Old Teflon loves them dips

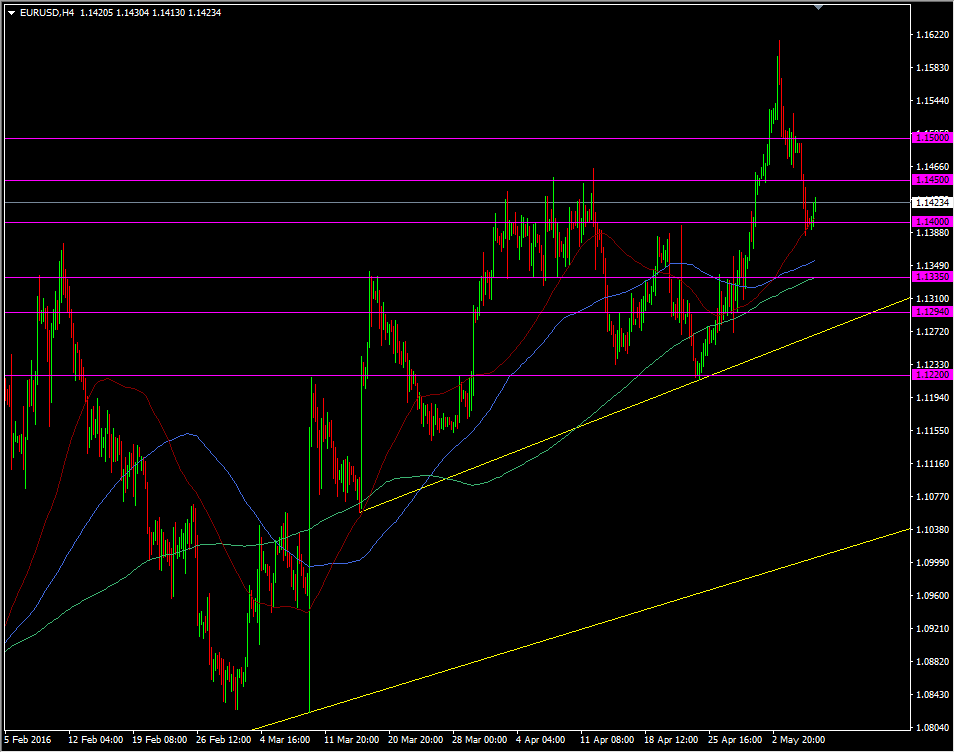

3. EURUSD

Reasons: Never one to miss making a big move on US data

Where to get in: Look both ways but longs would be favourable

Above

- 1.1500 is where I'd look for a stretch short if the numbers are pretty straight down the line. It wouldn't be big and a break of 1.1525/30 would tip me out.

- 1.1600/20 is the next obvious choice from this weeks highs. Again, I wouldn't give it too much room above that high. I'd be looking for whether the price is going to stall on the way up there around 1.1550/60. Overall I'm not too keen on a short as I think there's better value in the dips

Below

- Ignore 1.1400 unless we creep higher, to maybe somewhere above 1.1450 before the figure. I mentioned yesterday that if a question is asked at 1.1400, watch 1.1380/85 before looking for an answer.

- 1.1330/35 is a strange number to find S&R at but the charts don't lie and it's been a touch point multiple times since March. If we get through possible support at 1.1360/70 then I'd expect a test of 1.1330/35. A long there might be worth adding to just ahead of 1.1300, and there's prior S&R at 1.1294. A break of 1.1270 and I'd be out.

- 1.1215/20 is where I'd grab a long to hold for the longer-term but it's going to take a big NFP beat to get there, and then I'll first judge if it's a game changer for the Fed.

EURUSD H4 chart