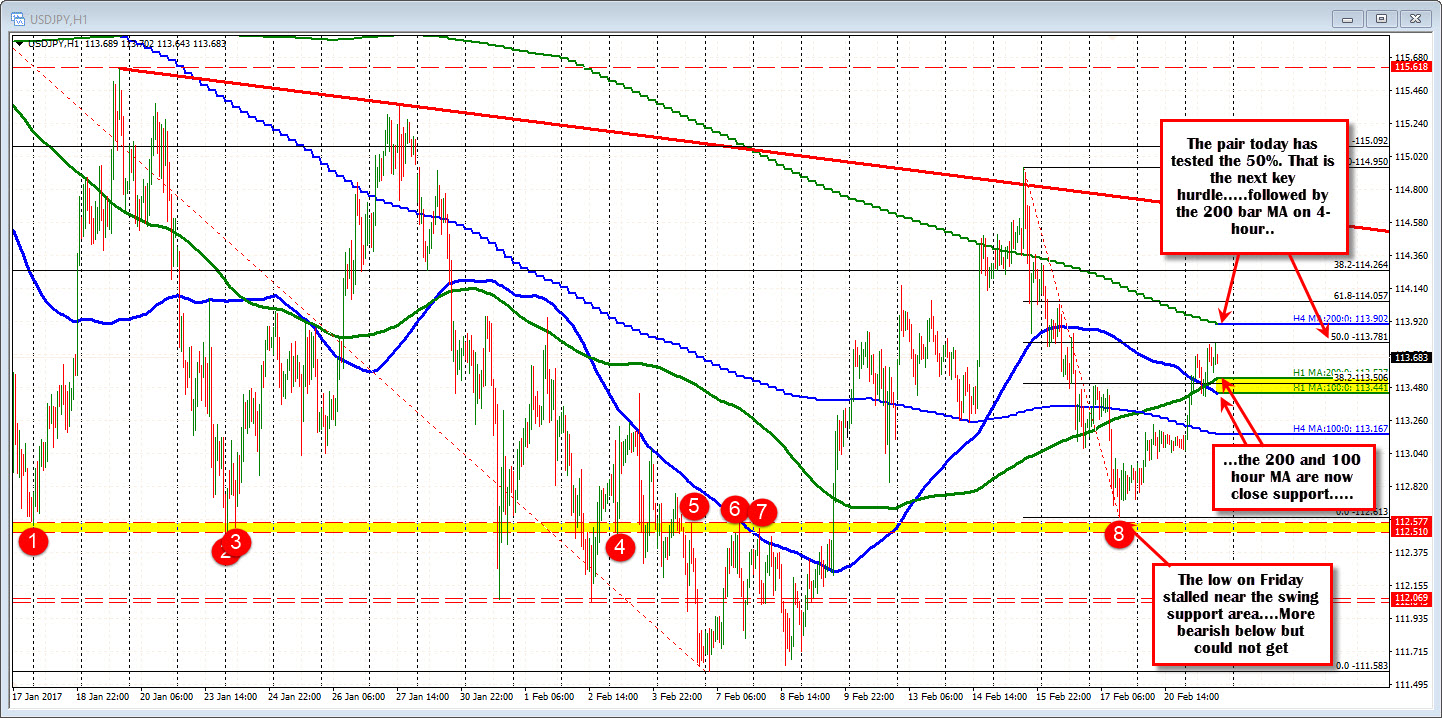

Above 100 and 200 hour MAs

The USDJPY has followed the dollar higher in trading today. The pair has consolidated around the 100 and 200 hour MAs (at 113.44 and 113.52 respectively), and is trying to get above the 50% retracement of the move down from last week's high. That level comes in at 113.78. The 200 bar MA on the 4-hour chart comes in at 113.901 and is another target on the topside.

When the market trades up and down like the USDJPY has doing, the hurdles start lining up and can reverse the tide. Nevertheless, I tend to look at the 50% level as a more key level. It represents the apex of the "trading see-saw"; on one side is more bullish while on the other side, the bears are more in control. The high today reached 113.774 so far.

Close risk for traders now will come against the 200 and 100 hour MAs. Those MA were stall points today for a while.

The fundamental story line is more bullish today for the dollar. That story line was more bearish last week. The technical story line has turned more bullish since bottoming at a nice swing low area on Friday, but we now sit in the middle of the range since Feb 9th. The price needs to work through the technical land mines now.

By the way, did you catch my video on trading the up and down markets. If not, here it is.