Rebounds after falling below MA and 50% Fibonacci retracement

The EURUSD came under pressure in the European/London early morning session. Concerned about Greece continue to drive the pair. There were reports that the ECB was exploring curbs on Greek bank funds. Greece countered by saying a deal was coming by the end of April. Who do you believe? And that is the rub with regard to the situation, but this is certainly nothing new.

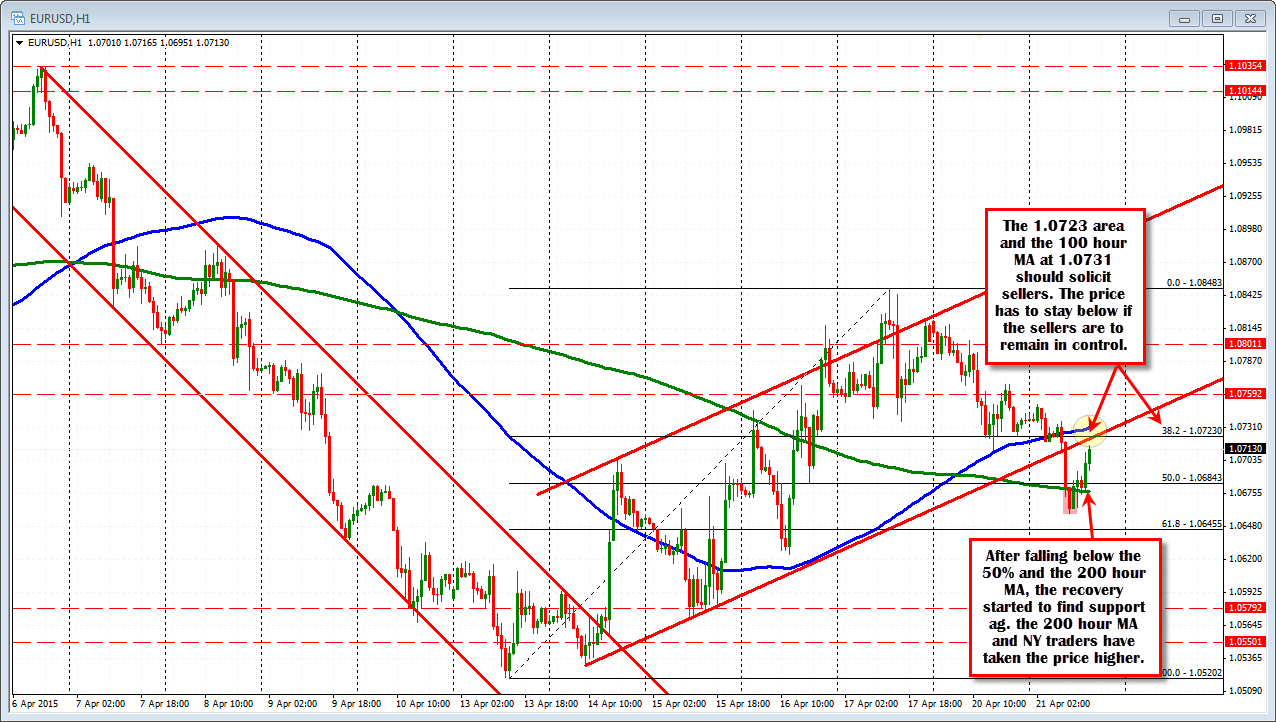

Technically, the EURUSD fell below both the 50% of the move up from April 13 low to the April 17 high and the 200 hour MA at the 1.06843 and 1.06798 levels respectively (green line in the chart above). That should have send the pair lower. However, the selling slowed and the pair could only muster one hourly close below those key levels. NY traders have pushed the pair up more as the 200 hour MA started to hold support.

The rebound should run into resistance from both the broken trend line and 38.2% retracement line at the 1.0723 level. The 100 hour MA at the 1.0731 will also be a test that should solicit sellers. IF the sellers are to remain in control, this will be the last line of defense.