Crude oil futures are up 1.97% in early trade

With data light, the USDCAD seems to reacting to oil and technicals.

On the oil front, Crude oil futures are up about 1.97% on the day. This is helping to pressure the pair back lower. Yesterday, was the opposite. It saw crude prices fall from Friday's highs that neared $51 per barrel.

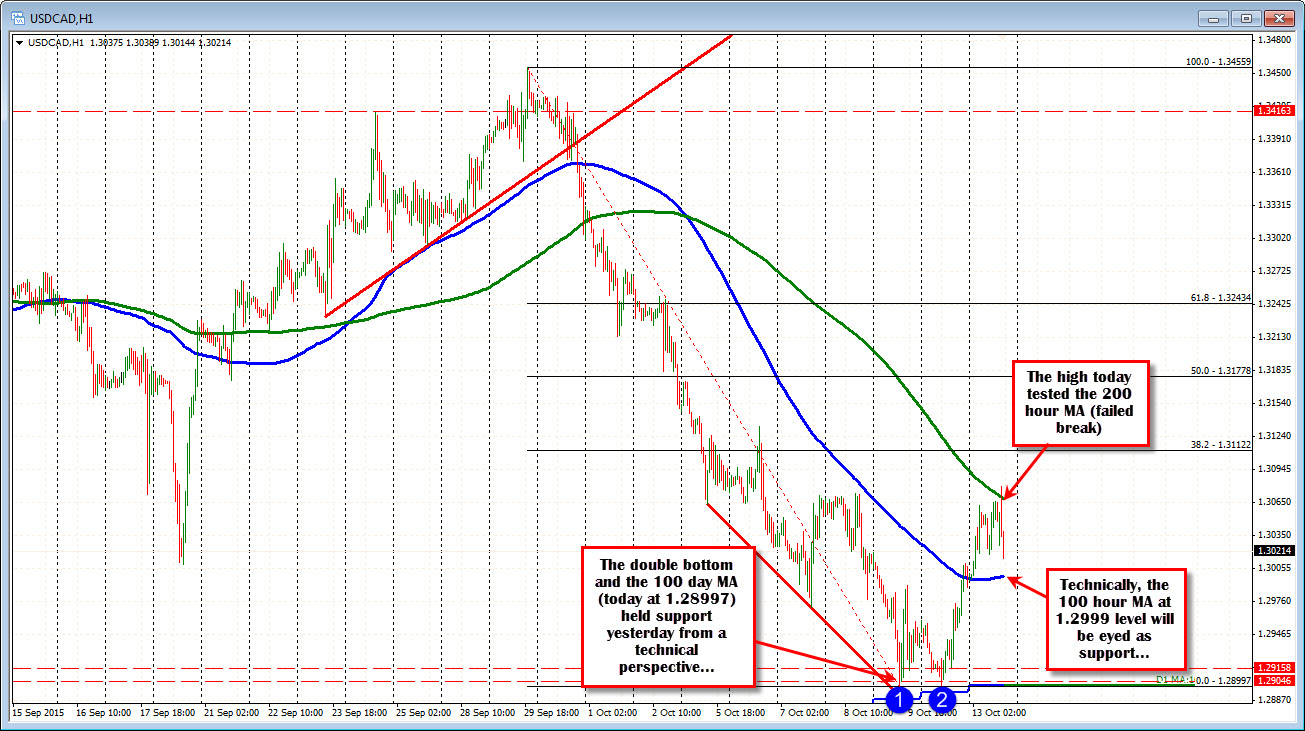

Technically, the pair yesterday found support buyers against the 100 day MA (the 100 day MA was at 1.2894 and the low came in at 1.2900). There was also a double bottom from Friday's low at the 1.2900 level (needless to say the natural support at the 1.2900 played a role).

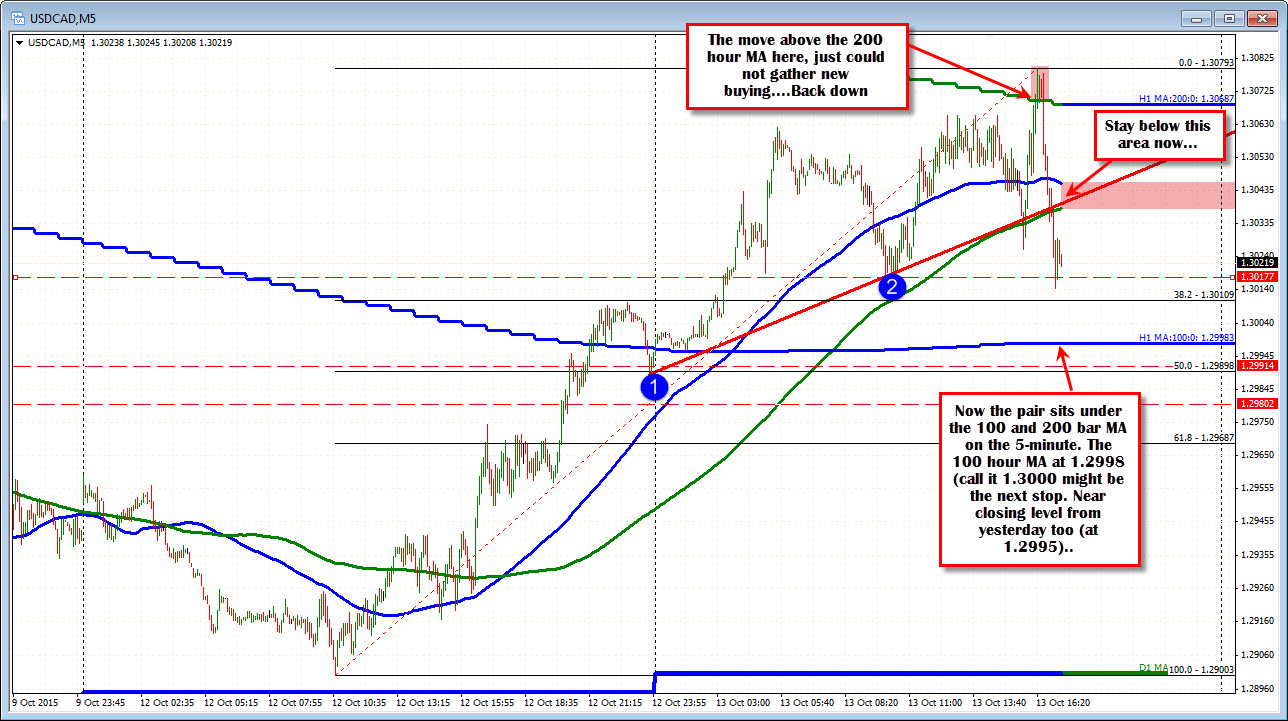

Today,the price highs tested the 200 hour MA (green line in the chart above). That MA line came in at 1.3072. The high did extend to 1.3079 but faded. The pair reversed the early NY session gains as oil futures started it's rise.

Now the price is moving lower and looking to test the 100 hour MA at the 1.2998 level. This should find technical buyers (with stops on a move below. The close from yesterday was 1.2995. This too should provide some support.

Looking at the Crude oil futures, yesterday while the USDCAD was testing it's 100 day MA, the active Crude oil contract was coming off a test of it's 100 day MA on Friday. The combination seemed to feed off each other and helped lead to the corrective move higher. Can the support on the USDCAD hold the level? Risk can be defined and limited against the level. If oil can stall the early rally now....