What levels are key through the Australia employment numbers later today.

The AUDUSD did indeed find the 0.8030 level, a nice level to lean against (see prior post), and the price was able to get below other downside hurdles to show sellers could take back some control - against key resistance at least. The fall is indicative of some profit taking after the two day run up post the RBA cut and removal of the easing bias.

Does the fall indicate the upside was a squeeze, and the sellers are back in charge? Well sellers against the 0.8030 are certainly looking good. They defined and limited risk against what was a "major target area" and have a 50-60 pip cushion if they feel the sellers will now take control.

What would give them even more control?

Looking at the same daily chart the 0.70378 and 0.7012 were highs from February and March. In April those highs were broken and the price surged higher before failing. If the sellers want to have an instant replay of that failure, they would need to get back below these levels. Otherwise, this move is just a correction off a major resistance level. Unfortunately, the work is never over until there is a clear break outside a range. The topside held on the first look.

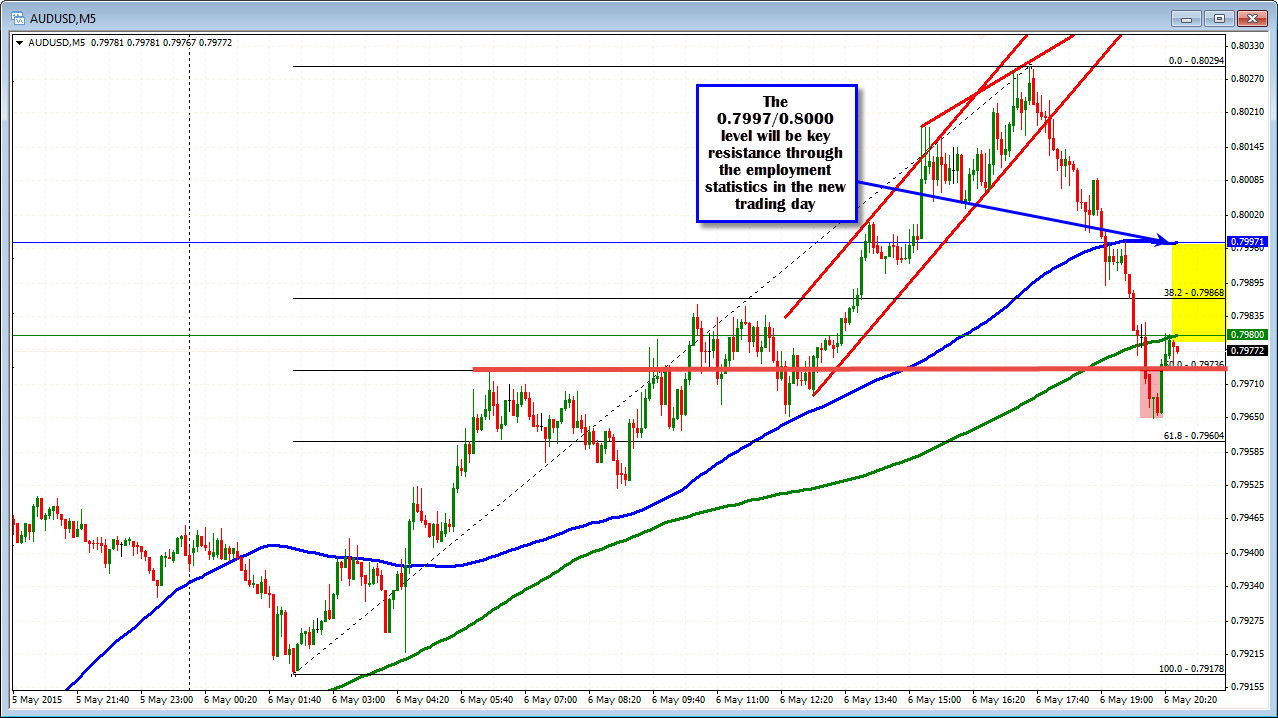

The 5 minute chart shows the corrective move. The price fell below the 100 and 200 bar MA and even the 50% . The current price is testing the 200 bar MA at the 0.7979. The 100 bar MA is at 0.7997 (lets call it 0.8000) is another target now. That sounds like a nice level (at 0.8000) to help determined bullish or bearish going foward. With the Employment statistics out in the new trading day (at 9:30 PM), that level might be the key line in the sand now. Stay below after employment more bearish. Move above more bullish.

Watch the 200 bar MA at 0.7979 and if breached 0.8000. Then it will likely be an employment trade. PS the expectation the employment change is 4 K. Last month the number surprised at 37.7K. The prior month was also revised higher to 41.9K from 10.3K. Both are very strong numbers.