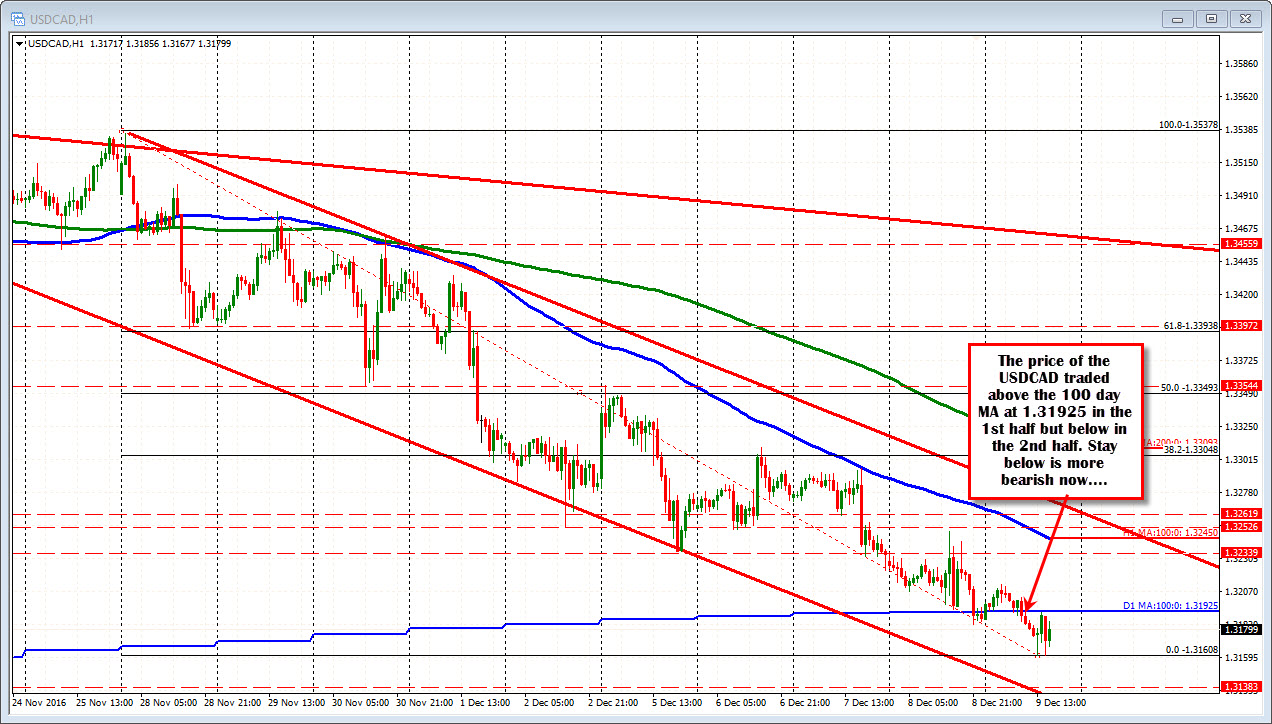

First half of day above. Second half of day below

The USDCAD is modestly lower on the day as traders prepare for the Non-OPEC members meeting this weekend. Crude oil prices are up about $0.69 or 1.36%. That may be contributing to a new low (going back to October 10th).

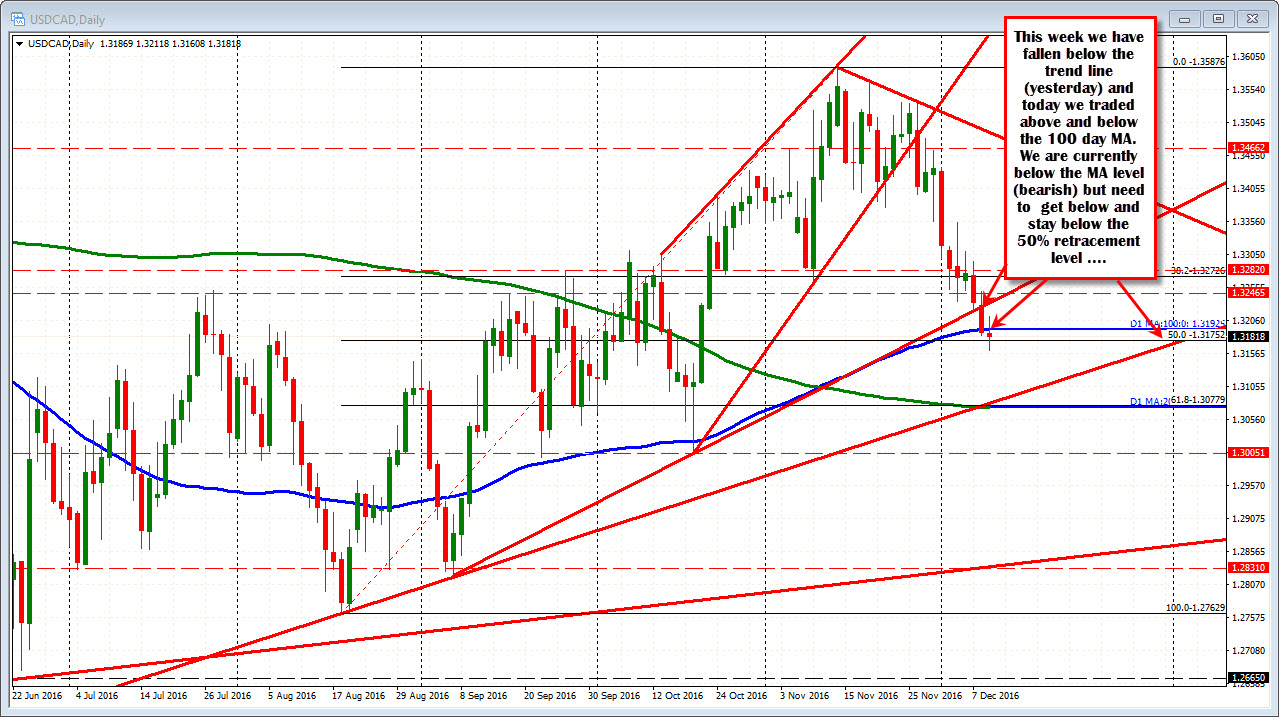

In the process, the price has moved below the 100 day MA at the 1.31925.

Looking at the hourly chart, the overlay of the 100 day MA shows that the 1st half of the day traded above the line. The 2nd half has traded below. That puts the sellers in control of the bias currently. Stay below and there should be some further selling.

On the downside, the 50% of the move up from the August low comes in at 1.31752. That level has been broken but we war currently above that level. SO there is some hesitancy on the 100 day MA break but the sellers still are in more control.

Going forward into the day, a move below that 50% level at 1.3175 should solicit more selling. ON a break, the next target comes around the 1.3130 level (need to move below the 1.30608 low as well). If we do move back above the 100 day MA, it should solicit more buying into the weekend close.

Remember there is that Non-OPEC meeting this weekend. As a result, there may be some weekend flows that guide this pair one way or the other toward the end of the day.