It has to go somewhere.

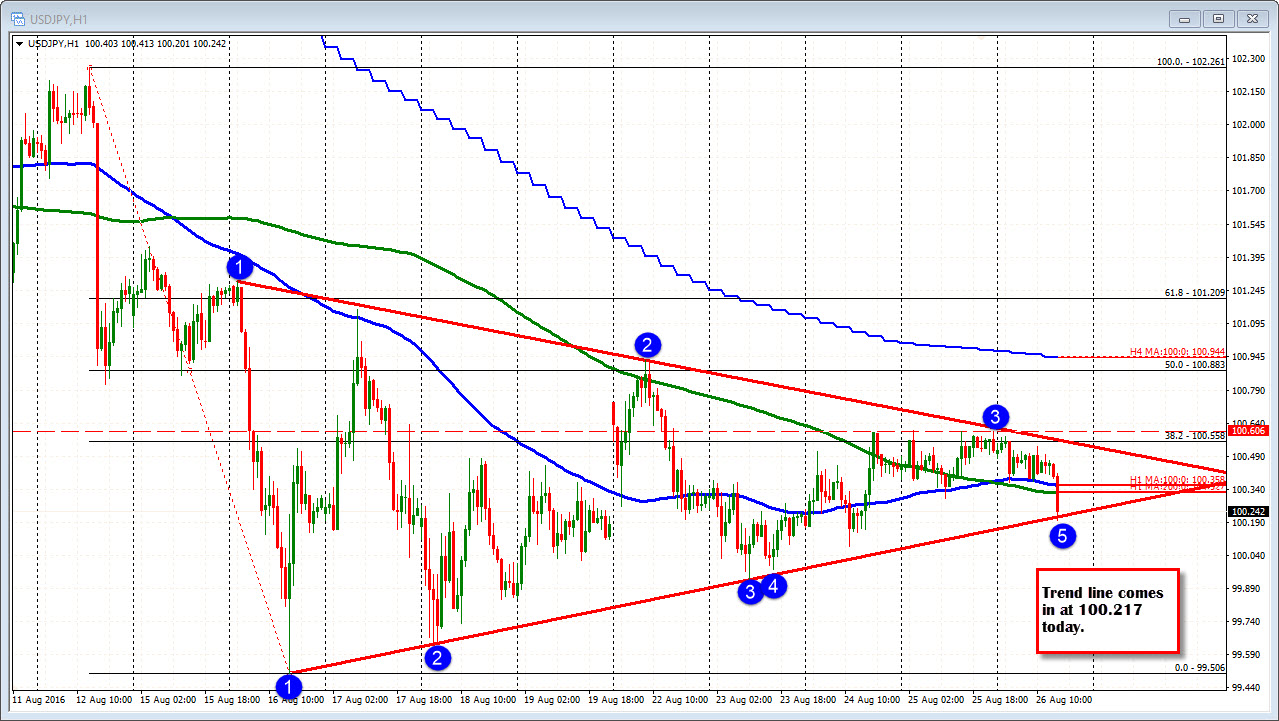

The USDJPY (and dollar in general) has moved tot he downside over the last few minutes. For this pair the price has been converging in a triangle. The lower boundary is being tested at 100.217.

A break below will look toward the week lower prices. The low on Wednesday was 100.08. The low for the week extended to 99.93 on Tuesday.

The range for the week is 99 pips. That is the lowest for 2016. The last time it was this low was the last week in December (rightfully so).

Traders looking for more downside, would love to see the 100 and 200 hour MA to hold (blue and green lines). Some traders might wait for the topside trend line at the 100.558 area. That is the 38.2% of the move down from the AUgust 12 high.

The Fed speakers are speaking the path of rates are higher but.... The "but" keeps the window open for nothing to happen.

The Yellen speech carries a lot of headline risk. When that happens if the speech is neutral, the chance of a whipsaw market exists as one headline is offset by an other. So understand not only the event but the liquidity risks.