Morgan Stanley technical analysis of EUR/USD using Elliot Wave analysis. The analyst wants to get short EUR/USD.

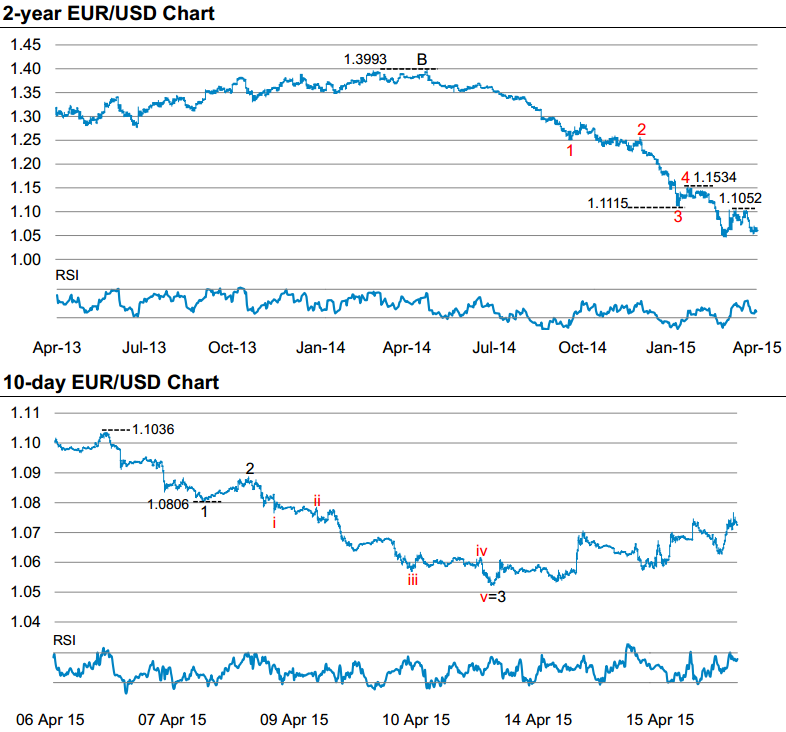

MS starts with a long-term look at EUR/USD, with a 15-year chart (or near enough), saying:

- Having accelerated to a low of 1.0463, going out of the lower end of the multi-year trend channel, EURUSD didn't remain there for very long and has since rebounded to a high of 1.1036.

- However the longer term bearish picture remains and so, should the downside momentum return, we watch for breaks of the following key levels: 1.0463, 0.9613 then 0.8565.

The analysts then comes in to a 2-year timeframe:

EURUSD is still within a 5th wave structure of the larger Cwave.

The 5th wave has formed a substructure, which we would expect to complete around parity. However we expect some volatility before getting there.

A move above the 1.1052 level would mean that there is a larger 4th wave forming, suggesting a move towards 1.15 before the longer term downtrend continues.

Concluding with a 10-day chart:

- EURUSD has begun to form an impulsive structure from the high of 1.1036.

- Currently in a 4-th wave correction, we look for the rebound to sell.

- We put a stop just above the 1.10 high since a move above here would be out of the top end of the recent range and we would have to reassess our trading strategy at this point.

As regular readers will know, I am not a user of Elliot Wave. If any EW analysts would like to weigh in with their analysis please do so in the comments - you can even post charts in there now!