ON our way to completing a lap for the day?

The EURUSD is on the march back higher and the dollar back lower as traders seem to be happy swinging the dollar around ahead of the inauguration of the 45th POTUS tomorrow.

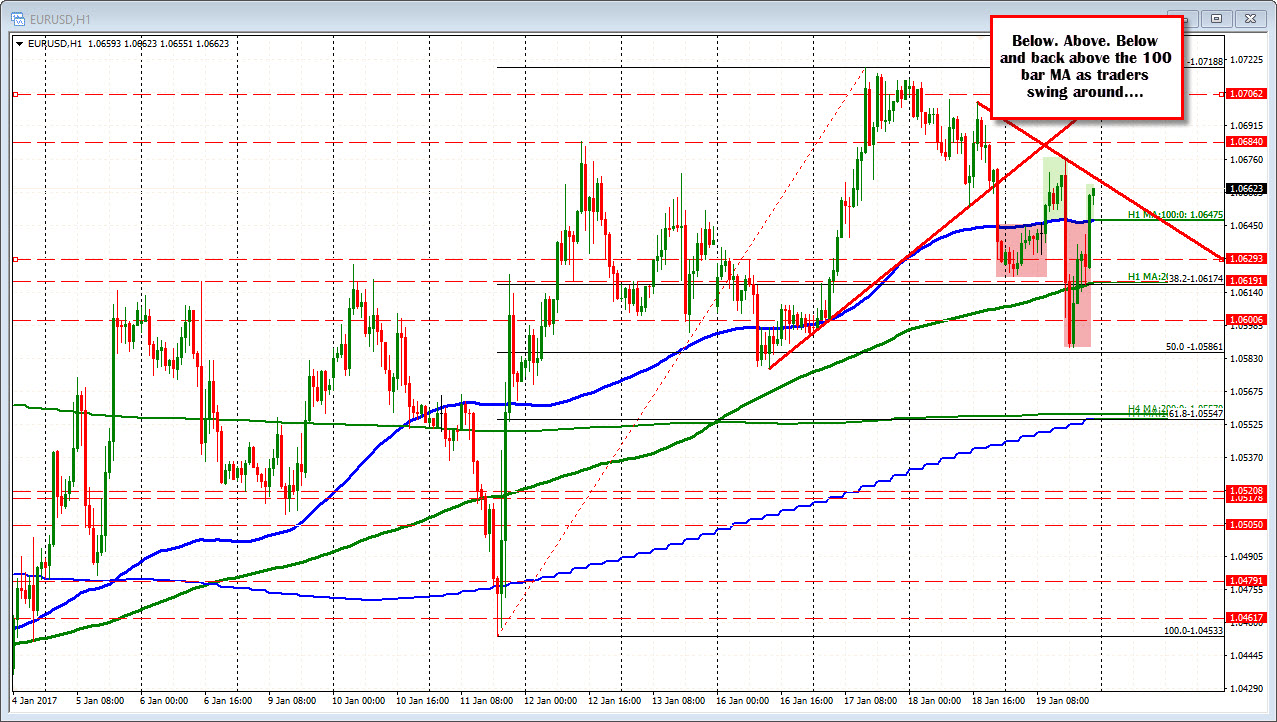

The focus this morning was on Draghi and that send the pair toward the midpoint of the two week range (at 1.0586). The rally back higher has the price taking back broken MA lines.

The pair is within 12 pips of the high for the day. So getting close to completing a full lap in the pair. Over the course of the last 24 hours the traders have seen the price waffle above and below the 100 hour MA. The last push is above the 100 hour MA. For traders long, that now becomes your close risk. However, I am not necessarily looking for a runaway market. Trend line at 10668. The high from last week at 1.0684. The 1.0706 level (that was the 38.2% of the move down from the Election Day high. A move above that level would be more bullish. Something would be going on.

As for inauguration day, who really knows what will happen?

I suspect, many people and traders will be distracted with the festivities. That could keep liquidity light and lead to more of the choppy trading seen today. When an event is drawn out and long (Draghi's hour long press conference is bad enough) and anything can happen that might impact stocks, bonds, the dollar, smart traders often take a seat and enjoy the show.

Wild cards?

- Some sort of mass disturbance that leads to a further spliting of the American people

- A terrorist act just because there are crowds

That should lead to higher gold I would think, lower stocks, lower bond yields, lower dollar (at least initially). However, let's not hope for any of that.