A number of swing levels in the 112.51-58

The USDJPY is approaching an area that has had a number of swing levels going back to mid January. The area comes in at 112.51-577. The low last week stalled just above that area at 112.61. Traders were anxious to buy early against the level.

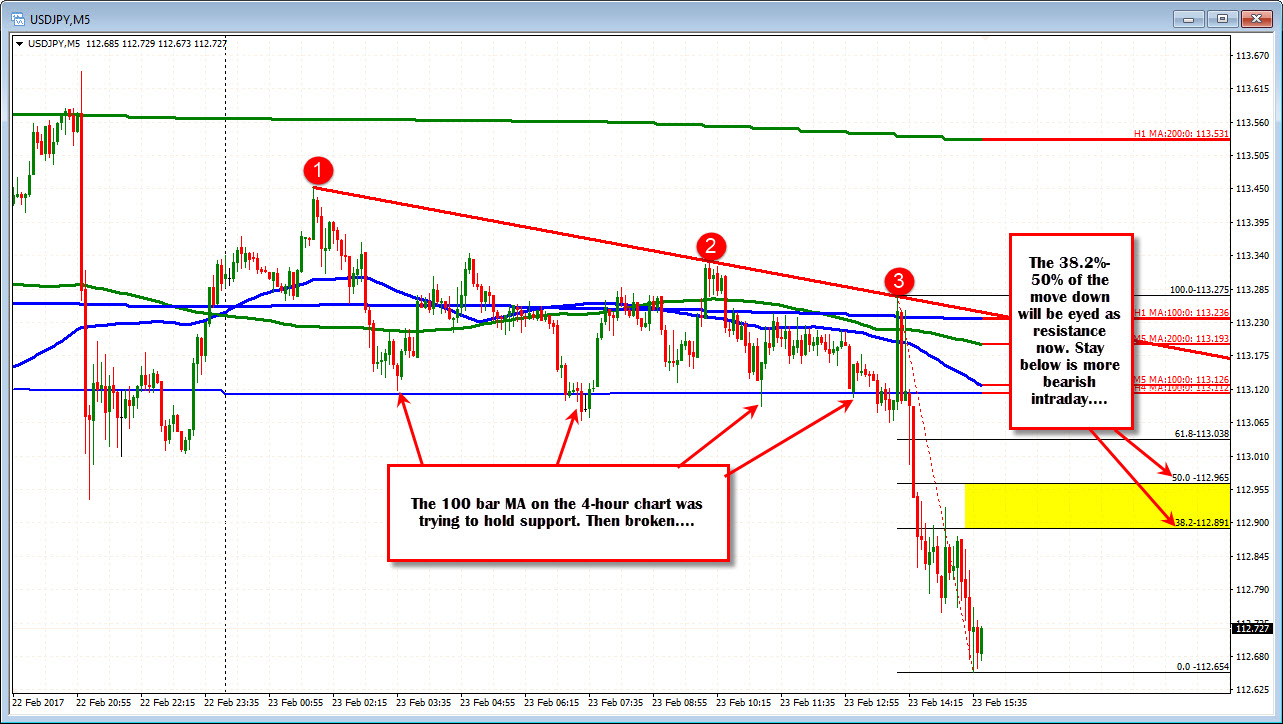

We head toward the level after the Mnuchin comments today. The market was hanging around the 100 hour MA and the 100 bar MA on the 4-hour chart between 113.11 and 113.26. The break away has taken the price to a low of 112.654. Earlier buyers?

Looking at the 5-minute chart above, the pair was contained by the topside trend line. That was the last test before the reversal back lower.

The tumble lower has moved about 60 pips. The 38.2%-50% of the move down came in at 112.89-965. Stay below that area and the sellers remain more in control.

US bond yields are moving a little more lower. The 2 year is -2.4 bp. The 10 year is down 2.7 bp now. That is lower than earlier in the day. Spot gold is up about $11 to 1248.50 area. That is following the dollar (or leading it).

US stocks are higher though with the pre-S&P up 3.75 points. Perhaps the market is seeing the Fed delay as the market realizes impact from tax reform will not be announced until August. Then have approval process and impact which will take until 2018. That delay in hiking and anticipation of better things ahead, keeps the stocks more supported. Of course that story will change 100s of times since all that....