It is Friday and OPEC headlines can upset the apple cart

The USDCAD held the 100 hour MA yesterday and on Wednesday too. Each dip, was followed by a modest bounce.

Today, the pair traded to new week highs for the 2nd day in a row. Yesterday it failed. Today it failed.

So when the price fell below the 100 hour MA, we should see some further corrective action, right? Wrong.

What went wrong?

- It's Friday. Anything can happen

- OPEC headlines increase risk. Now that risk can go either way, but with crude below $50, it seems the market is expecting less confidence (or so it seems). That should be supportive to the USDCAD (weaker CAD).

- The next targets (which are not far from the 100 hour MA) could not be breached.

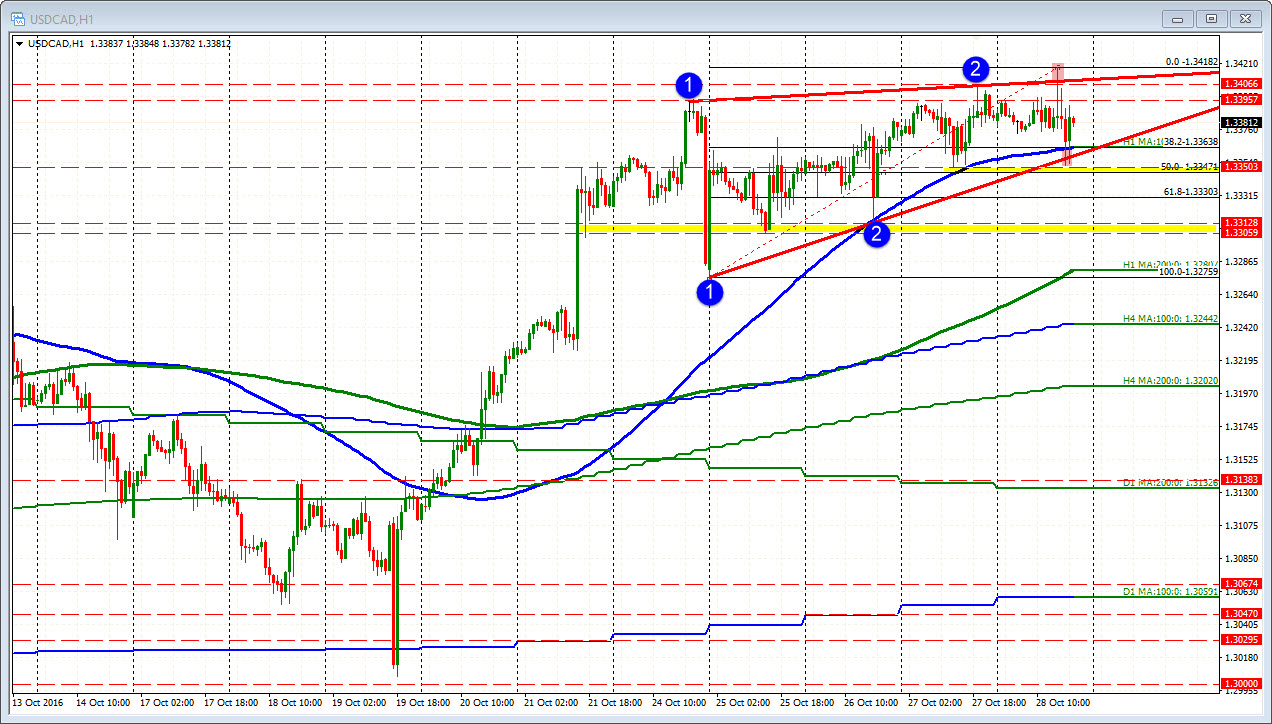

Looking at the hourly chart below, the next targets I speak of would have been the trend line connection the weeks lows (at 1.3356), and then the low from yesterday at 1.3351. You might also add, the 50% midpoint of the weeks trading range at 1.3347.

Getting below the 100 hour MA is one thing. Getting through the next targets are the next steps in the process.

What happened?

The price dipped below the trend line by a couple pips, but it could not move below the low from yesterday or the 50%. Sellers get frustrated. The price moves back higher (after all it is Friday ; ) ).

There is still hours left in the day, and an OPEC headline can cross at any time, but it may not be until next week we make a break in this pair. The lines remain the same though.