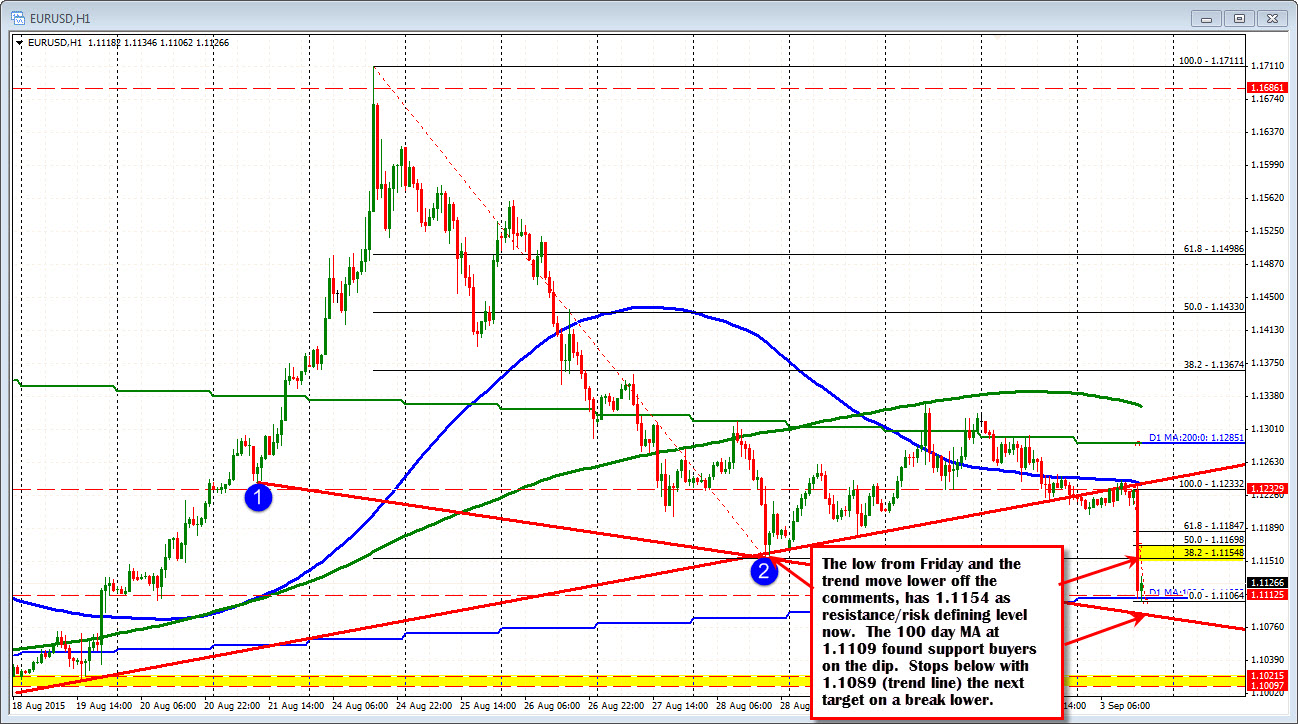

100 day MA at 1.11089. Low at 1.11062. Sellers still in charge

The EURUSD fell sharply with little in the way of corrections on the Draghi press conference comments.

From a technical perspective the pair fell below the Friday low (August 28) at the 1.11549 and continued on to the 100 day moving average at 1.11089. The low ticked in at 1.11062 so far just below that 100 day moving average. The price has bounced a bit higher to a high corrective price of 1.1133 so far.

The 38.2% retracement of the trend move lower comes in at the 1.11549 area – right at the low price from last Friday. This increases that levels importance from a risk defining perspective. Simply put, the price should stay below this level. This is risk for shorts. If not, there could be a move toward the 1.1170 level

With the ECB rhetoric more dovish and the US Federal Reserve with a finger on the trigger (US employment to come tomorrow), one would expect that the EURUSD should remain more offered. Yes buyers against the 100 day MA may get a corrective bounce to make some pips too, but on a break of that level, there should be additional downside momentum. The next target comes in at 1.1089 (trend line). Then 1.1009-21