New 8 week highs.

The EURUSD is inching higher and trades at new 8 weeks high (highest level since June 24th). The move today is also moving above and away from the 100 week moving average currently at 1.13086. That MA was broken yesterday and also on Tuesday, but retreated and close below the level.

Today with the move to new week highs, the buyers are showing more upside interest.

Note that back in May the price approached this MA (albeit at a higher level) and found sellers.

That level will be key as we head toward the week's close. Staying above is more bullish.

Drilling down to the daily chart, the price this week moved above the 100 day MA at the 1.12265 and trend line resistance as well. This too is bullish.

What are the next targets?

Looking at the daily chart, there is a lot of peaks in 2016 that the market will target. One of the first comes in at 1.1342 which was a high in March. The high today has reached 1.1339 so far today and backed off a touch. Traders seem to be leaning.

If that level is broken, the next targeted high is the Feb high at 1.13757. The June highs reached 1.1415 and 1.1426. Finally the 1.14335-65 has a number of highs going back to Feb 2015 (See red circles). There have been a total of eight days where the price has closed above the 1.1435-65 area going back to Feb 2015. That is not a lot. If the bulls take charge look for a move to test this area again.

What might give the sellers some relief?

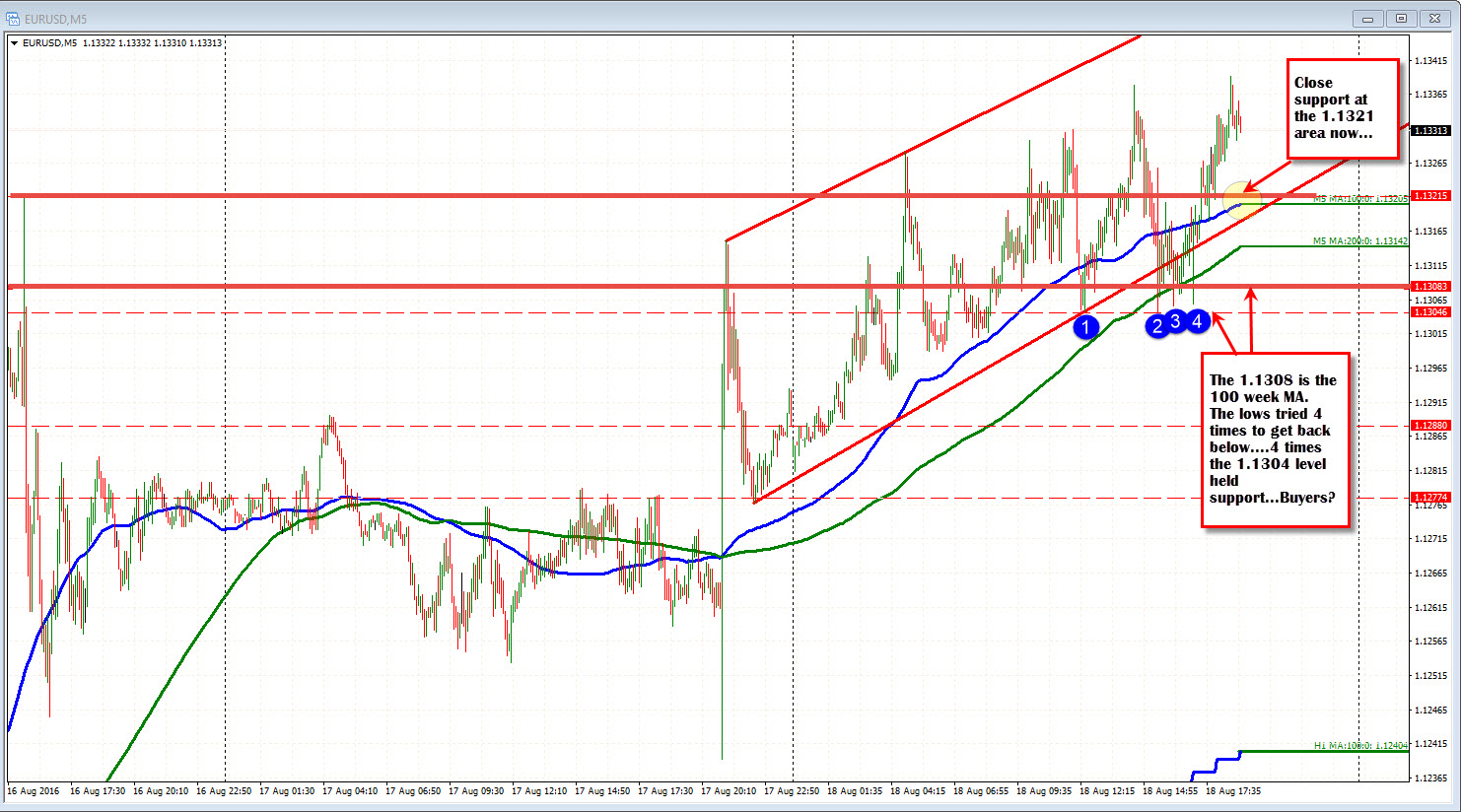

The high from Tuesday at the 1.13215 will be eyed now . The 100 bar MA on the 5-minute chart below is around this level (blue line in the chart below). The price has moved above and below this level today (in fact the price action is pretty choppy), but if the level does hold, that will be a clue, the buyers are taking control.

NOTE: the lows in the London/NY session has been at the 1.1304 area just 4 pips away from the 100 week MA level. Seller had the chance to move lower. They could not do it. The buyers are trying to take control - or so it seems.