Remains in the range

The EURUSD moved higher after the blowout ADP employment report.

The thing about this currency is that the ECB meets tomorrow and what Draghi says is the wild card.

David Tepper has been on CNBC today and he thinks quite strongly that the ECB/Draghi should change their tune from being negative, negative, negative, to things are not so bad. Who knows. Maybe he is listening to the business news. We are all human, influenced by the story. We are all creatures of habit. Global risks can and may turn around.

That makes this pair tricky. Today the focus may be on the US. Tomorrow, the eyes will be on the headlines from Draghi. Be aware.

Technically, the pair today has fallen and rebounded back toward the earlier lows for the day. So there is a reluctance to take the dollar racing to the upside (the EURUSD lower) and since the sellers on the number may be caught, we are seeing that snap back rally in the pair.

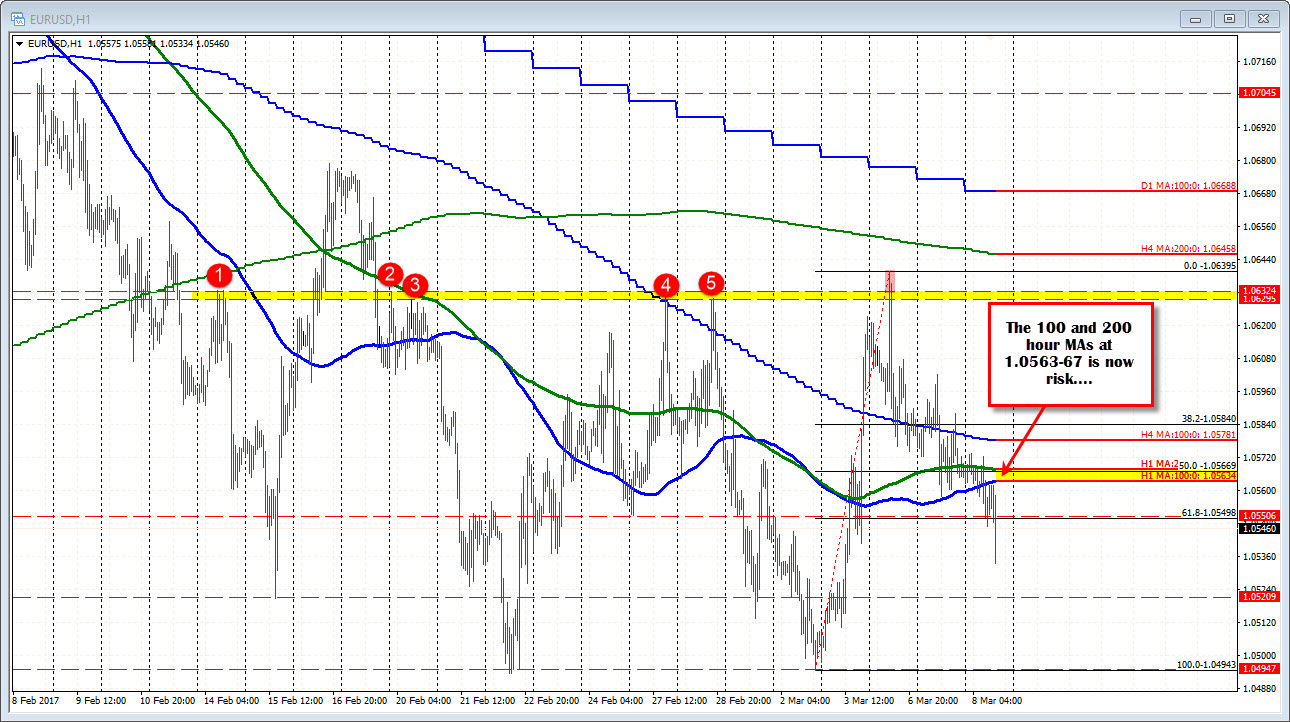

For trading the 100 hour MA and 200 hour MAs at the 1.0563 to 1.0567 will be eyed for sellers. It is a trade to see if the sellers show up at the level and push the price back down from there. If it goes above, that idea is not working.

