Pretty good data keeps the Fed in play

The personal spending rose by 1.0%. Income increased by 0.4% for the 2nd consecutive month. The Core PCE deflator remained at 1.6% for the month.

The EURUSD has dipped as traders will be weighing data and the Fed decision. Of course the US employment report will be the big one on Friday. Non Farm payroll is expected to come in at a below trend 160-165K. The Unemployment rate is expected to fall to 4.9% as the economy moves toward full employment.

Technically. the EURUSD price has dipped back below the 100 hour MA (blue line at 1.11527). The pair moved above that MA as NA traders were wiping the sleepy eyes after the long Memorial Day holiday - but with the better data, the price has moved back below. The high extended to 1.1165. The low after the data has moved to 1.1145. The price is currently trading above and below the flat MA line. What do you feel? That seems to be the trading decision today. With the employment on Friday and Fed after, the market will be yo-yoing it's way around. I would expect traders to lean against levels of importance at extremes, with stops if it moves too far away.

Widening things out a bit, the 100 day MA and 200 hour MA both come in at 1.1175. The price of the EURUSD has not closed above the 200 hour MA since May 11th (one bar). Prior to that you have to go back to May 6th - the last US employment day. If we get a move toward that level today, I would expect sellers against it.

Looking back at the recent lows from yesterday, the pair stalled near the 200 day MA (green step overlay line) at the 1.11015 level . The low yesterday extended to 1.10972.

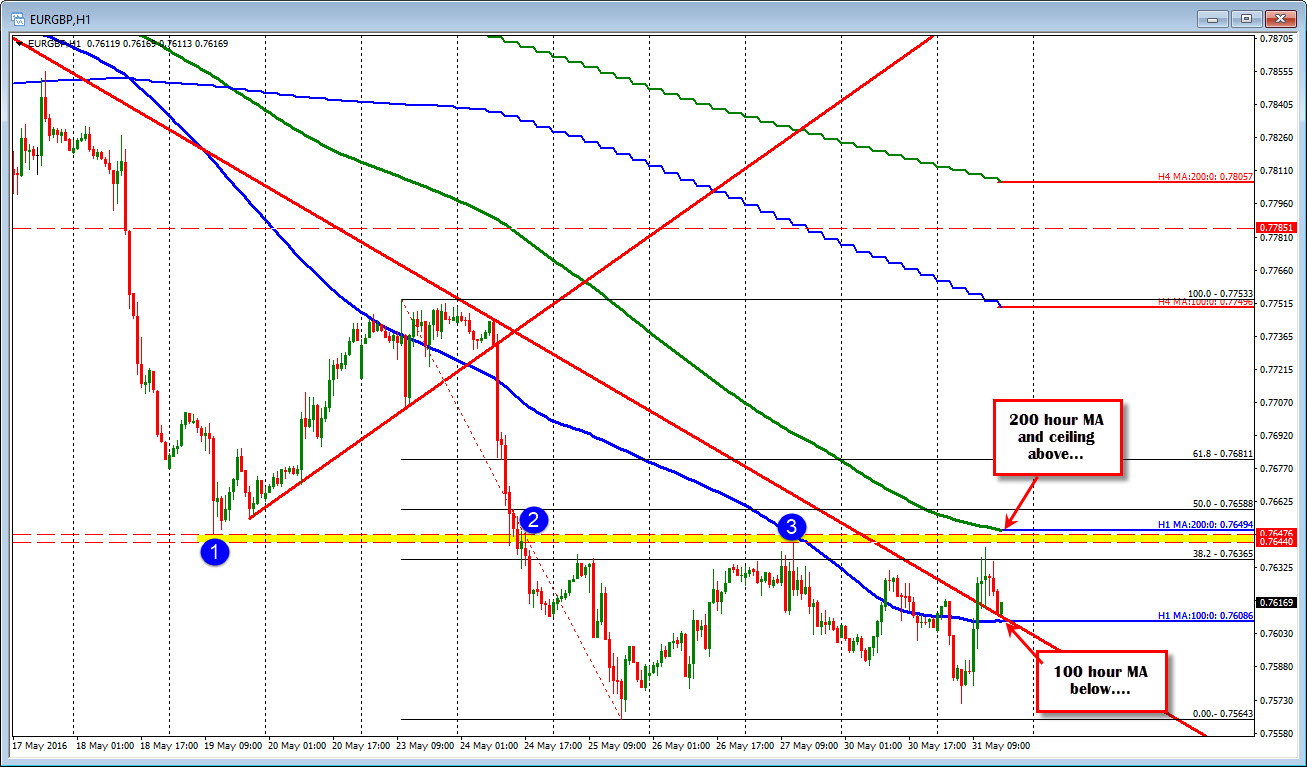

It is month end which can lead to bids on EURGBP. So be aware. It just dipped to the 100 hour MA at the 0.76087 (the low reached 0.7611). That level may be support to lean against which could be an influence on the EURUSD as a result.