Friday and month end (ish)

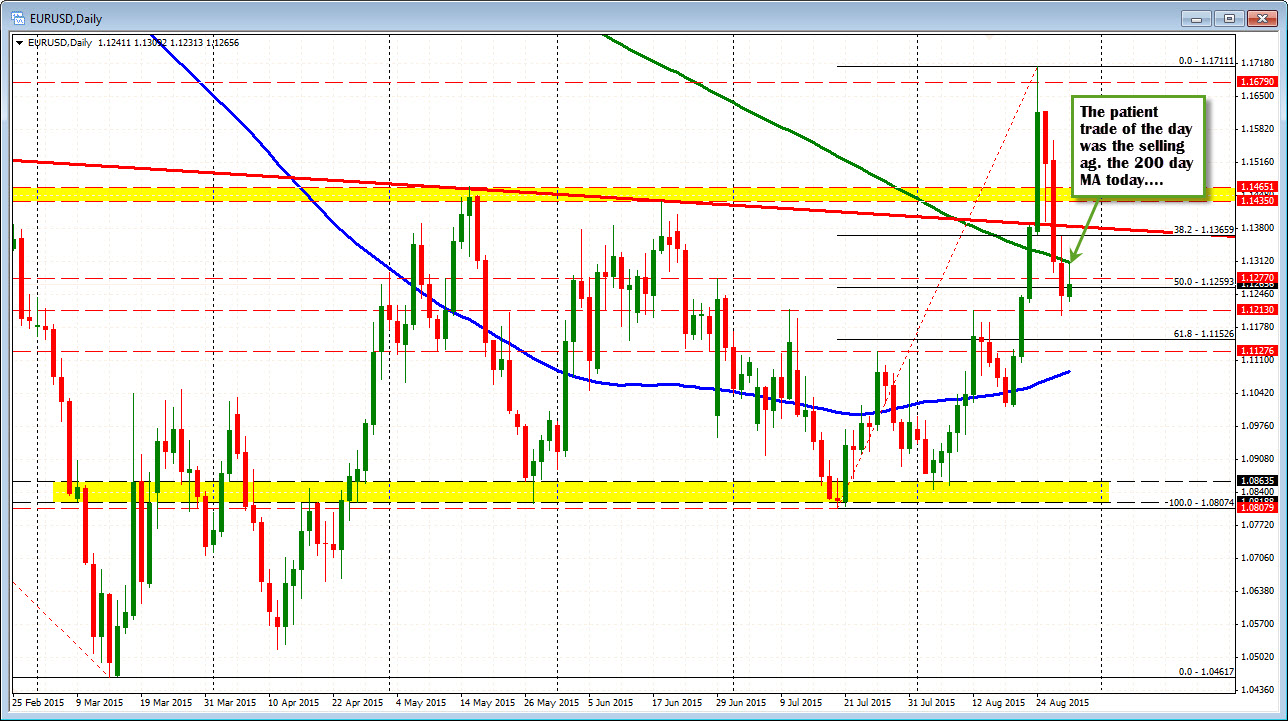

The EURUSDs trade of the day came on the corrective move to the 200 day MA (green line in the chart below). Traders lined up against the MA and the price rotated lower by about 60 pips.

Has the move turned the bias back around to the downside? That is dependent on the "market" and today is Friday and month end-ish as Monday is a banking holiday in the UK. So month end activity may play an influence with the larger flows (be aware).

What we do know technically, is:

- The 200 day MA held above (bearish)

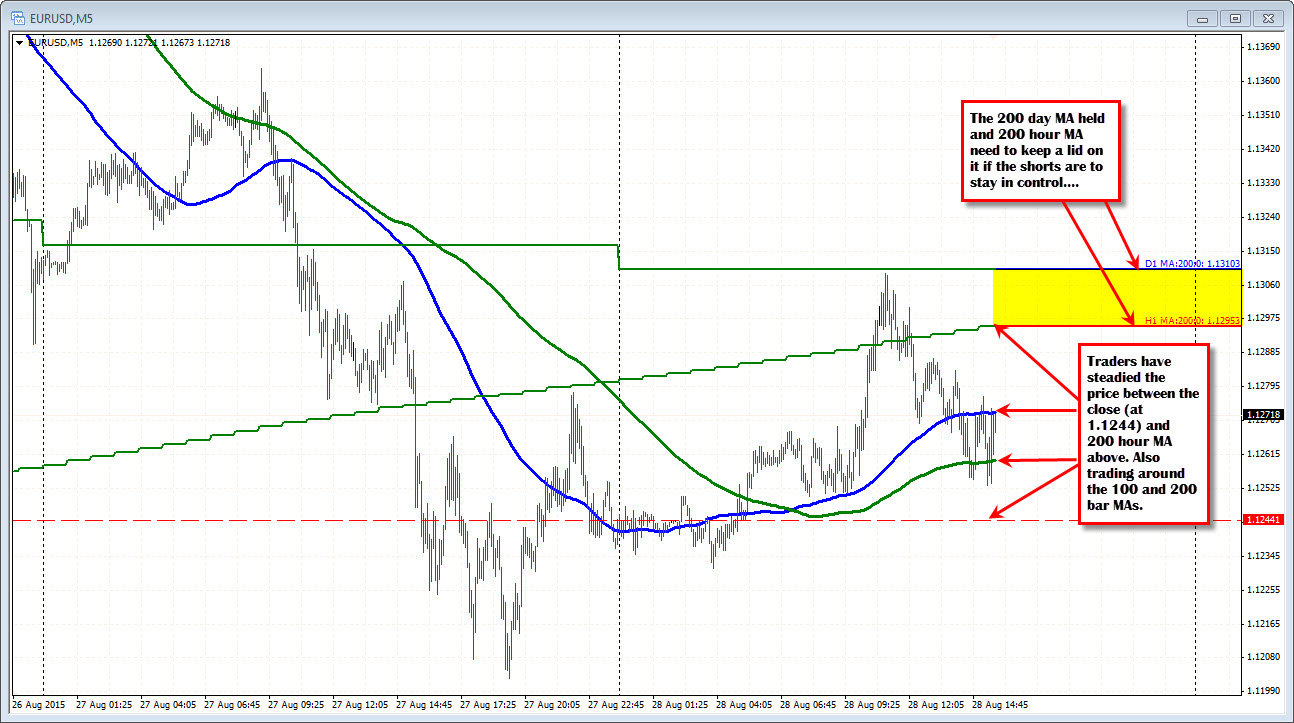

- The price is below the 200 hour MA (green stepped line in the chart below)

- The price is hanging around the 100 and 200 bar MAs (blue and green smoothed lines in the chart below at 1.1272 and 1.1259 respectively).

- The price is above the close from yesterday 1.1244

Shorts want to see a move below the 1.1259 and then close from yesterday at 1.1244. The price has not spent any time in the London session below that level today. It will be eyed for more bearish clues. What shorts/sellers do not want to see is a move above the 200 hour MA nor 200 day MA. If long, you need to see those levels broken.

WIth the price between the levels and activity and and down, there is a randomness to the trading today. It is Friday. It is before a long weekend in London. It is month end-ish, so we cannot be too surprised. The good news is we are getting closer to the end of the summer. So liquidity conditions should return more to normal.