Bouncing off the MA levels

The GBPJPY has done it's rendition of the Muhammad Ali "rope-a-dope". The pair is bouncing off MA levels - getting traders to swing wildly at the MA extremes.

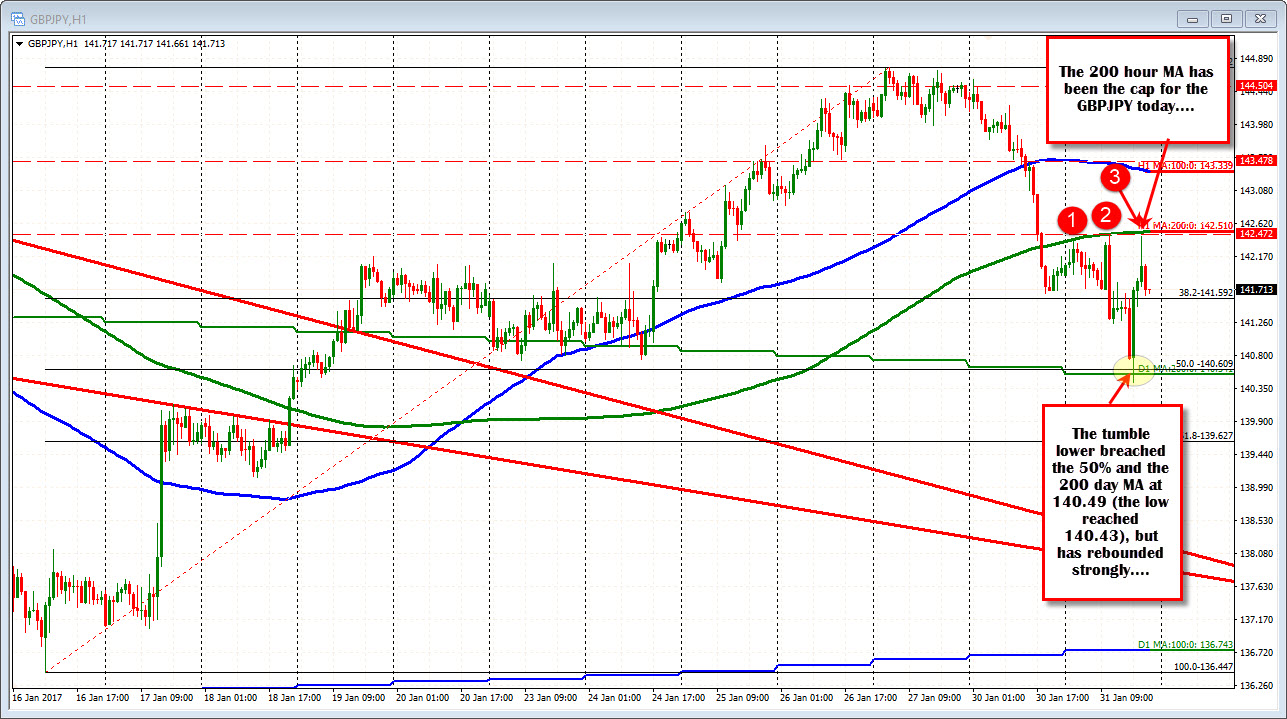

ON the topside, the pair has been bouncing off the 200 hour MA (green line in the chart above - see red circles). That MA has now been tested 3 separate times today. Each time, the buyers looking for the move higher, were hit with sellers leaning against the risk defining MA level.

ON the downside, the price did tick below the key 200 day MA at the 140.49 level, but stalled not far away at 140.43 level and quickly pushed back higher. Like against the 200 hour MA above, the sellers looking for more downside, were stunned by the quick rebound against the key 200 day MA level.

The winners are the traders who are moving around the ring, leaning against the ropes (MA extremes) and dodging the wild punches.

It often pays to dance around and wait for the chance to lean against a level before taking a swing at a trade. Selling against the 200 hour MA has been a nice trade for sellers. The 200 day MA has been a nice buying opportunity when the price tests that level. At some point, the rope-a-dope will give way. Look for momentum on the break. But in the meantime, be patient, dance around and lean against those MA levels.