Get and stay above 1.0900-10 key hurdle for the EURUSD

The EURUSD's gap higher saw a correction toward the 38.2% yesterday.

Today, we are seeing a move above trend line resistance off the hourly chart, and from that break, some up and down trading in the London session. However, the price remains higher, and the corrective selling off the weekend spike has been moderate (stayed above the 38.2%). The buyers remain in control.

Having said that there is some good resistance ahead.

Looking at the daily chart, the high price for 2017 came in on March 27 at 1.09057. That is a key swing high. If you go all the way back to June 2016, the low then came in at 1.0910. That was a swing low that started a pop higher. Traders will hang a risk level on those two levels. Add the natural resistance at the 1.0900 level and the 1.0900-10 becomes a key target to get to and through.

The high today has reached 1.0898 so far.

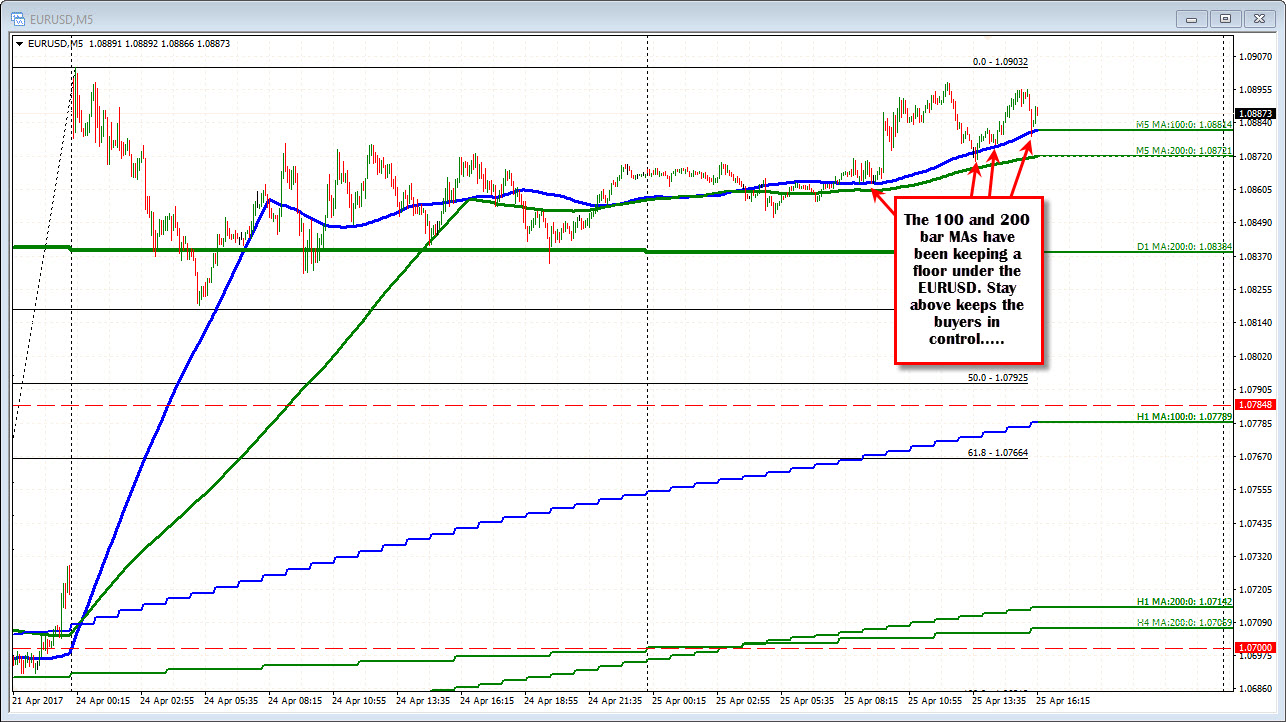

Drilling to the 5-minute chart, the pair has been finding support buyers intraday against the 100 and 200 bar MA. The 100 bar MA is not far from current levels at 1.0881. The 200 bar MA comes in at 1.0872. Stay above today, and I continue to give the nod to the bulls.