term view? Was the low from yesterday it?

To look at that, I am drawn to the weekly chart. Looking at it, the 200 week moving average comes in at 105.20. The low yesterday came in at 105.54 - 34 pips away from that MA line.

Looking further back, the swing high from Dec 2013 cam in at 105.44. There was a swing low in November 2014 at 105.17. Once again, the low yesterday came in at 105.54 - above those levels but it highlights the importance of the 105.17/44 area. If the price is to probe for a bottom, that is a key area.

In additions, the 38.2% of the move up from 2011 low was broken and is now above at 106.54. That too is bullish.

So where do we stand?

- The bottom may be in. That will depend on "2" below.

- The risk for longs right now would be the 100 hour MA at 106.82. Stay above and there is further upside potential.

- Get Above topside trend line at 107.18 and then the 107.35-41 area and the upside can be further explored, with 108.00 the next major hurdle.

A move below 106.82 and the market traders will grumble and the waters will become more muddy.