Resumes move lower

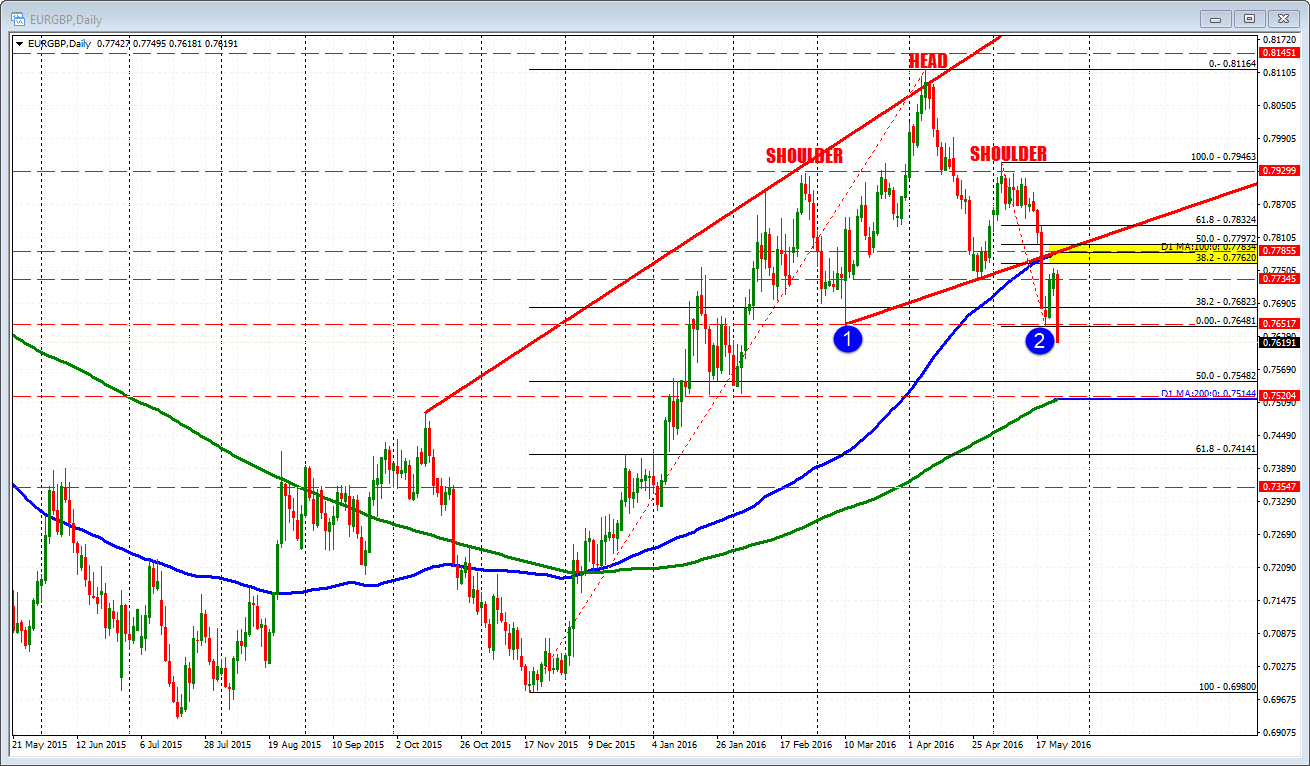

The EURGBP fell below neckline support last week and quickly moved to test the low shoulder point from March 10th (see chart below).

The correction higher stalled before the 38.2% (and the 100 day MA/neckline level, and the selling has resumed. The price is trading below the prior lows and looks to continue the downside momentum.

On the daily chart there is not much in the way of support until 0.7548 (50%) and 0.7514-20 (swing lows from Jan/Feb) and the 200 day MA (green line in the chart above).

