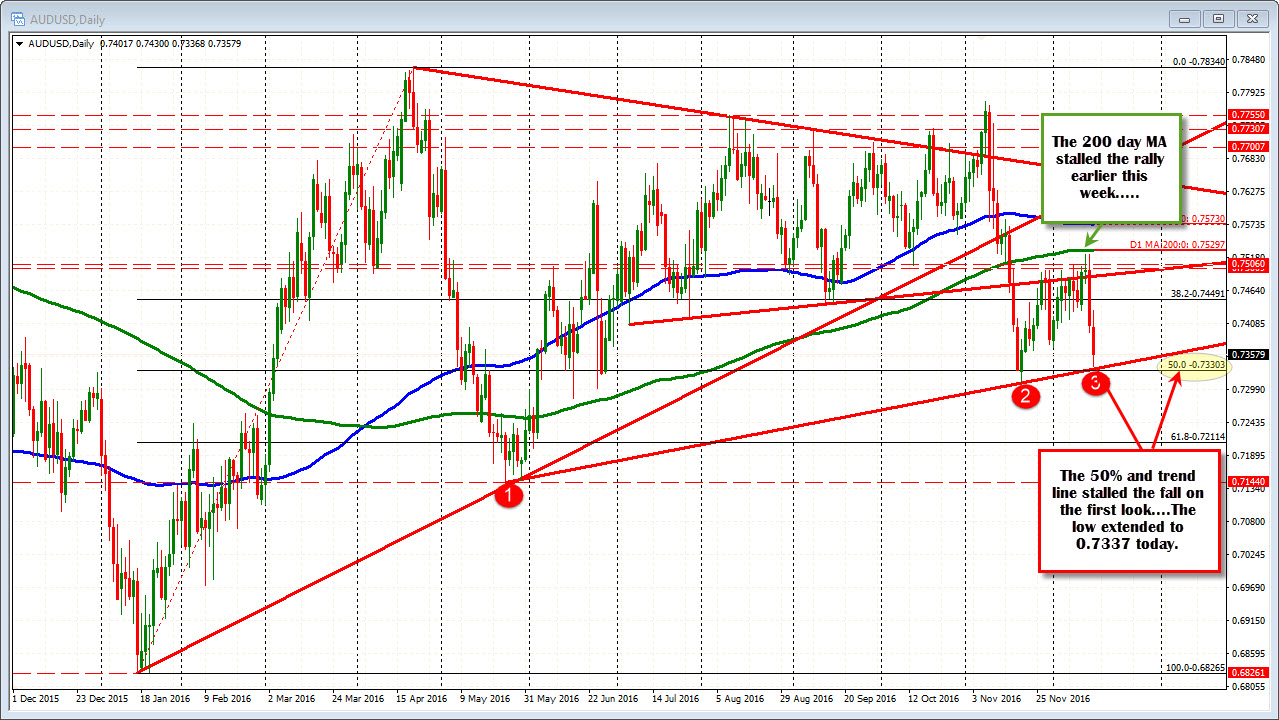

50% gets in the way at the low too

The AUDUSD fell in sympathy with the USD surge today. If you recall yesterday and on Tuesday, the pair moved above the 0.7500 ceiling but stalled not far away from that against the 200 day MA. The Fed tightening sent the pair lower.

Today, that fall (rise in the dollar) fell toward trend line support (at 0.7333) and the 50% retracement of the 2016 trading range (Jan low and April high). That 50% level comes in at 0.73303. THe low today reached 0.73368 - just above those levels.

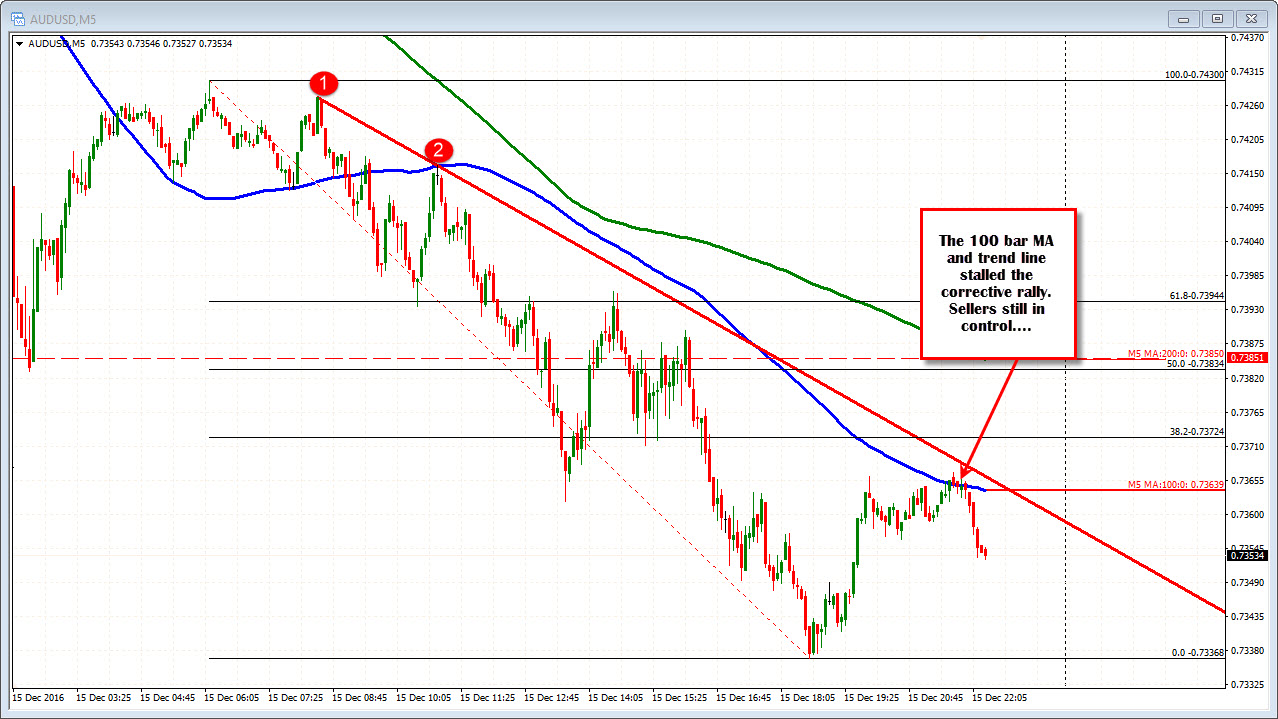

Drilling to the 5 minute chart, the AUDUSD's correction off the lows has pushed back toward the 100 bar MA on the 5- minute chart. That MA comes in at 0.73639 currently. The price has peaked above the line, but has come back off. The sellers remain in control.

So like a lot of the other pairs as we work toward the end of the day, there is a battle between support and intraday resistance. The primary trend remains more bearish. The buyers have more to prove but there is some buyers below who are leaning against support and hoping for a rebound.