More two-way action.

Yesterday saw the GBPUSD surge higher on the back of the snap election and thoughts it would solidify the mandate for UK PM Theresa May in her Brexit negotiations. That AND speculative shorts out there, helped contribute to the squeeze higher. There was a capitulation surge in the NY afternoon that saw the pair move up 1.2902 in what was a 110 pip move in less than a minute. Were a good chunk of the shorts squeezed out on the move? or are there more still feeling the pain?

Today's price action is not really giving us a clue.

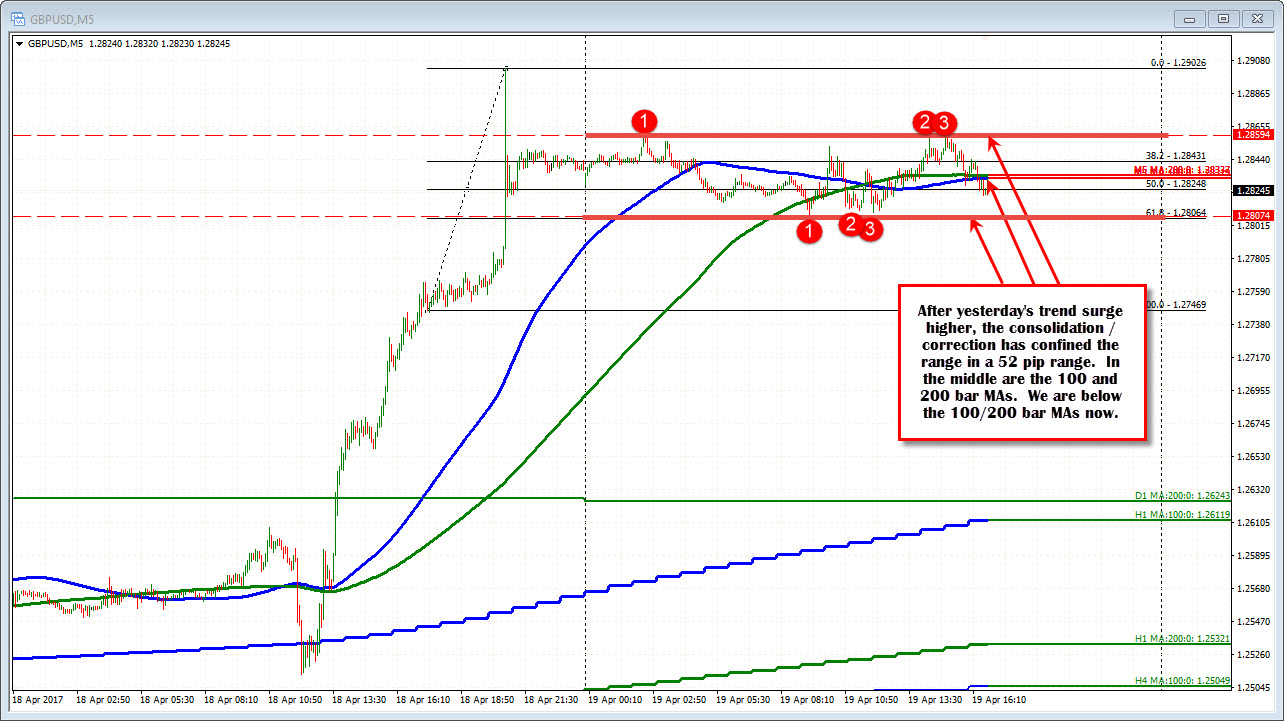

- The range is relatively narrow at 53 pips

- There is a ceiling at 1.2859. That is a good 40+ pips from yesterday's high

- There is a floor ahead of the 1.28000 level at 1.2806.

- In between the 100 and 200 bar MAs on the 5-minutes chart comes in at 1.2833. We currently trade below those MAs but have traded above and below those lines all day.

If there are shorts out there, at least they saw worse yesterday. That can give some courage and might encourage "doubling up to catch up" (i.e. selling more). That might work. It might backfire as well. The market loses a lot of traders when they ignore the trend moved and instead look to impose THEIR will vs the MARKETS will. Don't fight the market.

Nevertheless, the price action is more two-way today.

What would tip the apple cart one way or the other?

Well, the floor and ceiling from today's trading.

If the 1.2806 (and also get below 1.2800) can be breached, that would give sellers some comfort (at least most of the seat-squirming might cease).

However, is the price starts to move back above the 100 and 200 bar MAs at 1.2833 and then the 1.2859, the uneasiness from shorts (even new shorts from today), could start to get nervous again.

REMEMBER it is the short 106K in the GBP commitment of traders report which is the powder that helped cause the explosive move higher yesterday (see last weeks post from the CFTC's report below)..

The question now is "Were the speculative short positions slashed yesterday?" If so, the playing field is more neutral and squeezes like we saw yesterday should not happen. We could still go higher but not at the pace seen yesterday.

Or "Are the stubborn shorts seeing this as a BS move?". If so, the potential for more squeeze is very real.

Which it will be, we don't really know.

What we do know, however, is that pain and fear is what drives the market. If the picture from the chart cannot show a more bearish look, the pain level will start to elevate, especially if there are lots of shorts still out there. Time will tell, and we will see it in the price action I think, but the battle lines are drawn for the day. Support at 1.2800-06. Resistance at 1.2859.