The euro is closing in on a decent looking support area

1.1300 gave out pretty easily today as resistance around 1.1330/40 kept the recent bearish trend in play. I would have looked for the big figure to put up more of a fight but if the topside wasn't reclaimed, there was only one other way to go.

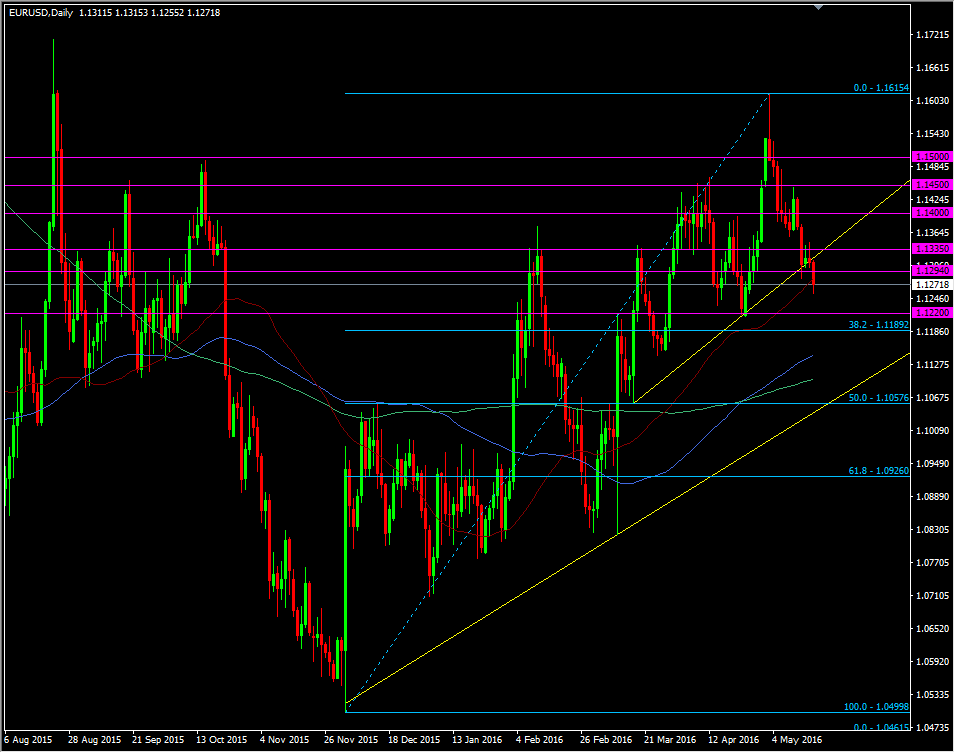

EURUSD daily chart

While the last couple of weeks has seen the price fall from 1.1600, the trend from November is still intact, until it's not. One of the big tests for that is the 38.2 fib of the Nov move. That lies close to an area of support around 1.1215/20, which is a similar looking S&R level to the one around 1.1330/35 that's been in play. With the 38.2 fib at 1.1200, near enough, it's looking a good spot to play a long from to see if the uptrend is going to continue.

There's several ways to play this one with increasing risk.

- Fairly tight - Long from 1.1220 and 1.1205 with a stop just under 1.1180

- Looser - Same as above with a stop under the 100 dma at 1.1144

- Larger risk - Same entry but adding at the 100 dma and again at the 55 wma at 1.1106 with a stop under the 200 dma at 1.1100

With the dollar looking firmer across the board (It's not super strong but it looks like it's going to keep firm into the June FOMC), I'm inclined to keep my risk as low as possible so I'm looking at option 1. Of course, there's nothing wrong with taking all three options as individual trades and entry points.

For shorts, 1.1300 is likely to hold increasing resistance and there's a fairly low risk trade shorting there with a stop above 1.1350. You might be able to push that boat out to 1.1370.

There's a lot of upcoming headline risk for the dollar, starting with the FOMC minutes today, which is why I want to keep any trades smaller and tighter right now.