Off to a quiet start to the week. Lower high. Higher low.

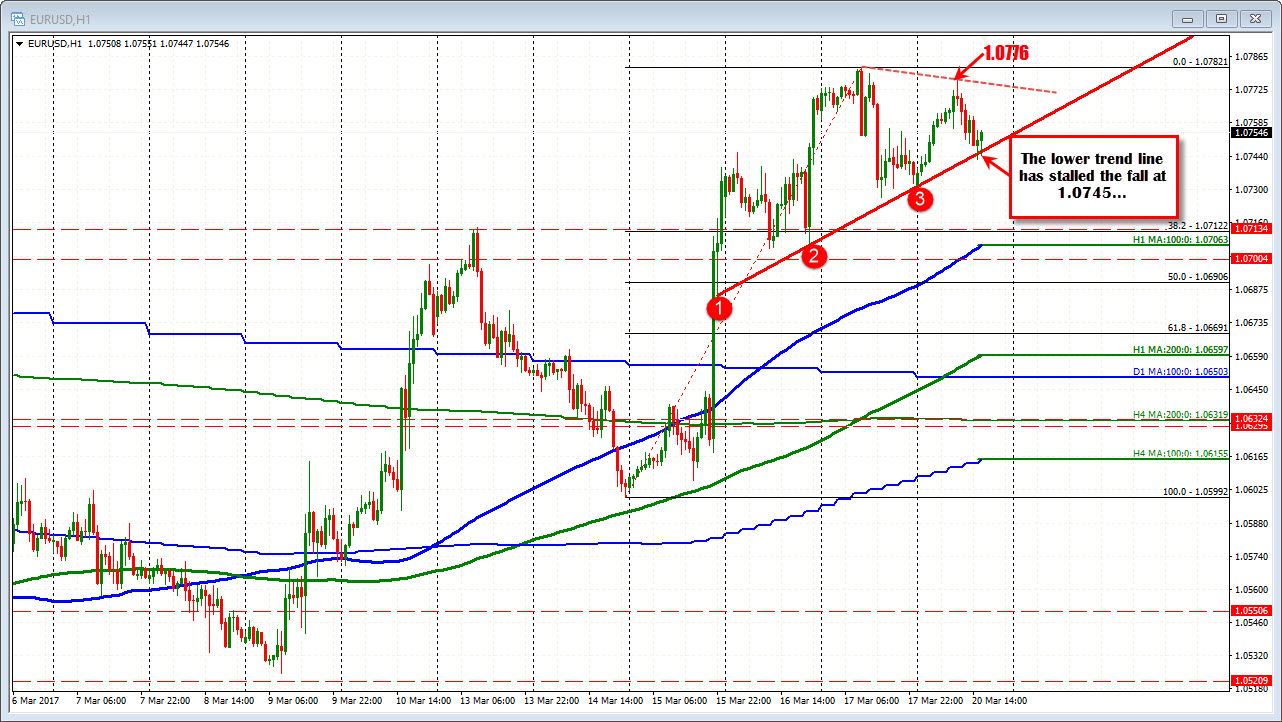

The EURUSD is off to a quiet start to the week. The trading ranges is 45 pips. The low is high than the low from Friday. The high is lower than the high from Friday. Looking at the hourly line, the price has been testing a trend line connecting the low correction price AFTER the FOMC decision. That line currently cuts across at 1.0745. The price has moved a touch below the line over the last two hourly bars but with no momentum. The buyers are remaining more in control.

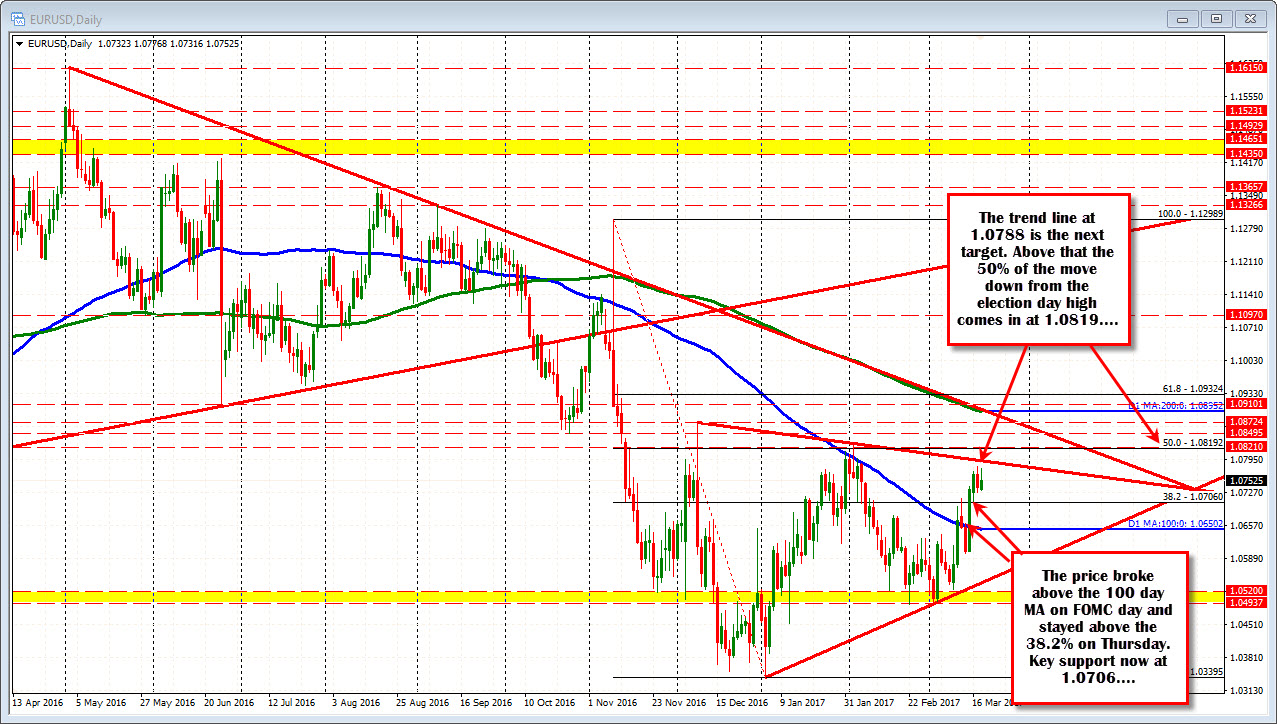

Last week the pair surged above the 100 day MA (the MA is at 1.0650 today). and then above the 1.0706 level. That level is the 38.2% of the move down from the election day high. (see daily chart below). The low price on Thursday stalled at that 1.0706 level. Stay above that retracement is more bullish. On the topside on the daily chart, the topside trend line is at 1.0788. Above that the 1..0819 is the 50% of the move down from the same election day high (see chart below).

Overall for the day...

- The price is higher for the day (closed at 1.0736)

- The price is staying above trend line support at 1.0745. This is close risk for longs. Move below and we could correct further.

If the price does head lower:

- The 1.0706 level is a key level to stay above.

- Below that the 100 day MA will be eyed by sellers

We are currently holding the support. So buyers remain more in control with the:

- 1.0788 a key trend line on the daily and the

- 50% at 1.0819 key targets.