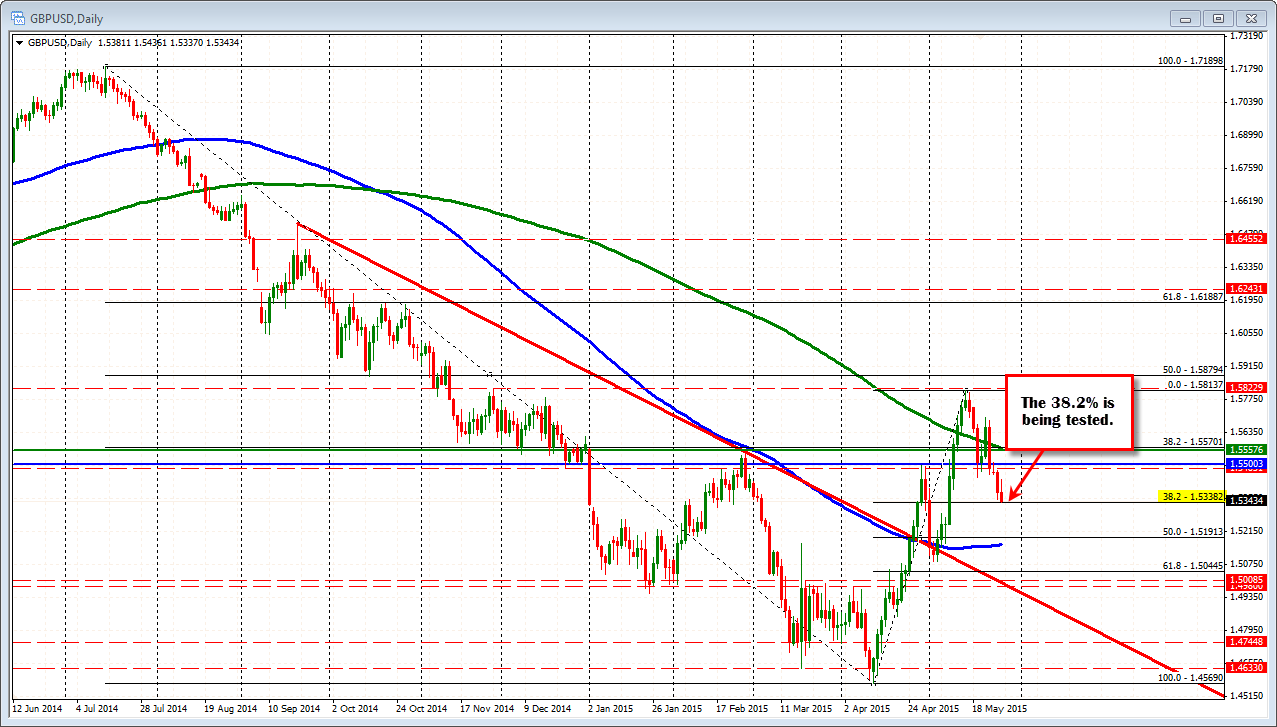

Tests 38.2% of the move up from April low

The GBPUSD is falling in tandem with the other currency moves against the dollar. The pair is currently testing the 38.2% retracement of the move up from the April low to the May high. That level comes in at 1.53382. The low for the day has come in at 1.5337 so far.

Looking at the hourly chart, on a break the next target would look toward 1.5300. This is the lower trend line connecting low over the last few days of trading.

Like the EURUSD, the low to high trading range for the GBPUSD is a bit light of average. The range today is 100 pips from the high to low. The average range over the last 22 trading days is 158 pips. So there would be room to roam on a break of the's 38.2% retracement support level.

The 38.2% of the move lower today comes in at the 1.5375 level. The low from the Asian Pacific and end of NY day low yesterday, comes in near that level. That will be a level that the pair should not trade above on a correction higher if the sellers are to remain in control.