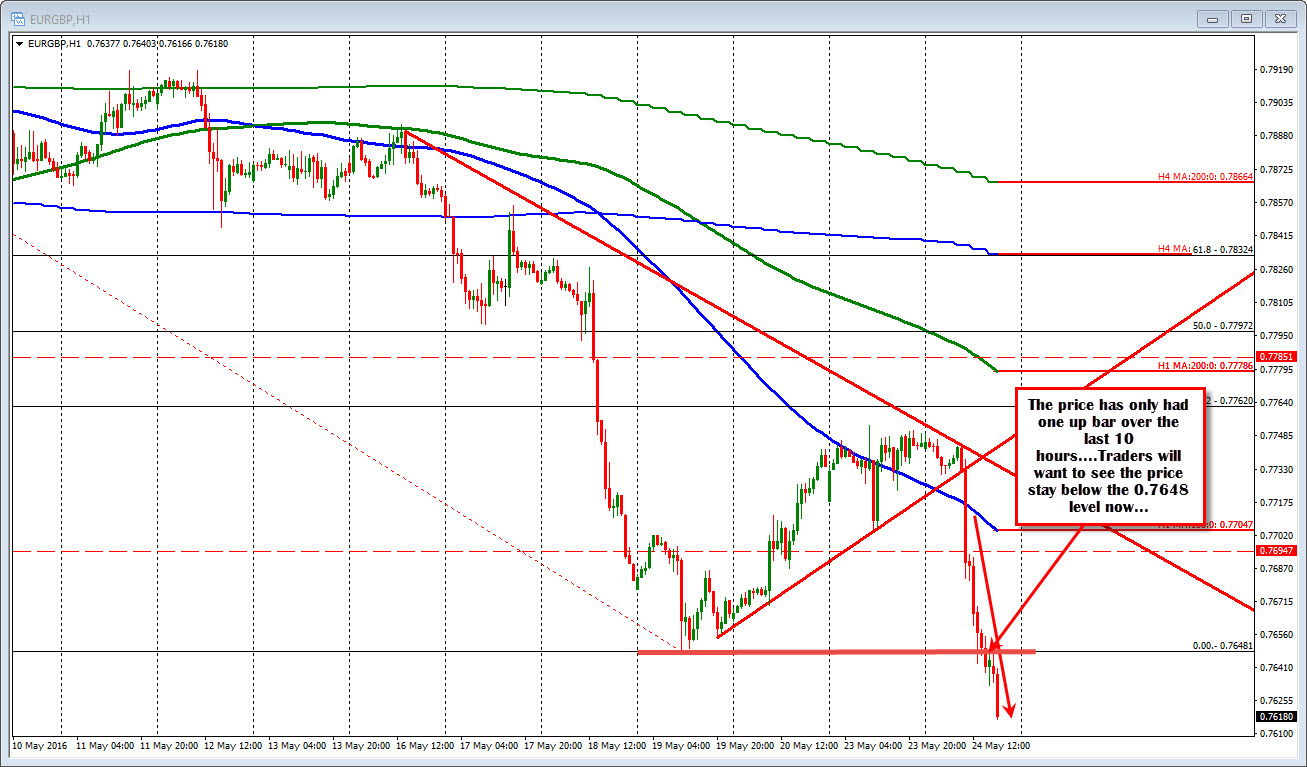

Looking at the hourly chart below, the price move below the trend line and the 100 hour MA really did not put up much of a fight near the day highs (see blue line in the chart below). The price did stall at the 0.7648 low, but the price has stayed below that line over the last 4 hour bars. Stay below, bears remain in control. That is the risk for the pair....

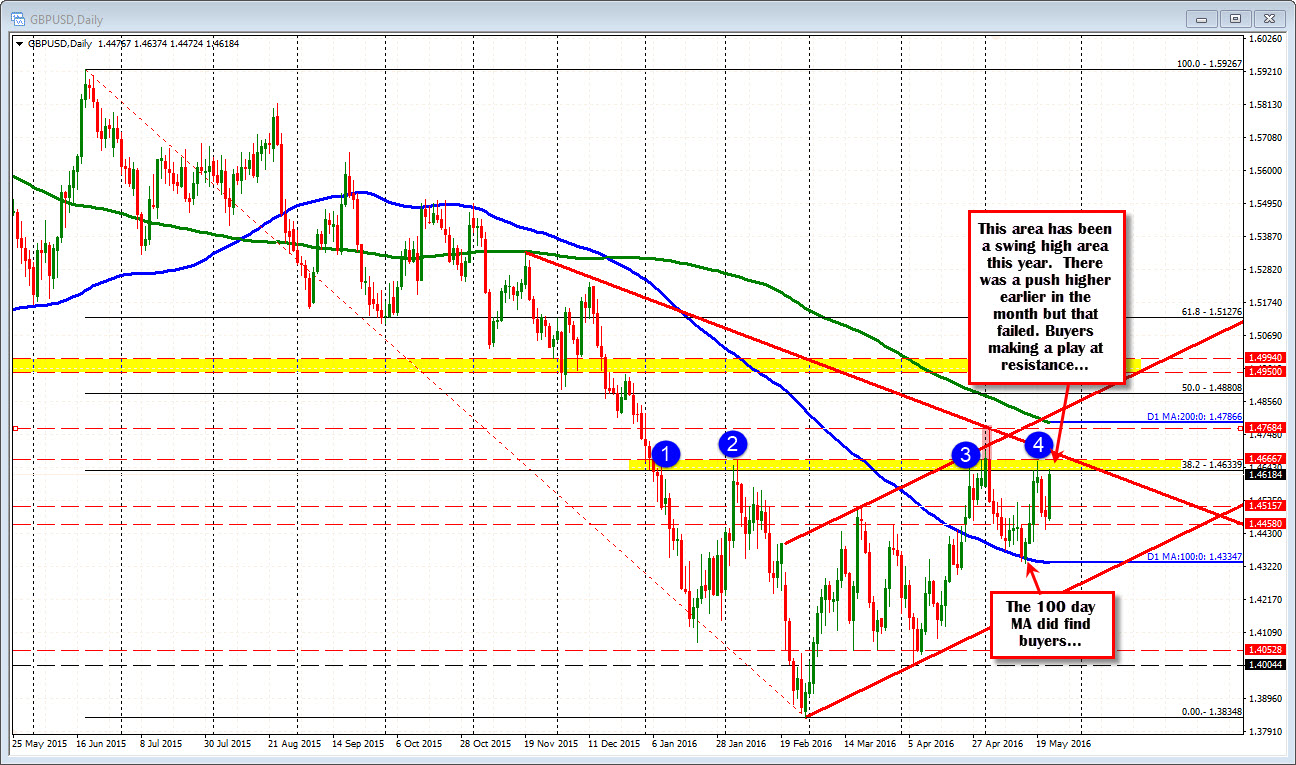

The combination is keeping the EURUSD under pressure. It trades at the days lows at 1.1142. Meanwhile the GBPUSD is pinching against the 38.2% level at 1.46339. The 1.4633-667 has been a swing level (sans the two days at the beginning of the month that broke but failed). Since that failed break, the GBPUSD has gone down and found support at the 100 day MA. So there are move bullish overtures.