They loved it on the way up and hated it on the way down...

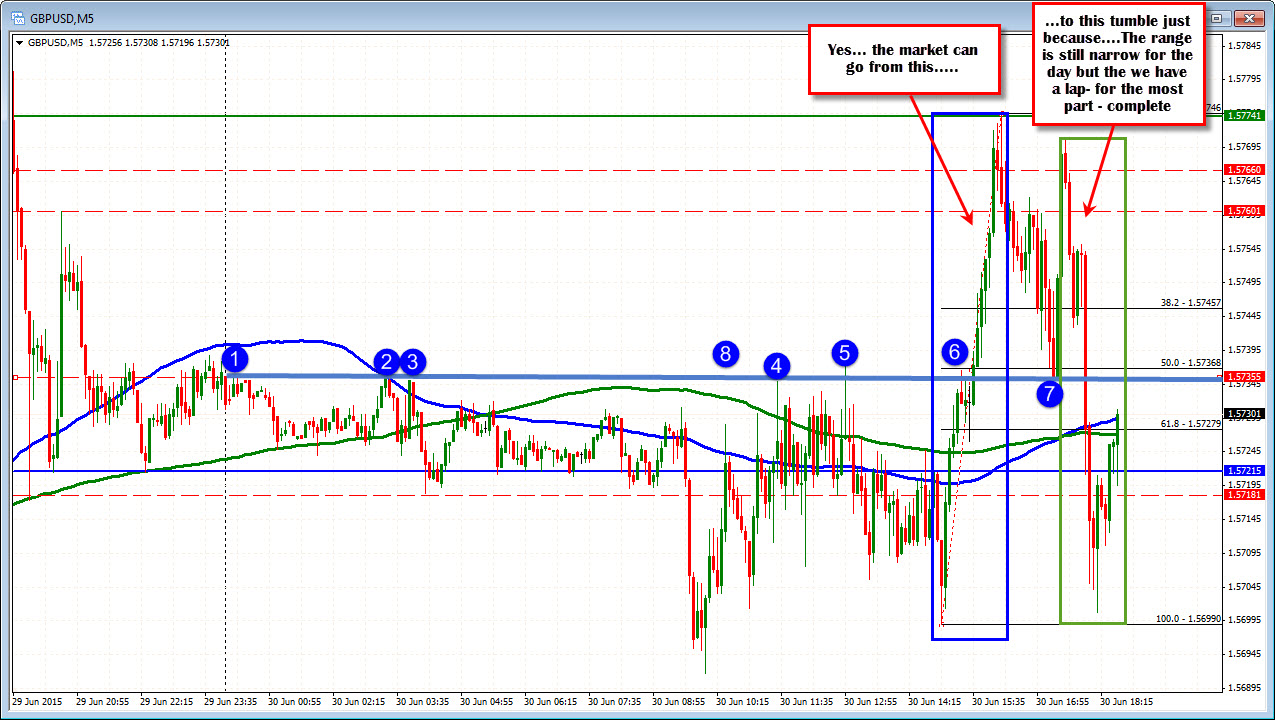

We gawked in amazement at the morning surge in the GBPUSD which took the price straight up (see prior post). The range was still narrow. Perhaps there was more to go....

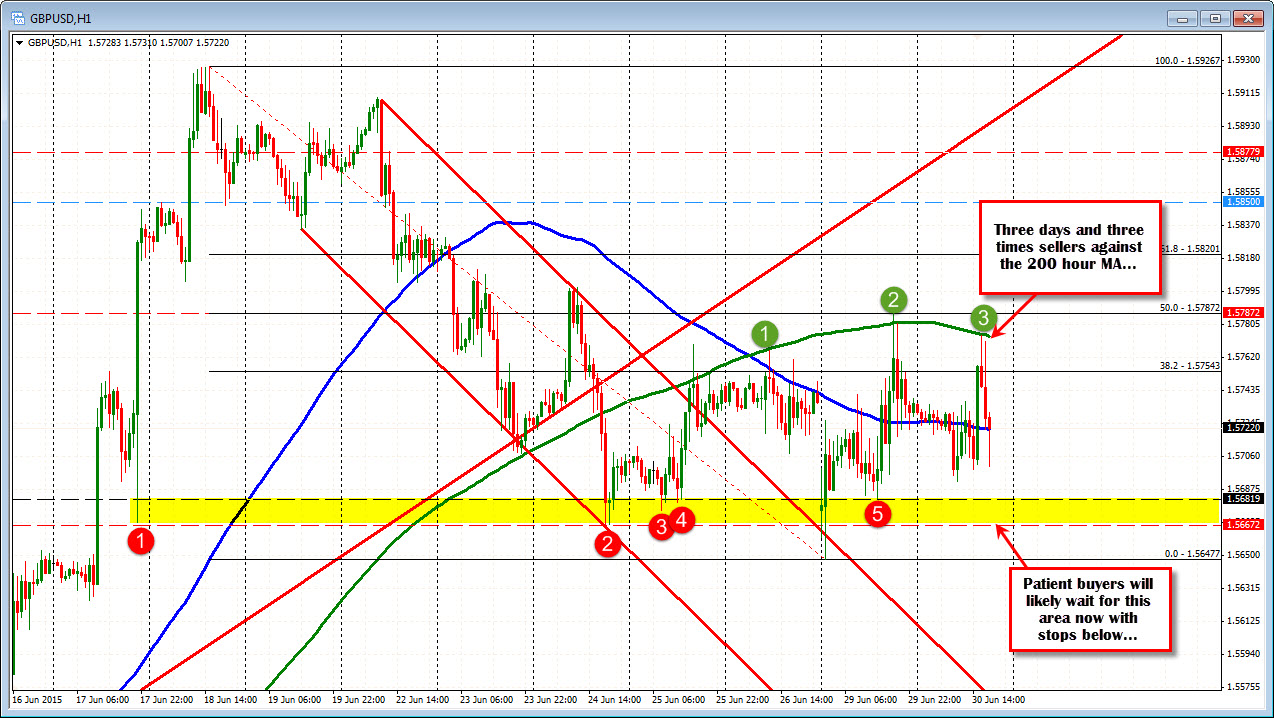

The problem for the bulls, was it got to the 200 hour MA (green line in the chart below) and that stalled the price for the third day in a row.

The initial fall took the price to the surges 50% and series of highs, but the next rally stalled just before the 200 hour moving average again and coupled with month end fixings (or so it seemed),the price moved below the 50% and nearly completed the lap around the forex chart oval - i.e. a sharp move higher and a equally as sharp move back lower to where it all began.

I think the best course of action seems to be patient still. Look for the patient buyers to wait for 1.5667-81 and the sellers to...well lean against the 200 hour MA/50% retracement....Eventually non trending transitions to trending. So traders can anticipate a break soon, but I get the feeling that the market is not in much of a hurry now....