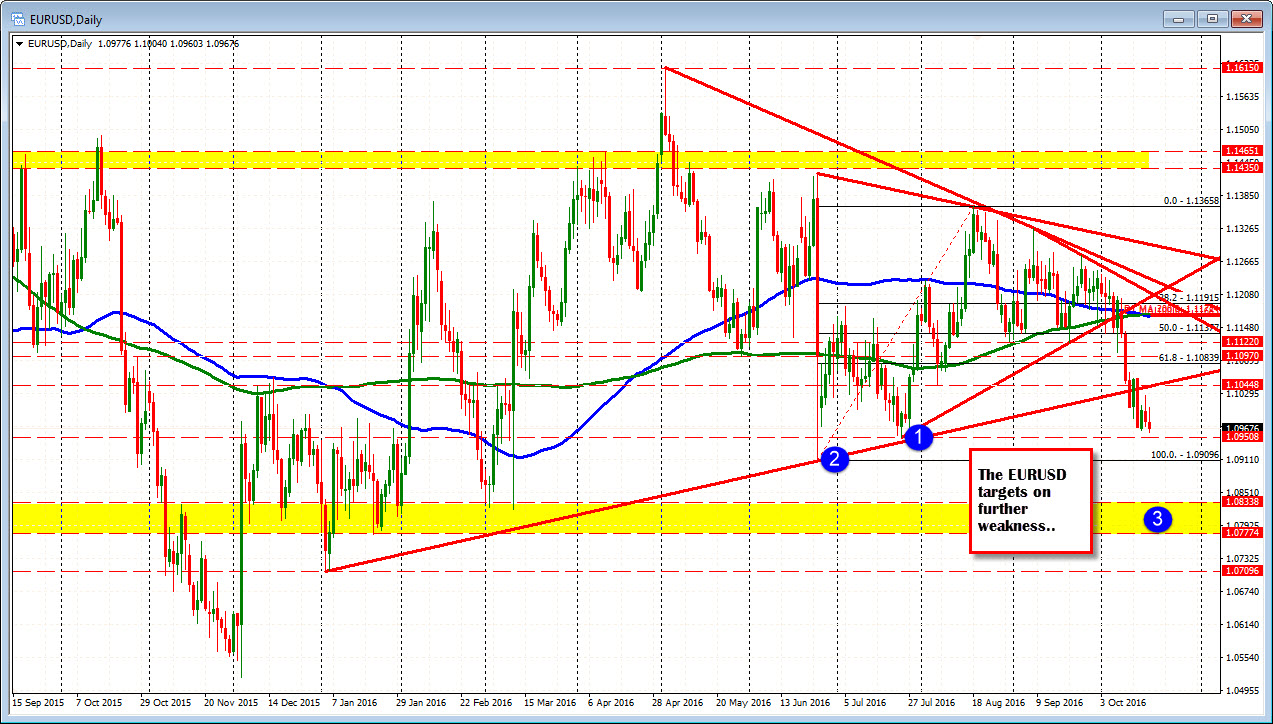

Extends small range but not in a hurry. Bears hoping for more.

The EURUSD is trading to new session lows and the lowest level since July 27th. Last weeks low at 1.09633 was taken out but only by 3 pips so far. The new lows, extending a paltry trading range of 32 pips coming into the US session (the range is now 44 pips. Yippee!). The housing starts and building permits ran opposite to each other with housing starts at the lowest level since March of 2015. The Building permits, however were up 6.3% (1225K vs 1165K est.). We are seeing a little rebound off the data (about 10-12 pips).