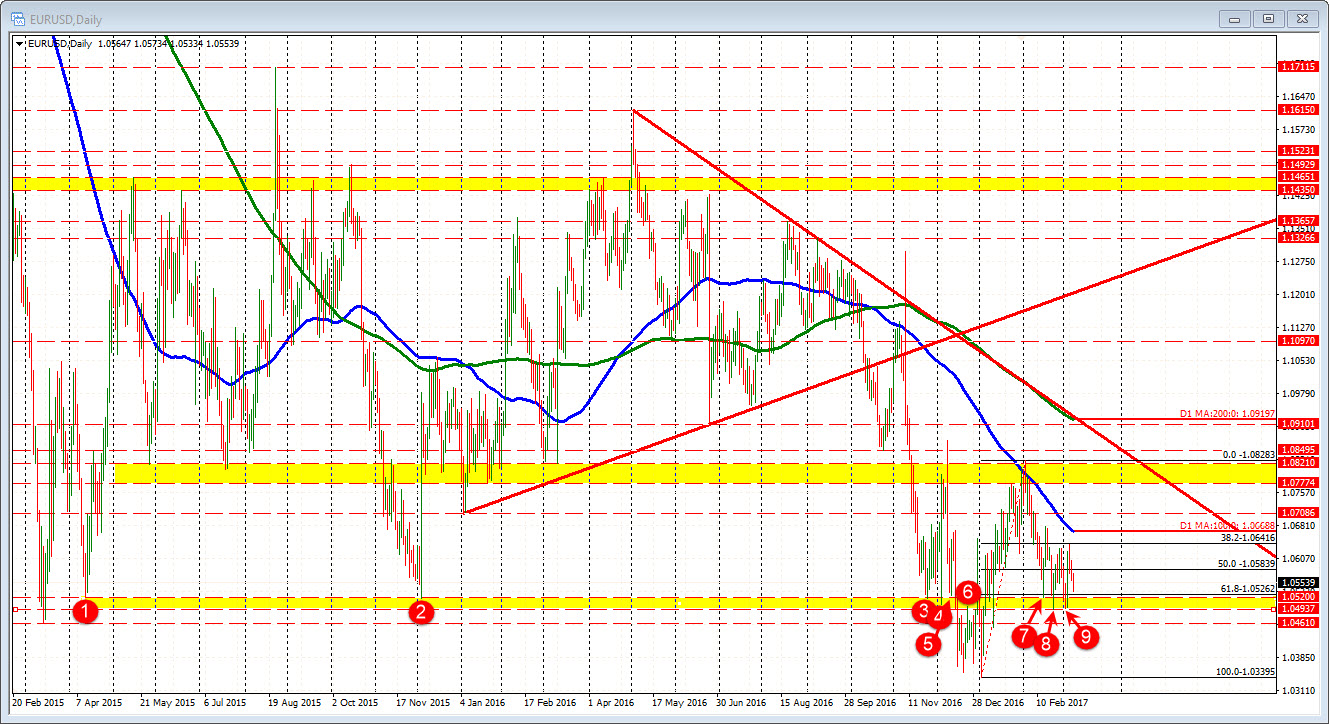

Taking a broad look at the EURUSD from the daily chart, the most recent lows reached 1.0494. Going back to April 2015, swing lows/highs have been centered in the 1.0494 to 1.0520. The low today reached 1.0533. If this pair is to go lower, that area is a key level for the 9 swing levels in the area. Yes we traded below that area for a number of days in December and early January, However, that is an extreme as we sit now that failed. If we go below that area, the sellers are still winning. If it cannot go and stay below, you can argue the floor is still the floor (that means higher).

The 1.0563-67 is risk for today for a trade. Expect support buyers if the price moves toward 1.0500.