Obama and better German data help the common currency

The EURUSD has pushed higher in early NY trading. The pairs bullishness is being attributed today to reports from a French official that Pres. Obama told delegates that the strong dollar posed a problem. The White House denied the report. Better German industrial production and a higher trade surplus may have also contributed to better tone in the European's common currency. The stronger US employment report has been taken off the front pages for the time being.

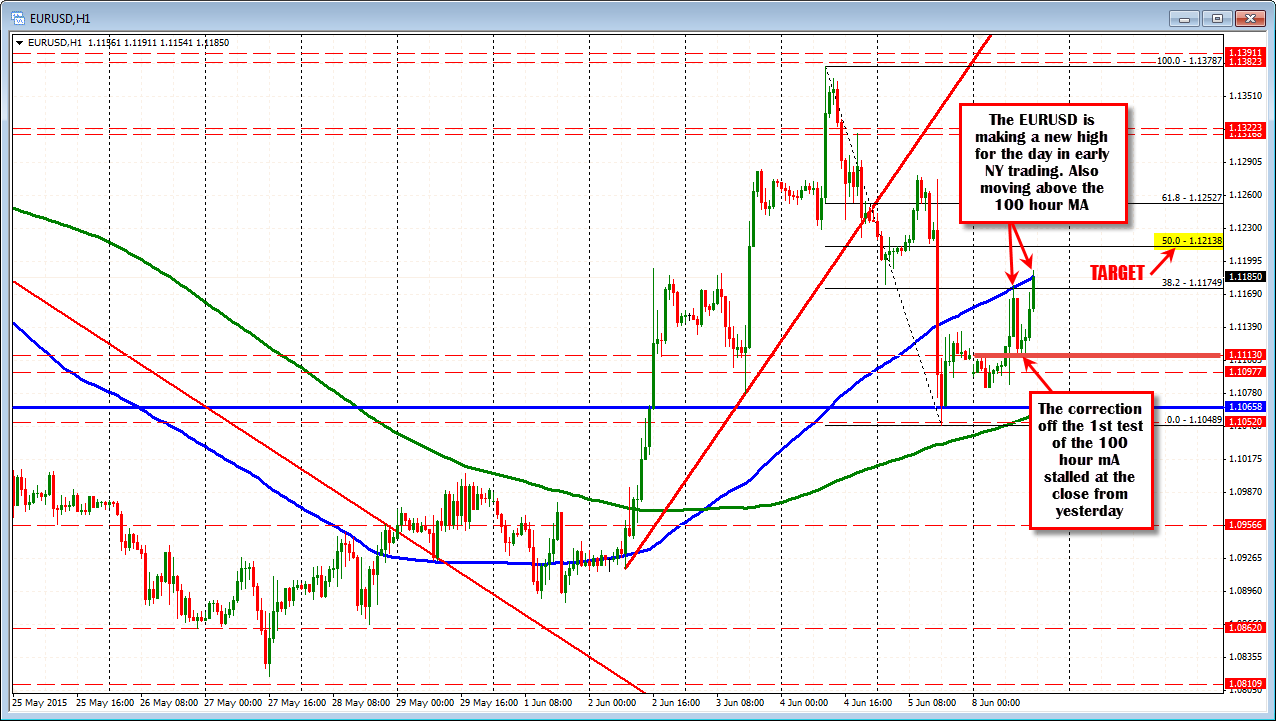

Technically, the pairs initial London morning push higher found traders leaning against the 100 hour MA (see blue line in the chart above). IN the early NY session, the price has been able to breach that MA level. Is the market looking for stops? Perhaps. The buying above has not found the momentum at least on the first breach so far. However, be aware that the range for the trading day is 109 pips. That is still a bit shy of the 22 day average which is around 143 pips. Last week was quite a volatile one with 3 days over 200 pips. If the buyers keep control, the midpoint of the move down from last weeks high comes in at 1.12138 That is the next major target. The pair should find sellers on a test of this level - I would think.

On the downside for today, The price rotated lower and stalled near the closing level from Friday....Ah that old trade. Traders gravitate toward closing levels. Up or down on the day, week, month does have an impact and tends to be a risk defining level. The price stayed above. The bulls/buyers took that as a clue to move back up and they did.

So the bulls are in control. The 100 hour MA is being pushed. The 50% looms above. Look for sellers on a test, but sellers will have to show that they can take back control in this EURUSD bullish day. That means moving back below those levels which were resistance. The 100 hour MA, the 38.2% retracement at 1.11749 will be the first levels to go below and stay below if the sellers are to take back control.

Obama? Really?