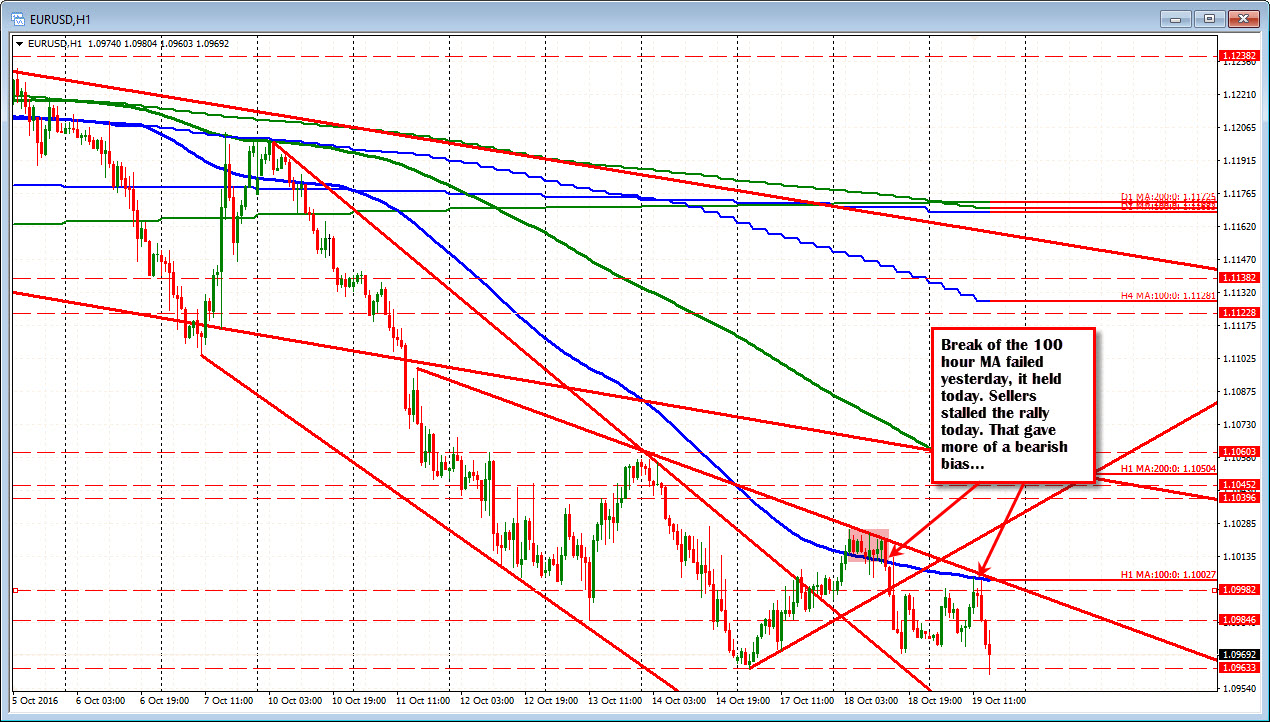

Technically, the selling has gotten it's inspiration for selling from holding the 100 hour MA at the 1.1000 area. Yesterday the buyers had a chance to take the price higher as that MA was broken, but it failed. A topside trend line also stalled the pair near the 1.1000 level.

SHould the selling continue and the range extended even lower, the next major targets come in at 1.09508 (low from July) and 1.0909 (low from June). A break below that level and the doors open for further declines toward 1.0777-1.0833 area.

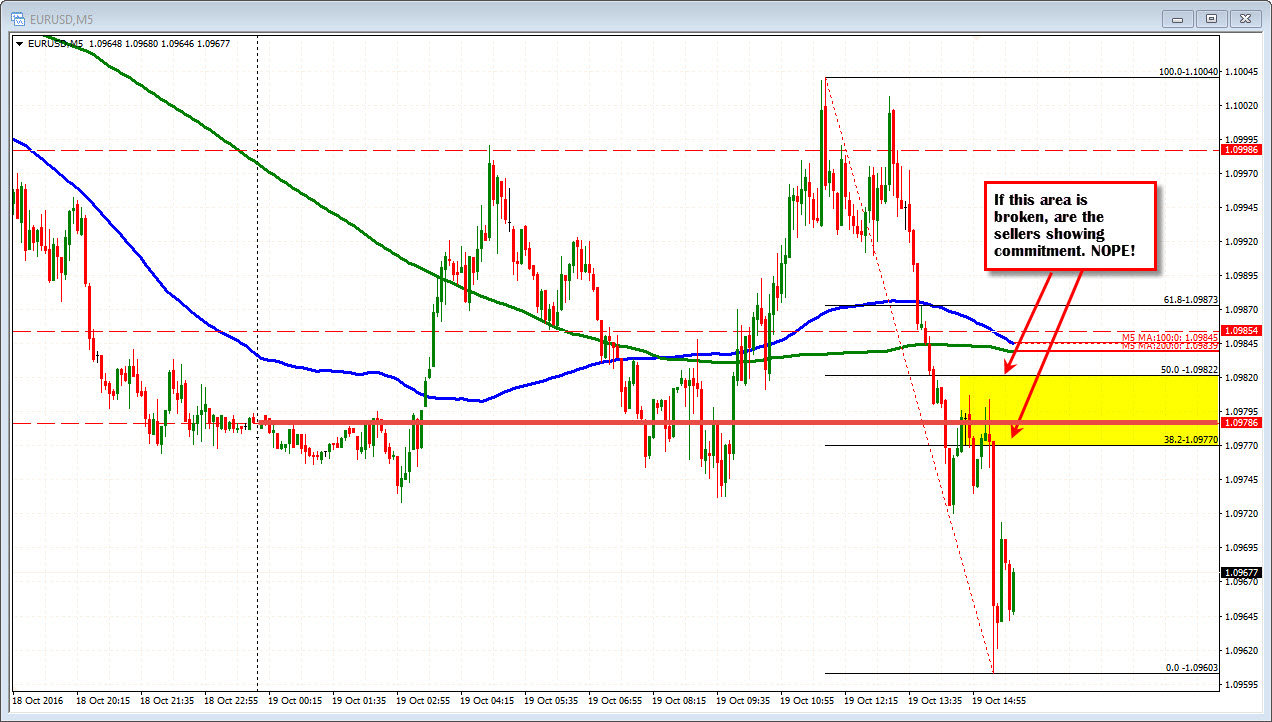

It is hard to sit with positions for too long in this market, but risk for shorts might look toward the 1.0981 area. The close was 1.0979 area. Looking at the 5-minute chart, when the price moved into the red last hour, the high quick bounce reached that level and fell from there. the 50% of the days range is at 1.09822. That too should be a barometer for sellers interest. If it moves above that level, are the sellers really committed to selling? They are not showing me that they are...