Yields lower.

The USDJPY is moving lower in early NY trading. Yields are falling with the 10 year yield now down 3.6 bp to 2.356%. European yields are also lower today with German bunds down 5 bps.

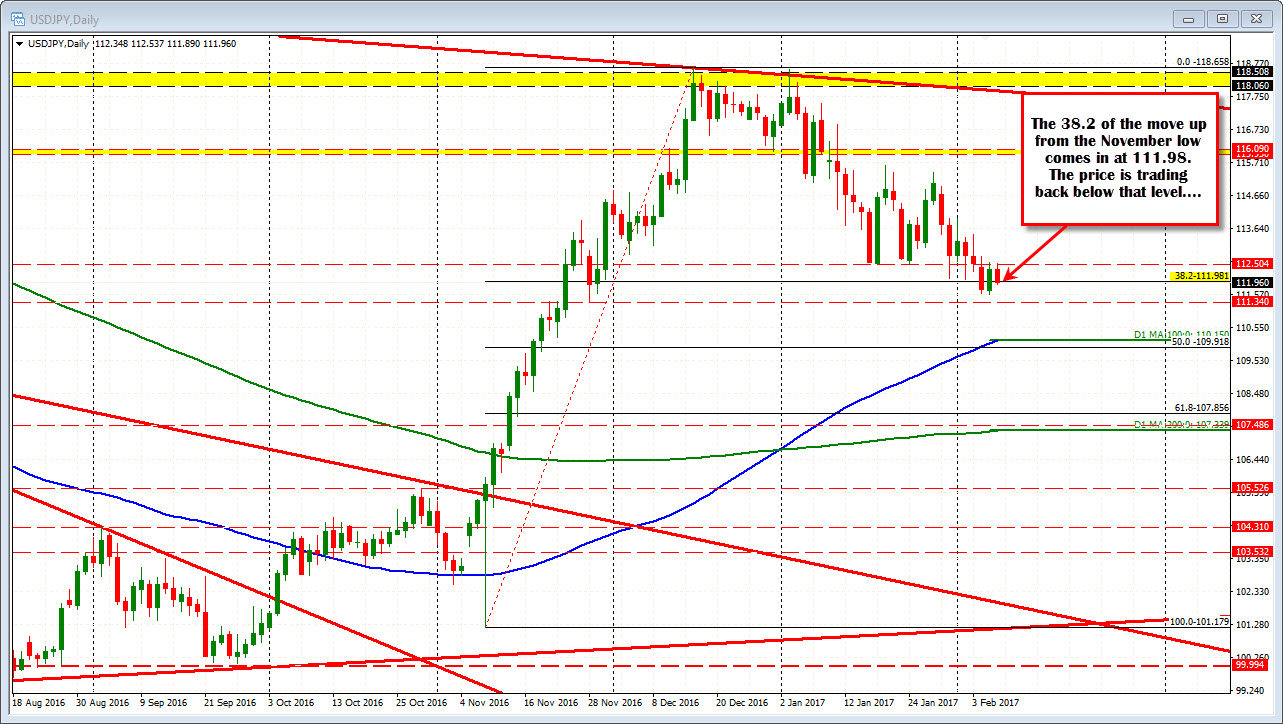

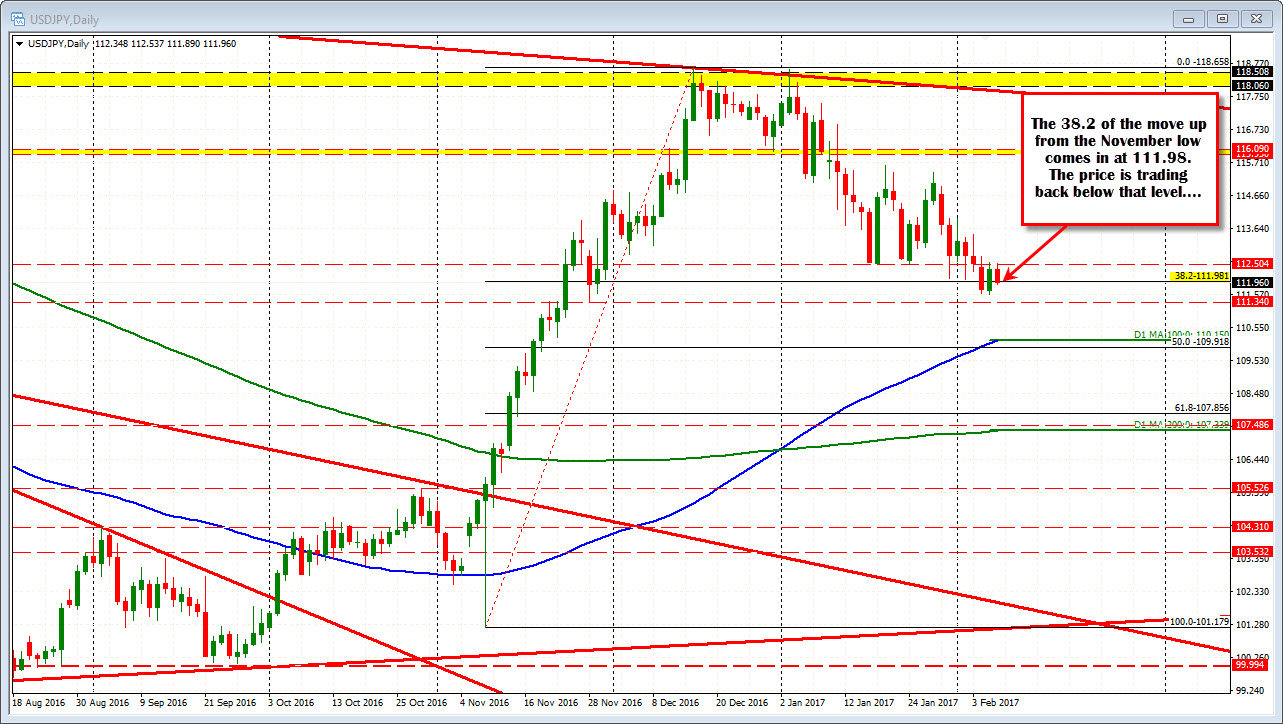

The pair is trading at new session lows and is moving below the 111.98 level (again). If you recall, that level is the 38.2% of the move up from the November low. The level held support on Jan 31 and Feb 2 respectively. This week, the level has been broken on both Monday and Tuesday. Each day the moves below the support failed.

Looking at the hourly chart below, the highs today and yesterday have tested the 100 hour MA on 3 separate occasions and each time found sellers. Last week, the MA was also tested and stalled at the line. The only break was after the employment report on Friday (Feb 3rd) and that was quickly reversed. If that MA cannot be broken and remain broken, the bears remain in control. The MA is currently at 112.407.

For now stay below 111.98-112.06 and the sellers remain in control, with the 111.80 and 111.58 as the next targets. If momentum starts to gather more steam below the 112.00 level over time, the 111.34 is the swing low from November 28th. The 100 day MA is at 110.149 today (and moving higher each day).