Squeezed above 100 hour MA. Back lower

The JPY should be a safe haven currency and indeed the USDJPY (and other JPY crosses for that matter) gapped lower over the weekend.

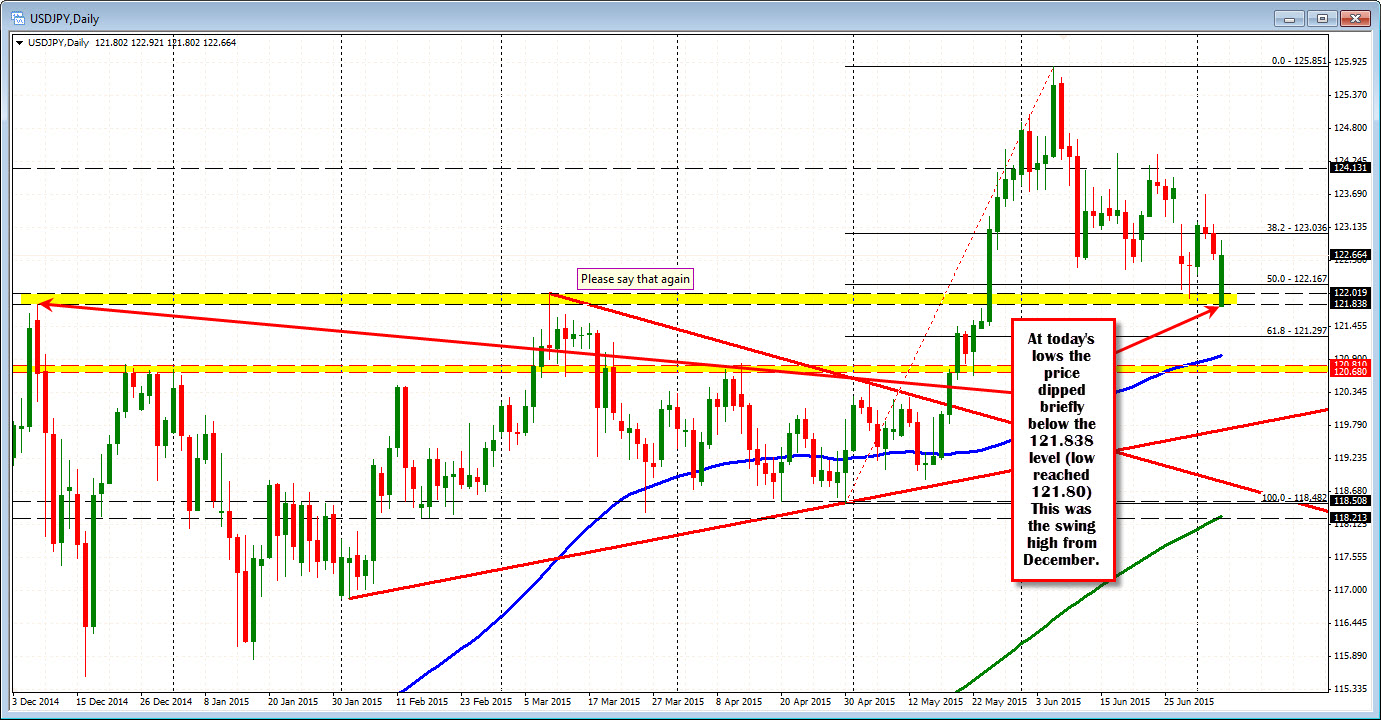

However, there has been a move back higher that took the pairs price back above the closing level from Friday (at 122.70 area) and even squeeze back above the 100 hour MA (blue line in the chart above at 122.83). That move was short lived, however, and the price has rotated back lower.

Is the correction higher over?

Like the EURUSD, the USDJPY will have its share of ups and downs as a result of news, stocks, perceived risk. That is not going away.

Technically, although the price squeezed above the 100 hour MA, it failed. That sets a potential high and should reestablish the 100 hour MA as a patient level to lean against now (at 122.83). Before that keep an eye on the 50% of the move down from last week at the 122.75 for clues. Stay below that level, and the bears will be in charge. Move above and the market will be looking for the 100 hour MA to hold the line.

On the downside, there were swing lows from June 10 to June 22 that came in the 122.42 to 122.58 area. On Friday, the low stalled just above the 122.58 level. The broken 38.2% of the move down from last weeks high comes in at 122.527. The 100 and 200 bar MA on the 5 minute chart below comes in at 122.52-58 and the 50% of the last trend leg higher today comes in at 122.55. This is the cluster support that the price needs to get and stay below if the bears are to take further control.

If things turn upside down (stocks tumbling, chaos in Greece), the 100 day MA for the pair might be tested. That comes in at the 120.97 level. Before that, watch the 121.83-122.01. These levels correspond with the swing highs from December 2014 and March 2015. Today the low price moved to 121.80 - below the December low. However, quickly rebounded back to the upside.

In the near term, however, the smaller battle is being waged by the sellers against the 122.70-75. Can they keep the lid on the pair and push back below the 122.42-58 area? Or will the buyers keep more control. That is the first hurdles for traders today.