New extremes in EURUSD, GBPUSD, USDCHF and USDJPY

The dollar has moved to new day extremes, extending the bullish dollar trend after the better than expected ISM data (click here) and Constructing spending (click here).

EURUSD:

The EURUSD fell to fresh 14 year lows, taking out the low from December at the 1.03517 level. We are trading back above that level after falling to a low of 1.03395. The corrective high stalled ahead of the 100 bar MA on the 5-minute chart. The 50% of the last intraday move lower comes in at 1.03735. That is just below the London morning session lows at 1.03745 (risk level).

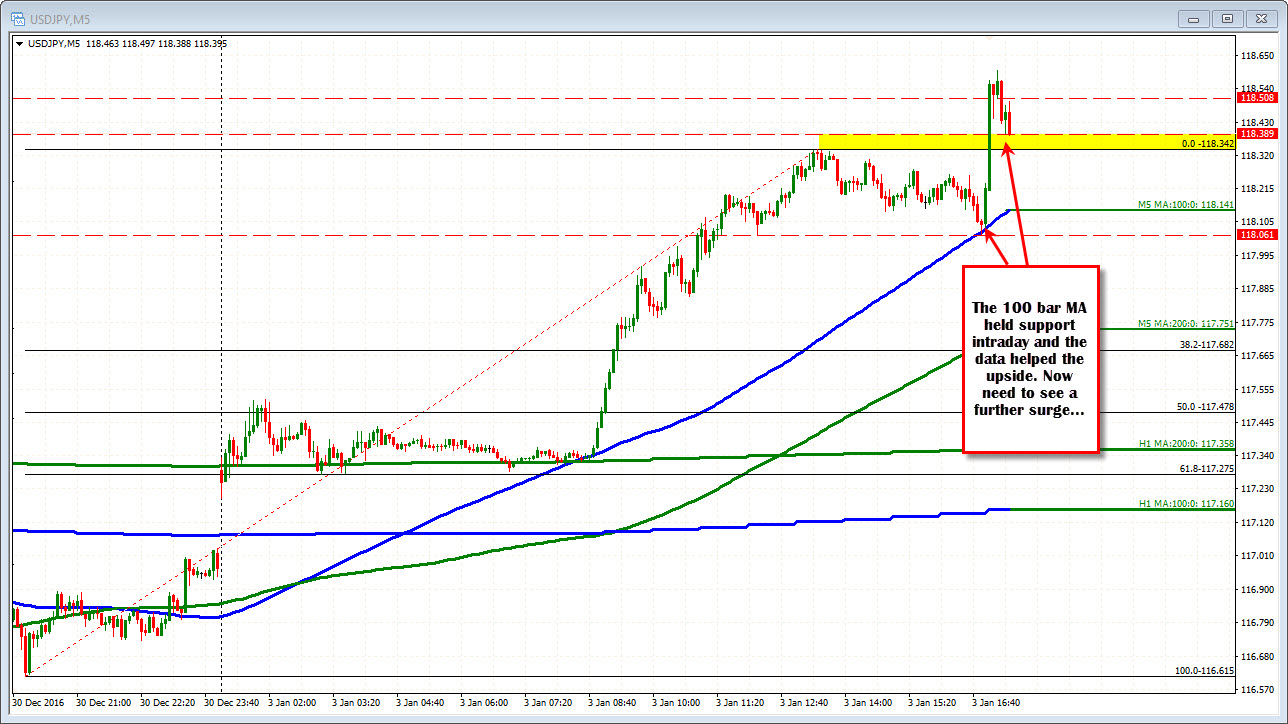

USDJPY.

The USDJPY moved above the trend line at 118.42 and also the 1.0851 level. We currently trade at 118.48 with the low after the initial surge coming down to 118.39. Can the price move above the 118.51 level and stay above? That is the test for buyers. The 118.34-42 will be close support. Buyers on the better news want to see momentum (see earlier post)

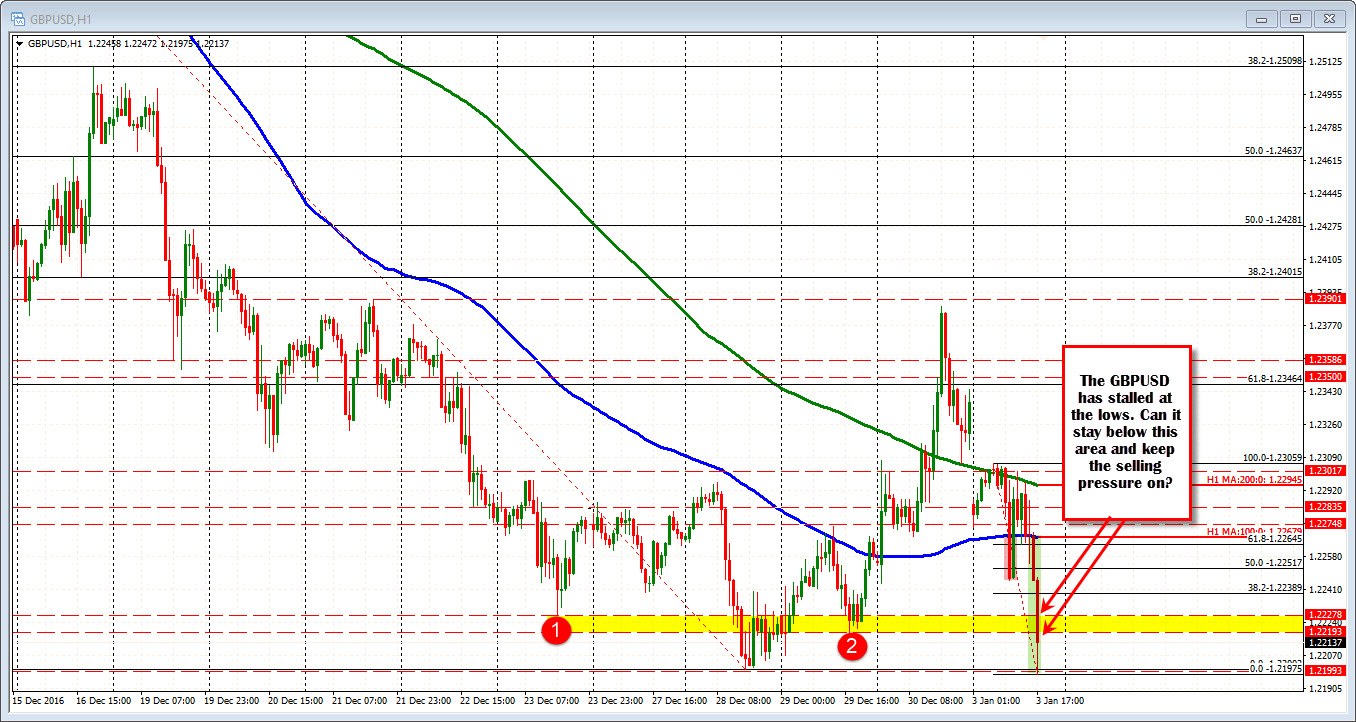

GBPUSD.

The GBPUSD fell to session lows. This pair has been more reluctant to move lower vs the USD today, but the data gave it a shove to the the downside. THe pair tested (dipped below actually) the low from last weeks trading at 1.22002 (the low reached 1.2198). The bounce off that low has been modest. Of not technically, is the move lower is moving away from the 100 hour MA at 1.2287 (more bearish). Earlier in the day, the price moved below that line but rebounded quickly. Close resistance at 1.2219 to 1.2228.