Traders enter against the level in trading today

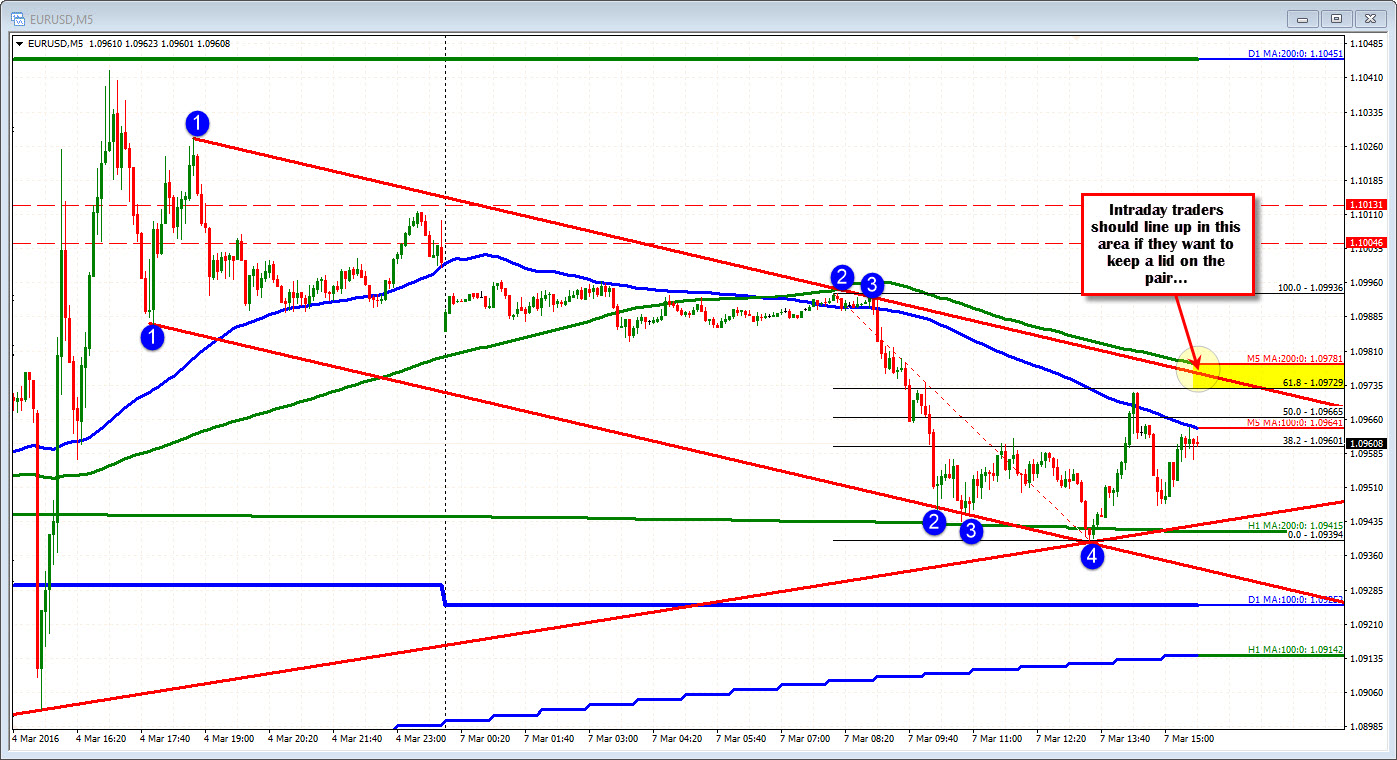

The 200 hour MA at 1.09414 was tested once, it was tested twice (it even traded below it during three 5-minute bars but only by 2-pips). As NY traders entered, a low price of 1.0947 was reached. The price is currently trading around the 1.0960 level. PS the pair also tested a lower trend line at the same level.

So traders are doing a Monday morning lean as risk can be defined and limited at the area.

The ECB decision is on Thursday and the expectations are for a cut in the deposit rate and an increase QE, but that should be priced in.

Taking a closer look at the hourly chart, the trend line and 200 hour MA are the first key target on the downside. The 50% of the move up from last weeks lows at 1.09337, the 100 day MA at 1.0925 and the rising 100 hour MA at the 1.0914 are other support target levels. The combination should be a tough nut to crack should the market continue through the initial line of support. ON Friday the pair stalled right before the 200 day MA.

Any topside resitance?

Looking the 5 minute chart, the 200 bar MA (green line in the chart below) is tracking with a topside trend line around the 1.0976-78 area. If the sellers today want to keep a lid on the pair, this would be where they should look to make a stand. Then again,those sellers may have been the buyers against the 200 hour and trend line. So they have have switched their allegiance after holding the key support. Either way, when a key technical level holds like it has today, it starts a battle between buyers and sellers. That is where we are at.